Quad Witch Sets Stage for Volatile Finish to the Week

The S&P is down almost 13% in three weeks.

Technical Edge —

NYSE Breadth: 93% Downside Volume (!!)

NASDAQ Breadth: 75% Downside Volume

VIX: ~$32

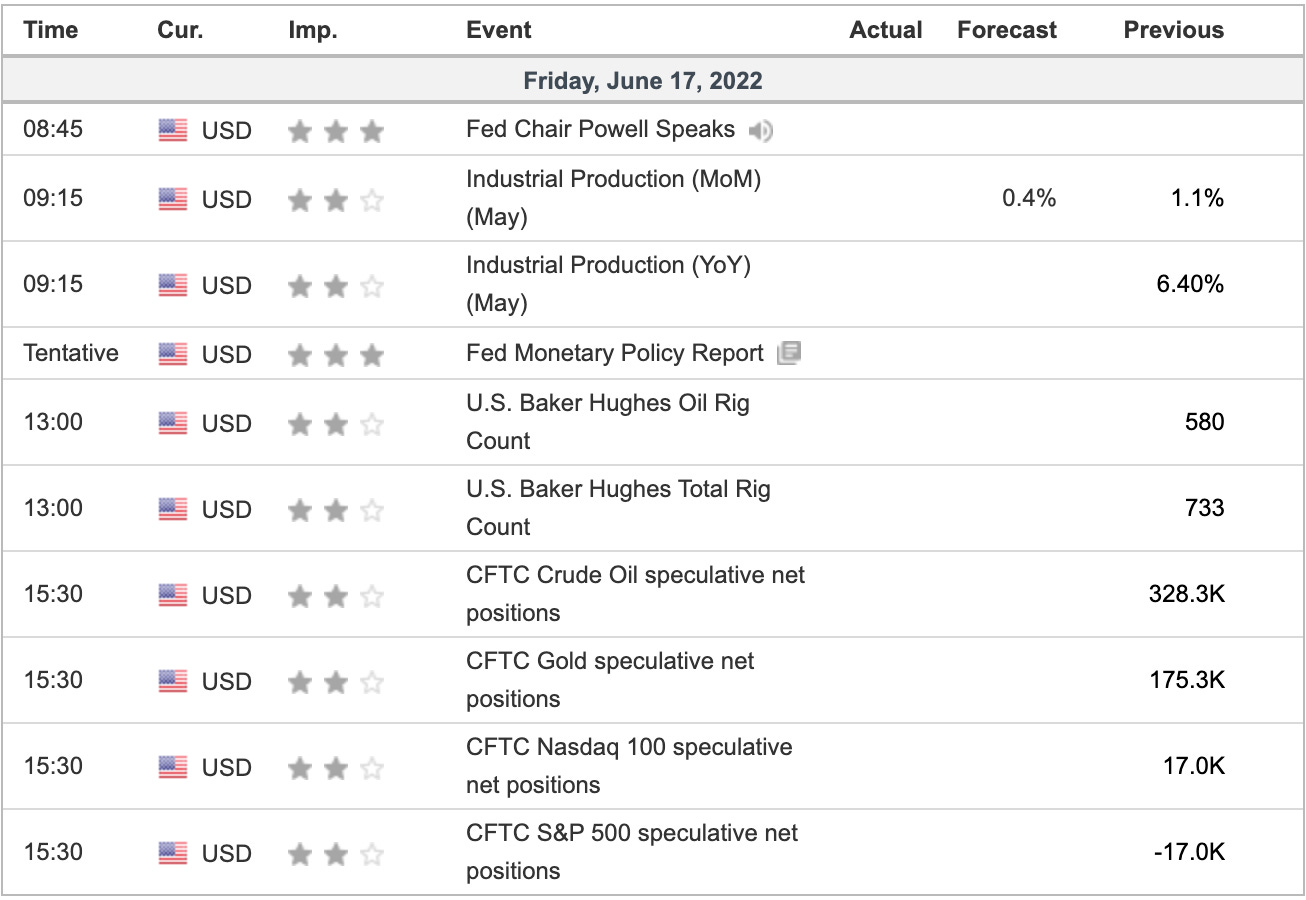

This is a much-needed three day weekend unlike any other. So far the ES has fallen 5%+ in back-to-back weeks — and that even includes Friday morning’s ~1% rally. We’ll see how it finishes today and whether that observation holds true.

