Technical Edge —

NYSE Breadth: 63% Upside Volume

Advance/Decline: 55% Advance

VIX: ~$22.25

We have not had too much action on the indices for us, although yesterday’s move was a nice “rally out of that pocket of support.” Instead, our individual positions have been doing the heavy lifting.

Let’s keep today light as a result and just look at the S&P and the bonds.

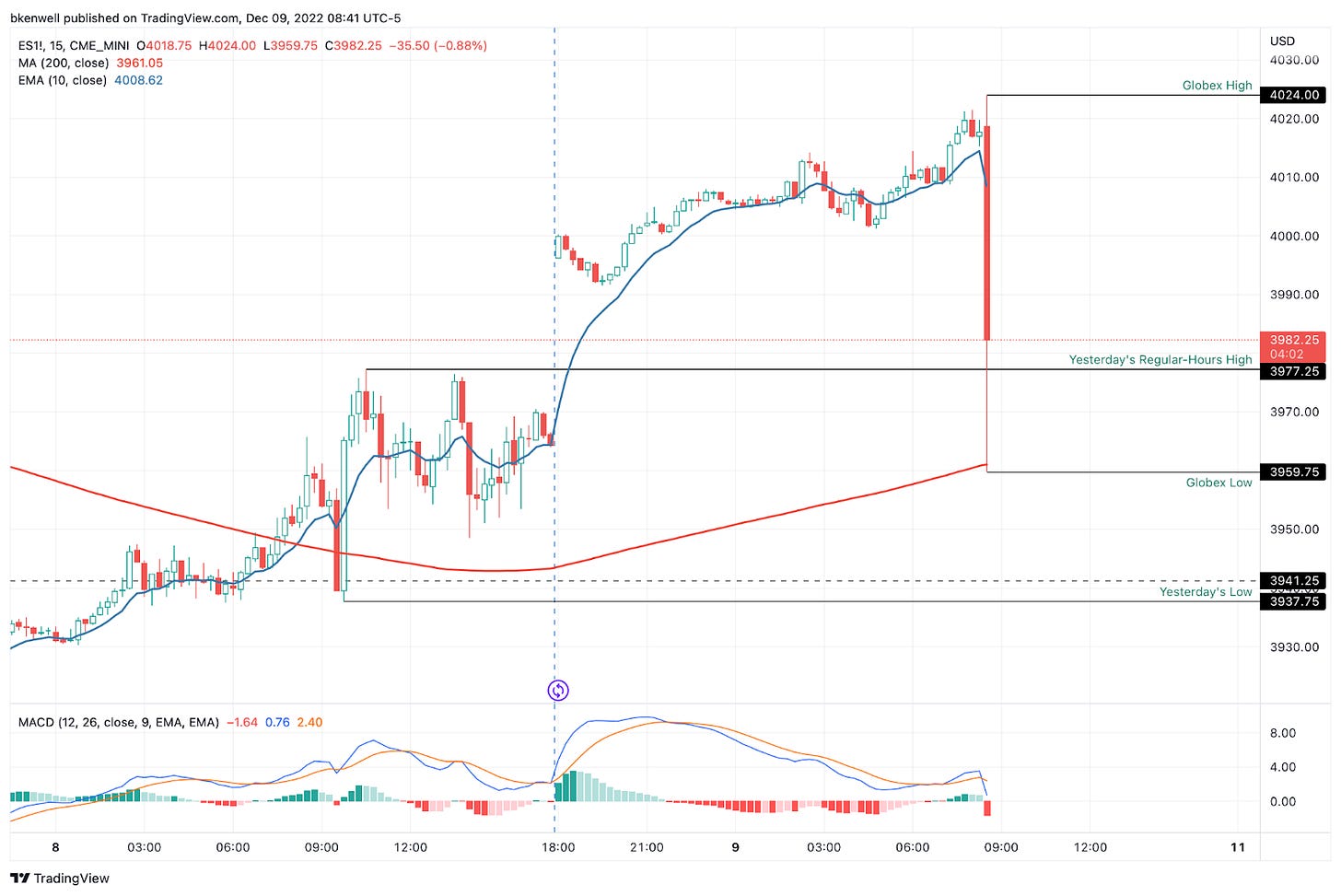

S&P 500 — ES

Yesterday’s action came within 3 points of our 3980 to 3985 target range and that’s good enough for us.

The ES popped on the Globex open and was pushing higher. That’s had it hitting our secondary price targets from yesterday — 4010 to 4015.

Here’s the thing, though.

