Don’t Forget: We recently took a look at some longer term setups for those interested.

Technical Edge —

NYSE Breadth: 9% Upside Volume (!)

NASDAQ Breadth: 26% Upside Volume

VIX: ~$32

Game Plan: S&P Every Which Way

With the VIX back up over $30, we need to exercise some caution here. That’s also going to make it difficult to justify putting on short-term trades in individual stocks.

Set to come into Monday with a gap-down, we could be looking at a scenario where they may try to bounce the market early in the day/early in the week, but again, with an elevated VIX we must exercise caution.

If things get “panicky,” that’s when we get the big moves to the downside.

We’ve had five 80%+ downside days in the last nine trading sessions, with two of those sessions in excess of 90%+ downside days. That’s a lot of distribution.

Bonds are again trading lower in the pre-market, as the TLT flirts with new 2022 lows. On Friday, bonds helped lead the rally, but if they continue lower and if the dollar continues higher, equities are going to struggle.

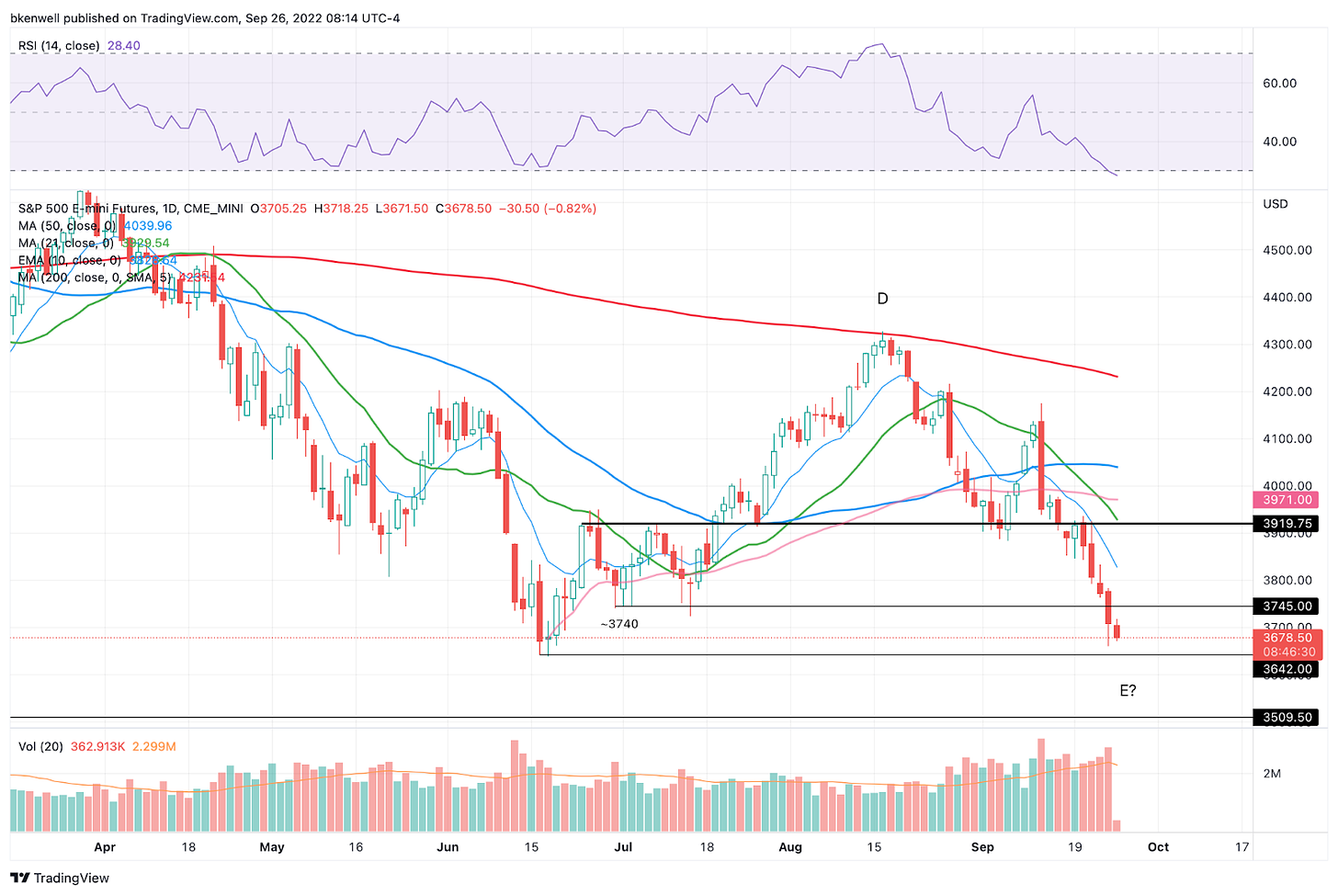

S&P 500 — ES

There was one great trade to nail in the ES on Friday and that was selling the early rally into the 1H downtrend, something this group planned for before the open. Other than that, it was mostly a trend-day down until later in the afternoon.

Now looking at the daily chart above, the ES made almost no attempt at all to find support in the 3740 to 3750 area. That’s what I like to call “deliberate price action” — as it deliberately sliced right through a key zone.

Now trading lower on Globex, we’ll find out if Friday’s low will hold or if they’ll want to push this down to new contract lows below 3639.

ES — Zoomed Out, Then Zoomed In

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.