Making matters even more difficult is today’s quad-witching expiration. Volumes will be high and the water can often be choppy. There may also be a lot of unwinds going on as traders roll, exercise or exit their positions.

Stay nimble and remember that not every session is suitable for trading. Our No. 1 goal as traders — particularly in this environment — is to protect our capital! No edge = No trade.

You may notice that the VIX has remained stubbornly high, but hasn’t really rallied despite this week’s fall in the stock market. That’s given the relatively controlled state of the pullback.

Say what you will about the market, but this decline has been orderly. That said, it’s been painful.

The S&P is down ~13% in the last three weeks and unless it rallies 5.5% today, it will close lower for the third week in a row and the 10th time in the last 11 weeks.

Game Plan — S&P 500 (ES and SPY), Nasdaq, Dow

We are gapping higher on the day. Keep an eye on those closing prints. I would not be surprised if the market wiped out the early gains first, then decided on which direction it wanted to go.

S&P 500 — ES Daily & Weekly

Above is the daily chart, below is the weekly chart for the ES.

One thing I have said and will continue to say is that the levels have been pretty clearly laid out. Despite it not being an easy environment, the clean breaks and rejections have helped.

On the upside, the ES needs to clear 3710. If it can, the 3742 to 3766 range is in play, followed by 3800 to 3810.

On the downside, a break of the Globex low near 3668 puts Thursday’s low in play at 3642, followed by ~3625.

As for the weekly view, of course some sort of bounce is possible. However, 3875 to 3900 (and there is a gap-fill level in there at 3896) is resistance until proven otherwise.

On the downside, a test of the 200-week moving average and 3500 level can’t be ruled out in my opinion.

