Technical Edge

NYSE Breadth: 30% Upside Volume

Advance/Decline: 31% Advance

VIX: ~$16.75

We’ve had some decent action out of our two individual stock trades thus far, although this week will likely be a make-or-break situation for them. As for the week, there are three things I want to note.

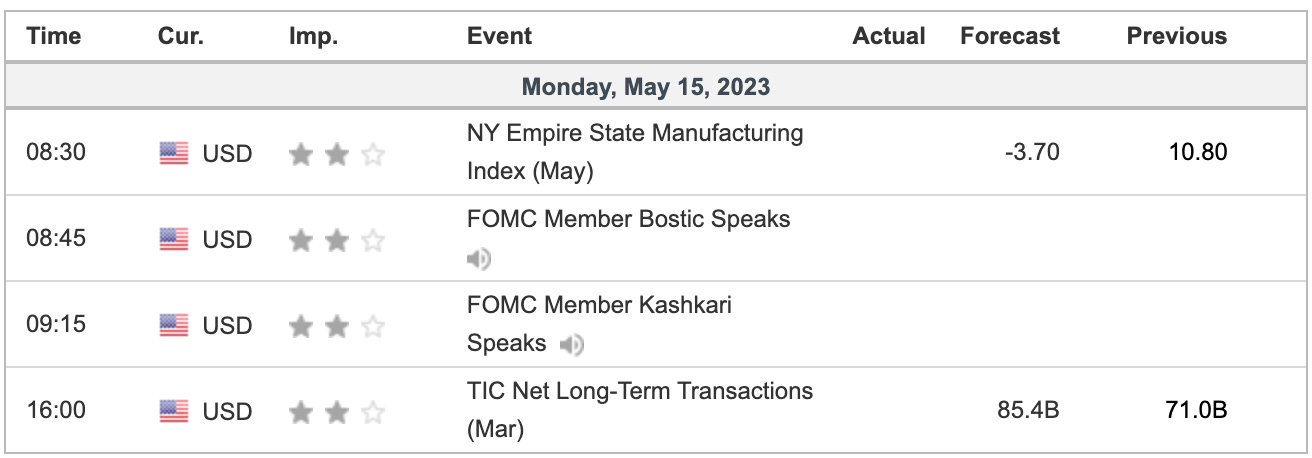

First, there are a lot of Fed speakers on deck (14 to be exact). So beware of some of the intraday headlines.

Second and third, I want to keep an eye on regional banks (KRE) and the dollar (DXY). When both are working against equities — aka, the KRE is dropping and the DXY is rallying — the S&P has trouble on the long side.

S&P 500 — ES

The upside has been capped by ~4175. The downside limited to ~4115. We need a break of this area to push the outer edges of the range. Even more recently, notice how the ES has pushed higher or lower, then retreated back 4140 to 4150 area by the close.

