Technical Breakdown

NYSE Breadth: 63.5% upside volume

NASDAQ Breadth: 49.9% upside volume

It’s hard to believe that the S&P 500 and Dow Jones made new all-time highs last week, isn’t it?

Within just a few days (and largely thanks to tech/Nasdaq/growth stocks) we’re trying to figure out where the market will find its footing amid rising rates and a multi-day selloff. We’re near support in some indices, but bonds and interest rates remain a headwind for now.

The market is setting up for a notable gap-down this morning. That to me is better than a gap-up. Amid a pullback, gap-ups are the worst. It allows bears to get a nice high price to short and continue flushing the market lower. It’s hard to bottom on gap-ups.

I have no problem with shorting, by the way. But when you are looking for a bottom, gap-ups are a disservice to bulls. For newer traders, gap-ups have a tendency to suck them in on the long side (FOMO) and then stop them out.

A gap-down is a much better approach, even if it doesn’t lead to a bottom. It at least gives longs a level to pivot against.

Because we have a gap-down and not a gap-up, I am not looking at too many short setups this morning.

Game Plan

On Sunday, Danny and I were talking about the markets. What do you think? Where do we go from here?

I told him that the S&P was sitting on its 50-day and that we had a mild bounce off Friday’s low. At the very least that gives us a low to keep an eye on (it’s also last week’s low, adding to its significance).

I told him that if we break this low and can’t reclaim it, then more downside could be in store. Conversely, holding or reclaiming this low could set up the bulls for a bounce.

We’ll find out this morning how that low is going to be handled.

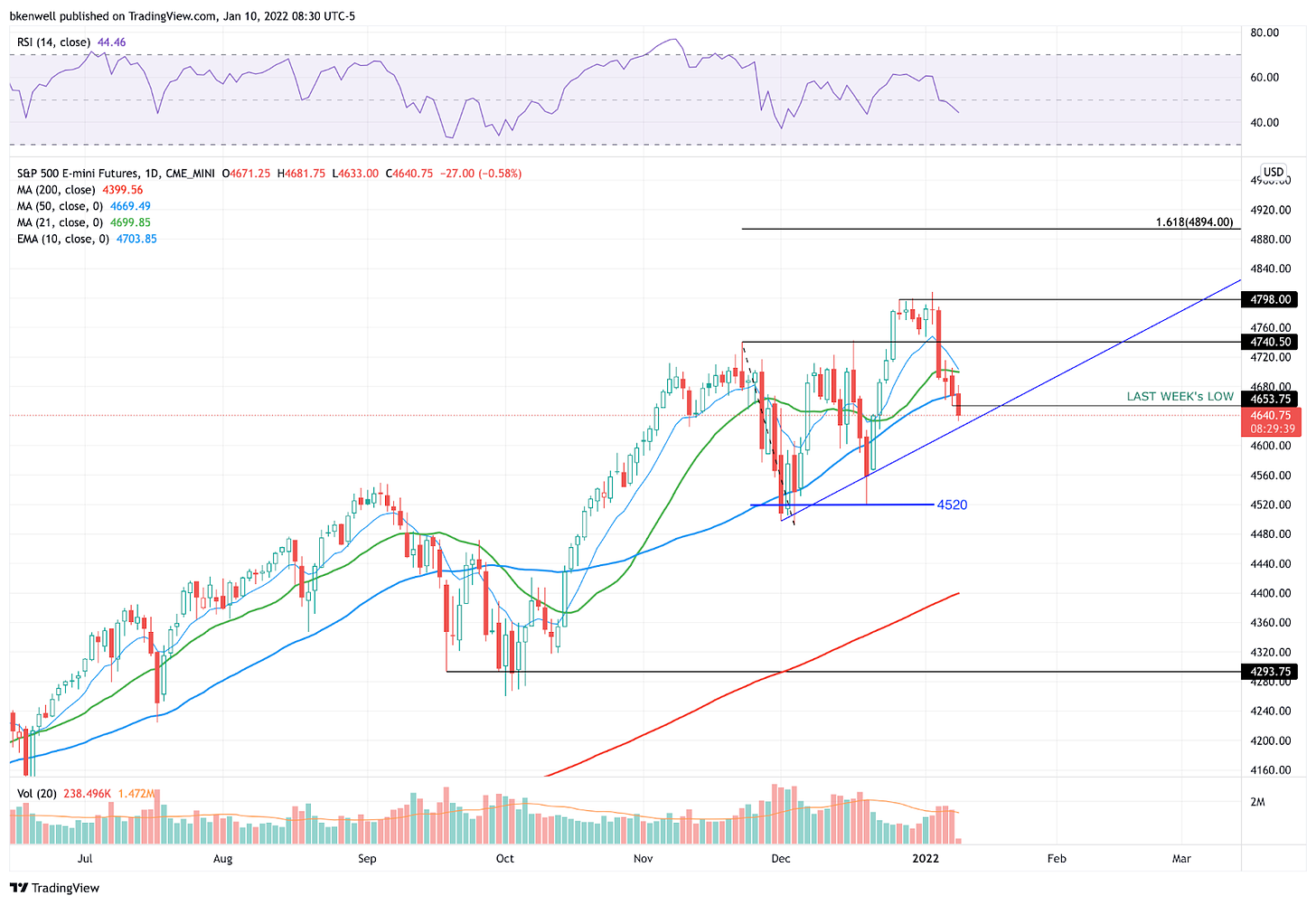

S&P 500

Depending on what instrument you trade, last week’s and Friday’s low will be different.

Last week’s low in the ES is ~4654

In the SPY it’s $464.65

In the S&P 500, it’s ~4663

For now, that is the level to watch. Above is a daily chart of the ES, showing what this morning’s action looks like. For the S&P and SPY, it will result in a gap-down open.

What I want to see is, can the S&P reclaim Friday’s low? If it does, can it stay above it?

For some traders (potentially me included) a reclaim of Friday’s low will be an opportunity to get long, with a stop just below today’s low of day. Unfortunately, it depends on how low today’s low is. If it’s too low, the risk/reward simply won’t be worth it.

On a bounce, the 50-day moving average is the next level to clear. Above that and Friday’s high is the target.

On the downside, a sustained move lower could eventually put the 4520 area in play for the ES. For the SPX, that’s 4530 and for the SPY, that’s $450 to $453. That’s your roadmap for today.

Now for the Nasdaq, Dow and Individual stocks.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.