Technical Edge —

NYSE Breadth: 52% Upside Volume

NASDAQ Breadth: 60% Upside Volume

VIX: ~$34

Game Plan: S&P, Nasdaq

Yesterday’s action was ugly. In the technical section, we wrote:

My concern is: Gapping-up in a bear tape and just to get to the daily-up spot, the ES has to climb 1.6%. That’s a big move.

About the worst thing bulls could see happen, would be a higher open like this, a tag of the highs and a flush to take out the two-day low around 3660.

That’s what happened, but after we took out the low, the markets bounced and the S&P closed back within (or near) the two-day low. That creates some conflict on the charts. Essentially, did we just get a “kick save” after making new lows and we’re back within the range (and quite oversold) or is more trouble lurking?

Bonds nearly closed on the lows yesterday (the TLT), while the dollar continues to thump higher.

The Bank of England blinked this morning and is going on a short-term bond-buying spree. That has the pound back under pressure and the dollar index rising again. Bonds are up a bit this morning.

If bonds bottom and the dollar retreats, I will expect the S&P to rally. When this will happen, I don’t know, and how far that rally goes remains to be seen.

But if you don’t already, I would suggest keeping bonds and the dollar up on your screen (TLT and/or ZB, along with DXY and/or UUP work fine), as well as AAPL and maybe TSLA — two stocks that have been relative strength leaders amid the recent turmoil.

Apple is down 3% in the pre-market, so today will be a good test.

If the market loses Apple, it will lose and amid the chaos and complexity, sometimes it feels as simple as that.

S&P 500 — ES

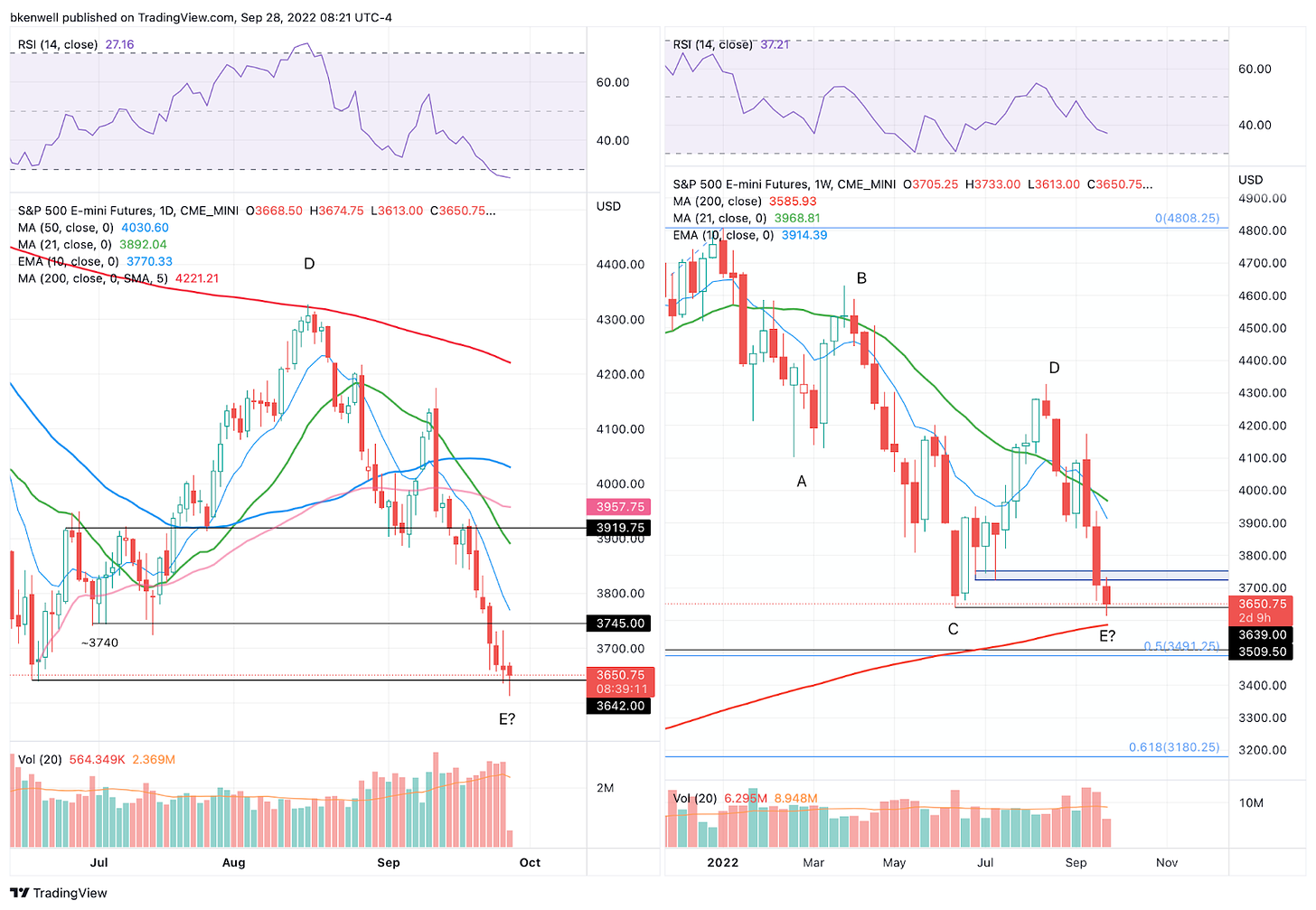

On the left is the daily chart, on the right is the weekly chart.

You can see where a push lower may find support on the weekly chart, in that 3500 to 3575 area.

On the daily, resistance has been obvious too, in the 3730 to 3745 zone. If we rally back through 3700 and hold above this level, then this zone is paramount. Active resistance is near the 10-day moving average.

If we see this zone, I will treat it as resistance until proven otherwise.

3660 is the line in the sand. The ES either needs to reclaim this level to open up more upside, or it may serve as resistance. If we can’t reclaim this area, then 3640 is in play, followed by the Globex low at 3613.

Just because we’re oversold doesn’t we can’t become more oversold.

ES — Zoomed In

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.