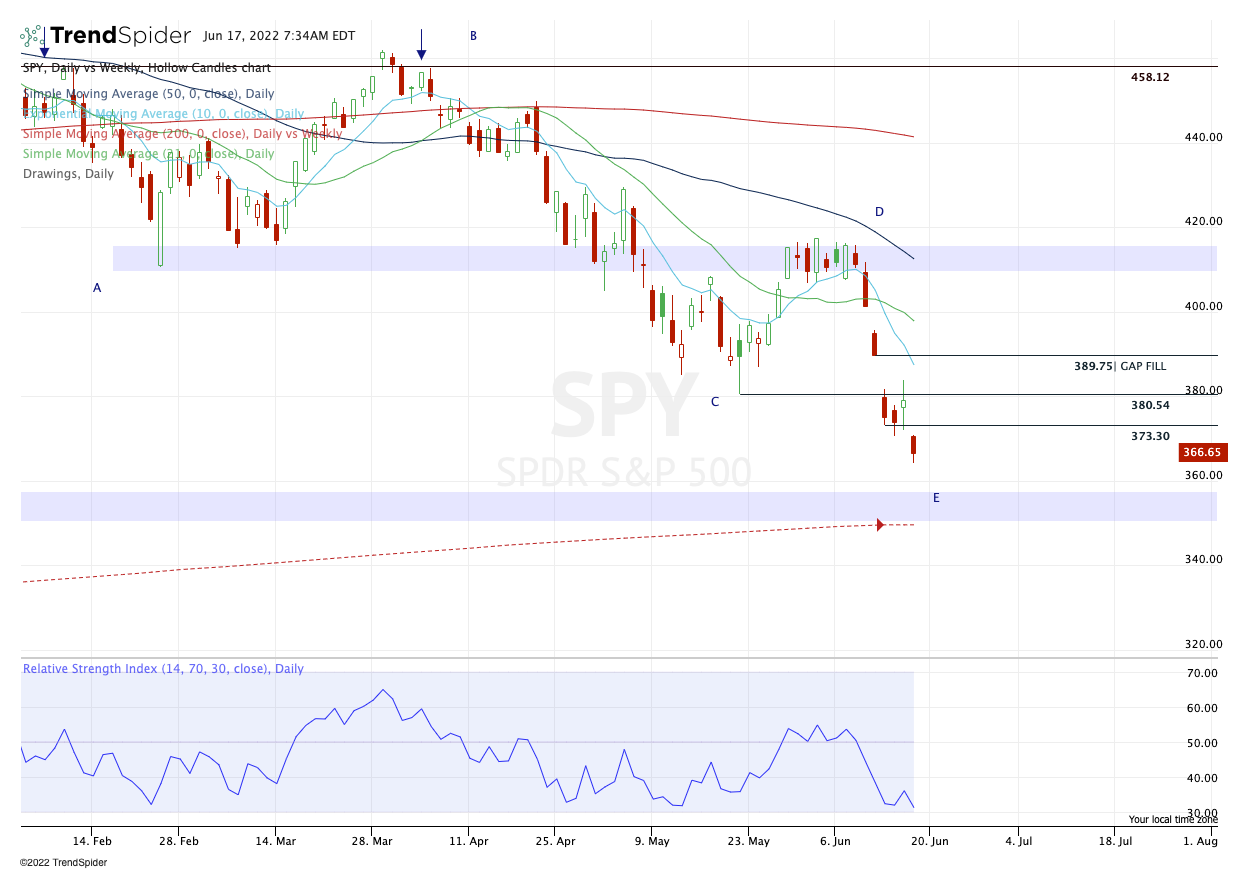

S&P 500 — SPY

On the upside, bulls need to clear $370.94 — yesterday’s high. If the SPY can do that, the $373 levels looms large, followed by ~$380, which was the prior 2022 low in May and clear resistance this week.

On the downside, keep an eye on $366.65, which is yesterday’s close. If we lose the gap-up gains, this level is in play, with yesterday’s low being the next level to watch at ~$364.

Below that could put $362 to $362.50 in play.

Nasdaq — NQ

At this point, I almost hope the Nasdaq doesn’t rally much, because it seems inevitable we are going to test the 200-week moving average here — let’s just get it over with, right?

It helps that this measure comes into play near a major breakout/prior support zone around 10,800 to 11,100. To tag the 200-week week would mean a decline of just 2% from this week’s low — that seems like nothing these days.

This is a “zoomed out” look, but on a bounce, watch the 11,500 level. Above that puts the declining 10-day in play, along with the 11,700 to 11,750 zone.

Dow — DIA

We mostly talk about the S&P and the Nasdaq, but I thought the Dow was a good one to look at now as it comes into its pre-Covid highs, prior breakout area and the 200-week moving average.

Thought out loud: Do we eventually get a slight overshoot on the downside and fill that gap near $285?

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

DXY / UUP — This one is a little more dynamic. I still have the ¼ position in UUP from the first trade and then added on yesterday’s dip. I will likely trim if we see $28 to $28.10 (or close to it) today. At $28.20+ I will likely get back down to a ½ position.

On the downside, I want to hold Thursday’s low.

XOM — Needs to hold $90 and I want to see it go daily-up over $93.13. Conservative bulls can trim at $95 and more aggressive bulls can aim for $96 to $97.

MCK — Needs to hold $299. $310 to $312 is a reasonable first trim spot.

AR — did not hold $36.80 on an intraday basis. Watching to see if we can get a rotation back up through $36.70 to $40. No rush to be stubborn though.

Relative strength leaders (List is cleaned up and shorter!) →

XLE

AR

XOM

PXD

DLTR

AMD

IBM

ARCH

NVA

MCK