Upside Levels: 4170-75, 4198-4206, 4242

Downside levels: 4110-15, 4100, 4075-80, 4063

SPY

Upside Levels: $414-16, $417.50 to $418.30

Downside Levels: $407 to $408, $403 to $404

SPX

Upside Levels: 4150, 4167-70, 4187-4200

Downside Levels: 4100, 4085, 4050

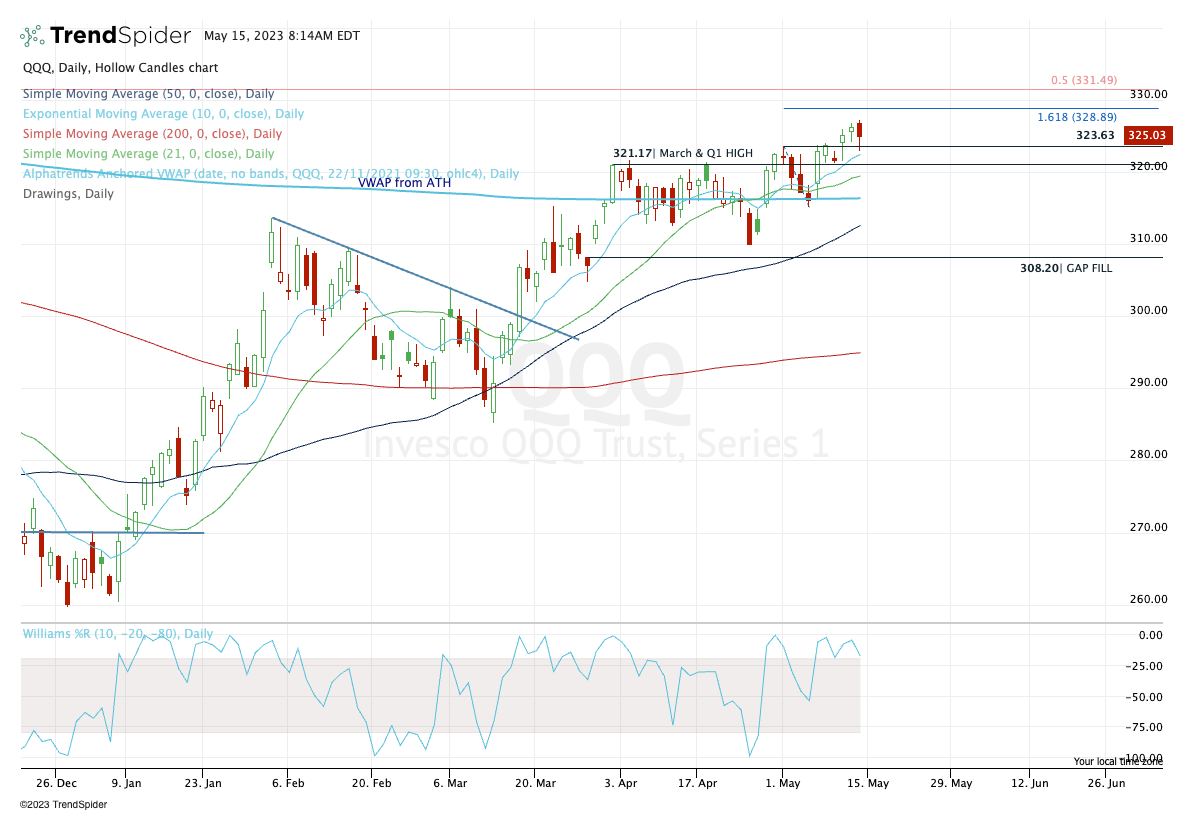

QQQ

Still watching $328-$331 on the upside and now watching ~$323.50 on the downside for support. Big-cap tech is still a massive driver in the market (MSFT, GOOGL, AAPL, etc.)

Upside Levels: $328-29, $331.50

Downside Levels: $323.50, $321.50, $318.50

NQ

On Friday I was “very interested in seeing how it handles a dip back down to the 13,300 area, which is the rising 10-day ema and the prior resistance level.”

It came within 10 points in the afternoon, then gave us a ~90 point bounce. In the pre-market, it’s +130 from that spot. I still think it’s a key are on the downside, while 13,500+ is the upside level to watch.

Upside Levels: 13,500, 13,600

Downside Levels: ~13,300, 13,160, 13,000

DXY

The level to hold is $102.40 on the downside. If it does, DXY bulls can remain in control, which is a headwind for equities. Back below this level and S&P bulls may find a bit of a catalyst.

AVGO

Inside week last week, weekly up at $632.70+

Nice little bullish consolidation in AVGO here as it tries to go weekly-up and clear downtrend resistance. If it fires, stops can be at $613 to $615.

$640+ is the first target to trim. Then $645.

GOOGL

I don’t expect it, but a tag of the 10-ema on the 4-hour chart and a gap-fill would be an attractive entry for longs and/or call buyers.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B

META — Trimmed ⅓ between $237 and $239. If we see $240-ish or higher today, let’s get down to a ½ position.

Break-even stop or can keep the $229 stop if playing more aggressive.

CRM — Closed above $200. Ideally, $207 to $208 is the first target zone. Can trim on any push to new high over $206.28

Conservative bulls can stop out below $198. Aggressive buyers may use $195 as their stop.

** UBER — still watching the $37 to $37.50 BTD setup from Friday.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

MCD, PEP & KO, WMT, PG — XLP

LLY, CAH

NVDA, CRM

MSFT, AAPL, META

LULU, CMG, DKS

FSLR — guess it’s back on the list. New 52-week highs.

Relative weakness leaders →

PYPL

MET

CF, MOS

PFE

GLOB