Technical Edge

NYSE Breadth: 32% Upside Volume

Advance/Decline: 34% Advance

VIX: ~$18.75

Just a thought out loud: We have talked about it off and on for about two weeks now, but one does wonder when the S&P 500 will care about the 10-year yield (TNX) and the US dollar (DXY) hitting 10-week highs.

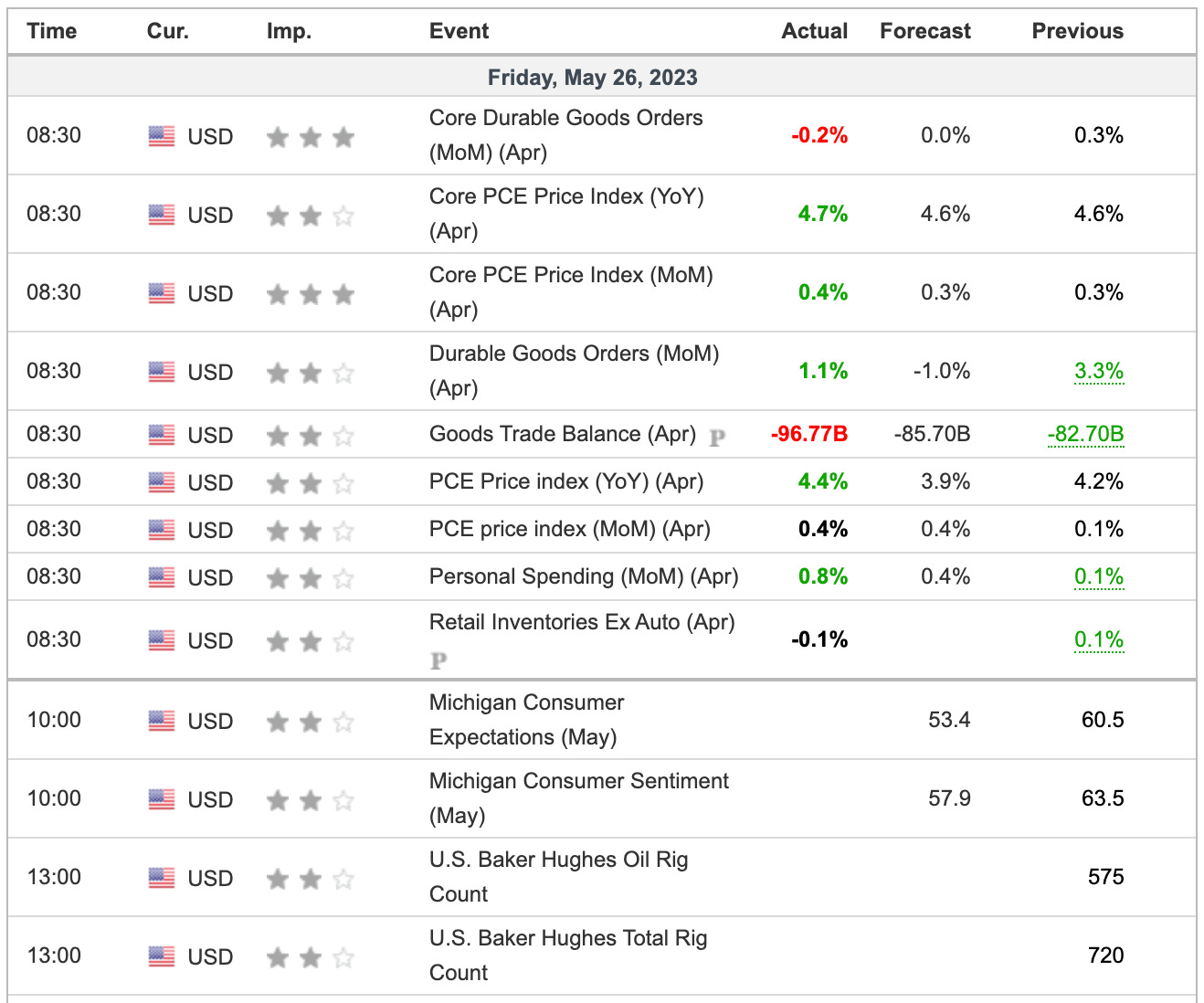

The PCE numbers came in hot (shown at the bottom), so that may push the Fed to raise at the next meeting (the odds were about 50/50 before today). I don’t know that another 25 bps increase is going to matter. Either the higher rates we have now curb inflation or they don’t.

Let’s keep it short and sweet today. Don’t force stupid trades. There’s nothing worse than going into the long holiday weekend on a bad note. Enjoy the three days off and “see ya” on Tuesday. Cheers!

S&P 500 — ES

Are bulls back in the driver’s seat? ES needs daily-up over 4175.50 to put 4200+ back in play. 4115-4125 is key on the downside.

Upside Levels: 4175, 4184, 4195-4200, 4225

Downside levels: 4115-25, 4100, 4075

SPY

The SPY needs $416.50+ for bulls to press the recent high.

Upside Levels: $415 to 416.50, $418.50, $420 to $420.50

Downside Levels: $412.50, $410, $407.25

SPX

Upside Levels: 4165, 4185-90, 4210

Downside Levels: 4130, 4100-4110, 4085, 4050

NQ

If the NQ can clear and hold 14,000, the upside extension is 14,234. That’s where it can go if bulls remain in control.

Downside zone for bulls to contain is 13,750 to 13,780.

For the QQQ, that upside extension area is ~$344.

MDLZ

The consumer staple trade has lost some luster, but MDLZ at the gap-fill and 10-week ema would be an attractive dip to buy. That’s around $73.90-ish. $76 would be a decent first trim zone. Stop at $72 to $72.50.

SBUX

Former relative strength stock, SBUX has struggled post earnings and is now down 5 days in a row. Daily-up off the 200-day sma over $98.90 could get us back above $100.

In that scenario, entry is on the daily-up — $98.90 — and while $100+ could be a trim for quick traders, the ideal firm trim area is around $102 to $102.50. That would be the declining 10-day ema and the 50% retracement. Stop at $97.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B. Now Add META, AVGO and UBER.

CRM — Took time, but got our $207-$208 trim down, now down to about a 40% position after $212.50 touch. Probably down to ¼ position if we see $215-ish now, but want runners for potential push to $220.

Raise stops to Break-even.

MET — Short from $52.50 area and down to ½ after we saw a dip down to $50.11. Move to break-even stop.

AMZN — Gave us our dip into the $113 range (+/- $1) and then traded $116+ for our first trim. Cleared Tuesday’s high to let us get down to a ½ position as per plan.

Stops at Break-even. Down to ⅓ position if we see $118+

PEP — Long from about $185.50 but not trading well. Nice reaction off the low yesterday. That level — $181.95 — is our hard stop. I would like to see $185-86 to get down to ½ position or get out with a small paper cut.

** TLT — I don’t know if we’ll fill the gap at $99.65-ish, but I will get long if we trade the mid-$99s and it holds as support.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

MCD, PEP & KO, WMT, PG — group has been faltering, though!

LLY, CAH

NVDA, CRM, AMD

MSFT, AAPL, META

LULU, CMG, ELF

FTNT

Relative weakness leaders →

PYPL — great short.

MET

CF, MOS

PFE

GLOB