Technical Edge —

NYSE Breadth: 40% Upside Volume

NASDAQ Breadth: 34% Upside Volume

I think there’s no shame in saying “we don’t know” — we don’t know this is the start of a new uptrend and we’re back to buying the dips or part of a massive, FOMO-inducing dead cat bounce.

When you look through the charts, you really can make a case for both outcomes. Here’s my problem.

When trading, I really prefer simple setups. You all see that every morning. Nothing below is overly complex. The most complex thing we do are retracements and that’s not very hard.

Usually by looking at a chart, I can see “it” within seconds. “It” being the trend and whether buyers or sellers are in control. If I have to look for too long, it’s not clear and I take a pass on that stock or ETF.

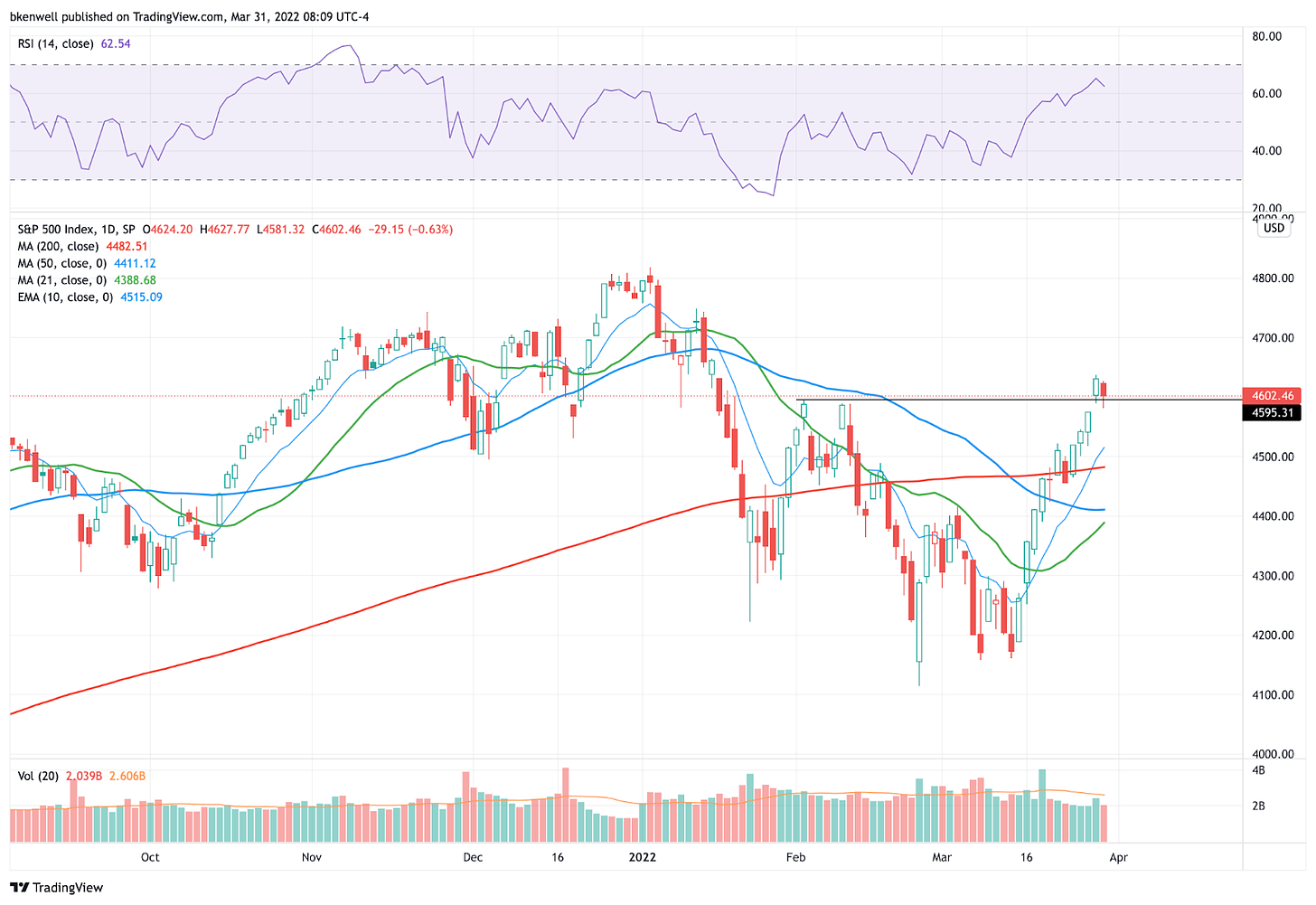

When I look at the S&P 500 or the Nasdaq, I don’t get that quick “see it” result and I have to dig and dig and dig. It’s muddy, it’s cloudy, and it’s telling me that we should get through the Q1 rebalance and the jobs report tomorrow before hopefully getting a better view.

That being said, the individual stocks have been more clear than the charts, IMO!

Game Plan

S&P 500, CAT & Profit Taking on the Winners

Feel free to extrapolate this layout to the SPY

Yesterday we talked about the need for some rest, “even if it’s just a mild correction into some short-term support. This would be the healthiest outcome for bulls.”

I think we need to

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.