Technical Edge —

NYSE Breadth: 56% Upside Volume

Advance/Decline: 66% Advance

VIX: ~$22

The S&P took out the prior day’s low, then scorched to the upside. Like a basketball pulled underwater — below Wednesday’s low — they let it go and it ripped higher. We did not get a clean “daily up” rotation, but it was a potent rally off a key support level.

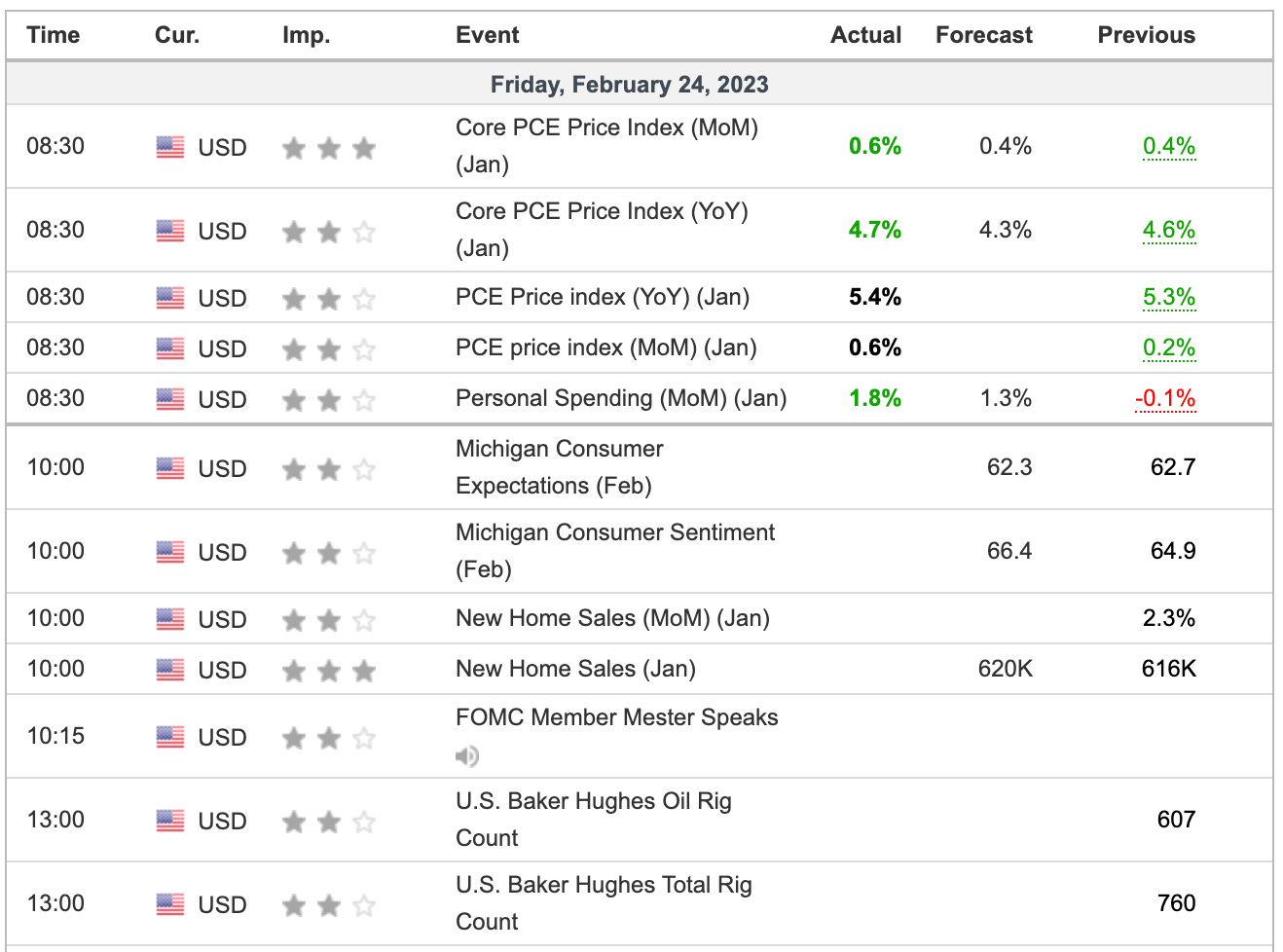

Now another inflation reading is in focus with this morning’s PCE report. The CPI and PPI reports were hot. So was the January jobs report. So I’m not sure why anyone thought this number would be below expectations.

The econ table at the bottom shows the results, but it came in hot across the board. While the Fed Minutes laid out a scenario for a 25 basis point increase in March, I think many investors are getting the hint that “25 and done” is likely off the table and that more hikes will be necessary to tame inflation.

S&P 500 — ES

Yesterday’s action is looking more and more like a “big buy program” off a key support area. Once they undercut the prior day’s low and reclaimed it, it was off to the races.

In any regard, we’re below yesterday’s low in pre-market trading. If the ES can’t regain this level (~3974) then it opens the door down to 3950, where it should find — at the very least — temporary support.

That level marks the 200-day moving average and the 61.8% retracement.

On the upside, a sustained reclaim of 3974 puts 4000 back in play. Although I have a hard time seeing the ES take out 4025.

SPY

If the PCE results were favorable, I could have envisioned a move to last week’s low and the declining 10-day moving average for a “real test” of who was in control.

Now, short of a big reversal, the SPY is not only ending the week on a sour note but undoing all of yesterday’s reversal.

Below $396.50 puts the 200-day in play at ~$393. Below that and the $390 to $391.50 zone is on the table.

AXP

Post-EPS reset in AXP. After a nice three-day consolidation, we’re looking for a daily-up over $176.60. May not get it, but keep it on your radar.

First target $175.50 (¼ trim) otherwise $178.50 (for ⅓ trim) — one or the other, not both, just your choice on which.

Stop would be ~$172.50.

JNJ

Where are my long-term buyers at? After 7 straight down weeks, LT buyers can likely justify a nibble here in JNJ. Yield is near 3%, valuation is about 15 times earnings and it’s a quality company with quality profits.

It’s not sexy but it’s not supposed to be.

Active investors can cut if it doesn’t hold $153 to $154 on a daily basis, but I like this one as a buy-and-hold.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

MRK — Long from ~$110 — Initial stop can be as tight at $108 or as loose as $105, (trader’s preference). Initial target for ⅓ trim is $112.50.

DD — Long from $72.50 (starter buy at $72.25, added at $72.75 when alert when out) —

Stop at $71. First target $74 to $75 (ideally $74.50+)

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

AQUA

AEHR

GE

NVDA, TSLA

SBUX

MELI

NFLX

WYNN, LVS

AXP

BA & Airlines — AAL, DAL, UAL

TJX, ULTA, NKE

CAT

HCCI

XLE — XOM, CVX, COP, BP, EOG, PXD — (Weekly Charts)