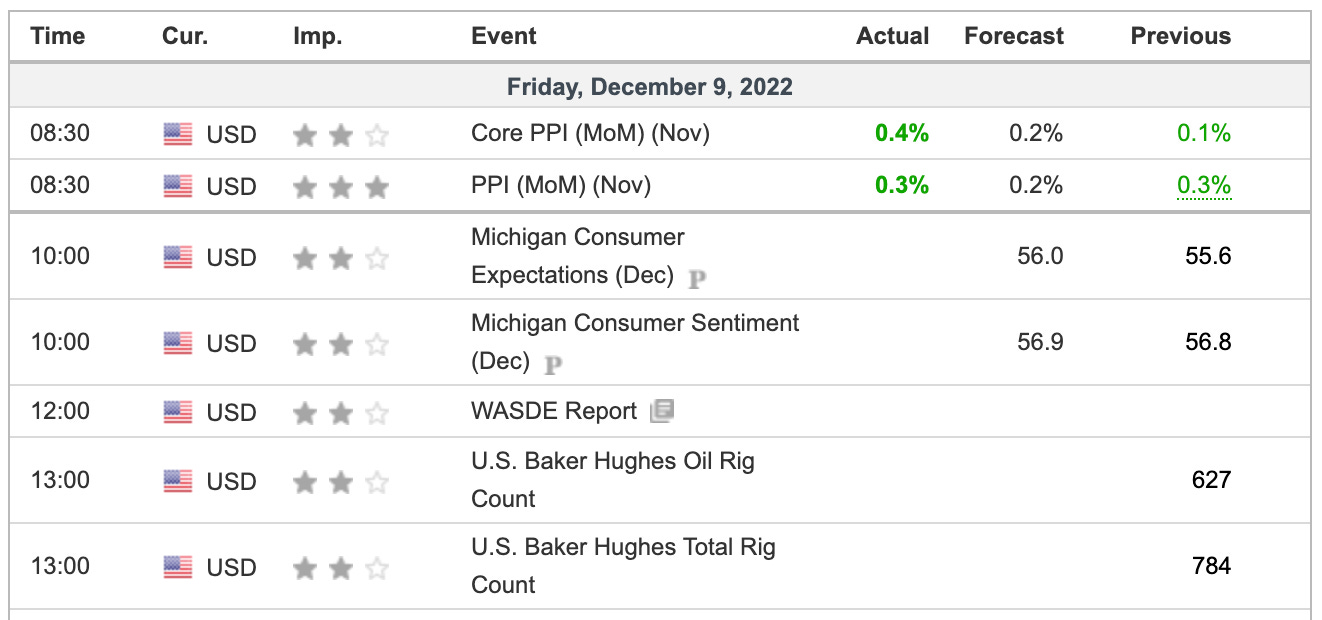

But now we’re getting the reaction from the PPI number which came in higher than expected (which is bad).

ES — Zoomed In

After the PPI dip, a few things have occurred. First, the gap has been filled. Second, the ES found its footing on the 15-min 200-sma and given us a low of 3959.75 to work with.

Already up 20 to 25 handles, let’s see how this area acts if it’s retested. Can we get some sort of break of 3960 and then a reclaim and bounce — AKA a reversal?

Or do we get below and stay below 3960, potentially opening the door down to the 3935 to 3940 area?

On the upside, 4000 is a key pivot, followed by the 4020 to 4025 area and the Globex high.

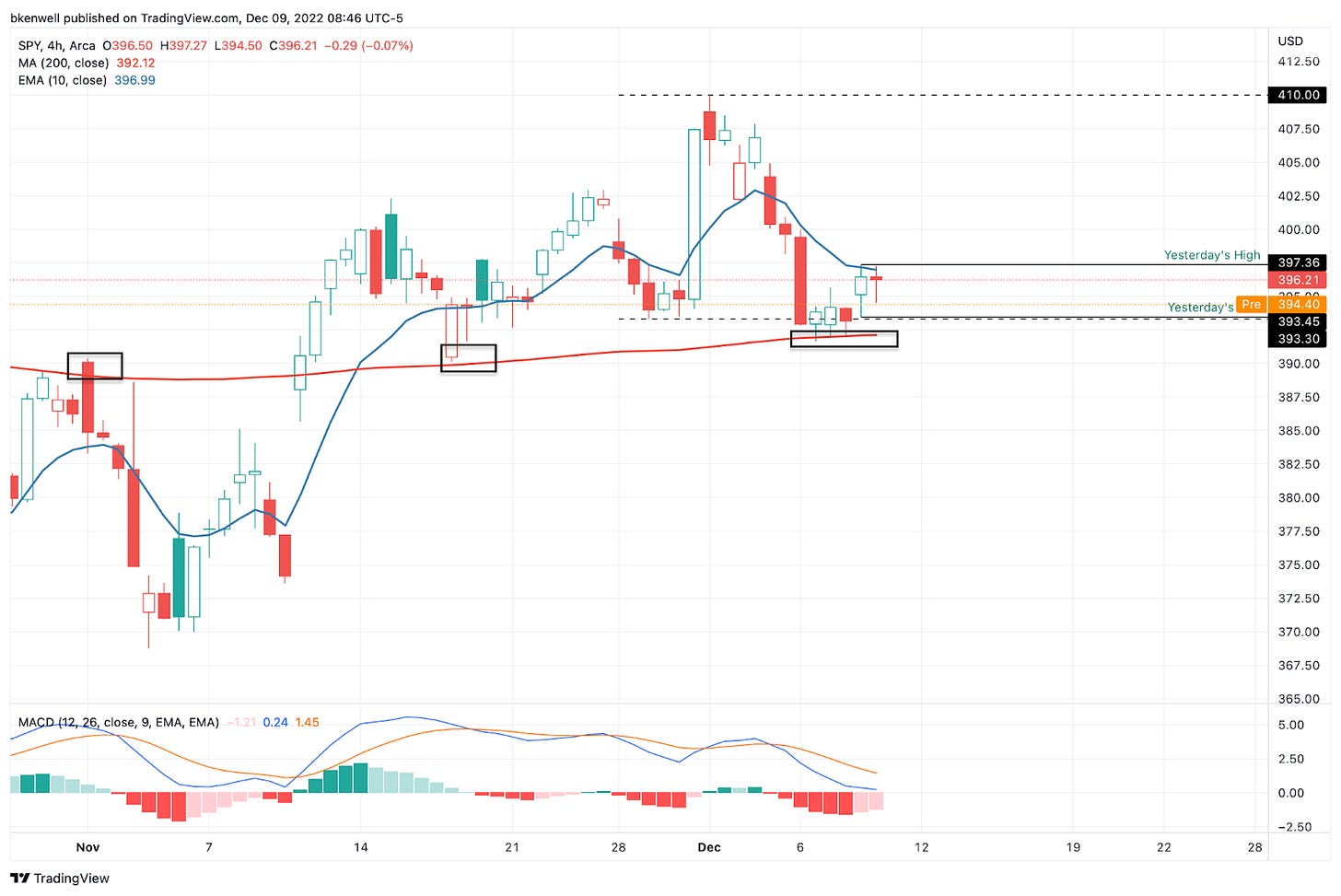

SPY

As for the SPY, it went daily-up over $395.64 and gave us our $397 target. Nothing to brag about — $1.50 a share — but some decent pocket change going into Friday.

Try to keep it simple with the SPY. Above the 10-day (and yesterday’s No. 2 target of $398.50) opens the door to $400, then $403. The latter is a big level for bulls to recover.

On the downside, the $392.50 to $393 is key. Below it and $390 is in play as a vital level.

SPY — 4-Hour Look

More of just an interesting look here than a trade. But notice how the SPX and SPY are trapped below the 10-ema, but are holding above last week’s low (the dashed line) and the 200-sma.

A break of either of these levels can create a continuation in the respective direction.

TLT

We’ve run the register twice on TLT over the last couple of weeks. Yesterday gave us an inside day after that gap-up on Wednesday.

A break of yesterday’s low at $108.47 could create an inside-and-down rotation, putting the 10-day back in play. If we see that today — and I don’t think we will — it may be worth a small long position.

Open Positions —

Numbered are the trades that are open.

Bold are the trades with recent updates.

Italics show means the trade is closed.

TLT — Trimmed down to our final ¼ or ⅓ at $108.50. A complete exit is okay too. Those still holding can fish for the $110 to $111.50 area.

IBM — Daily-up over $147.17 was the entry. $145.50 is our stop. Trimmed ⅓ at $149.50+ (pre-market is fine). Ideally down to ½ if we see new highs over $150.50.

Stop at $145.50 or B/E for less aggressive traders (B/E Stop hit)

CEG — Trimmed ⅓ at $93. Raise stops from $86 to $89. Looking for $95 to $96 for small trim (down to ½). Down to ⅓ if we see $97.50+

Ulta — Booyah! Down to ½ or ⅓ here — likely ⅓ as per yesterday’s update. I’d love to see $488 on the remainder.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

LNG

CAH

Retail — TJX, WMT, ULTA

SBUX

DE

CCRN

AMGN

MET

GIS

REGN

CI

MCD

ENPH, FSLR — solar has strength

VRTX

UNH

MRK

XLE — XOM, CVX, COP, BP, EOG, PXD (Weekly Charts)