Technical Edge —

NYSE Breadth: 35% Upside Volume

Advance/Decline: 36% Advance

VIX: ~$19.50

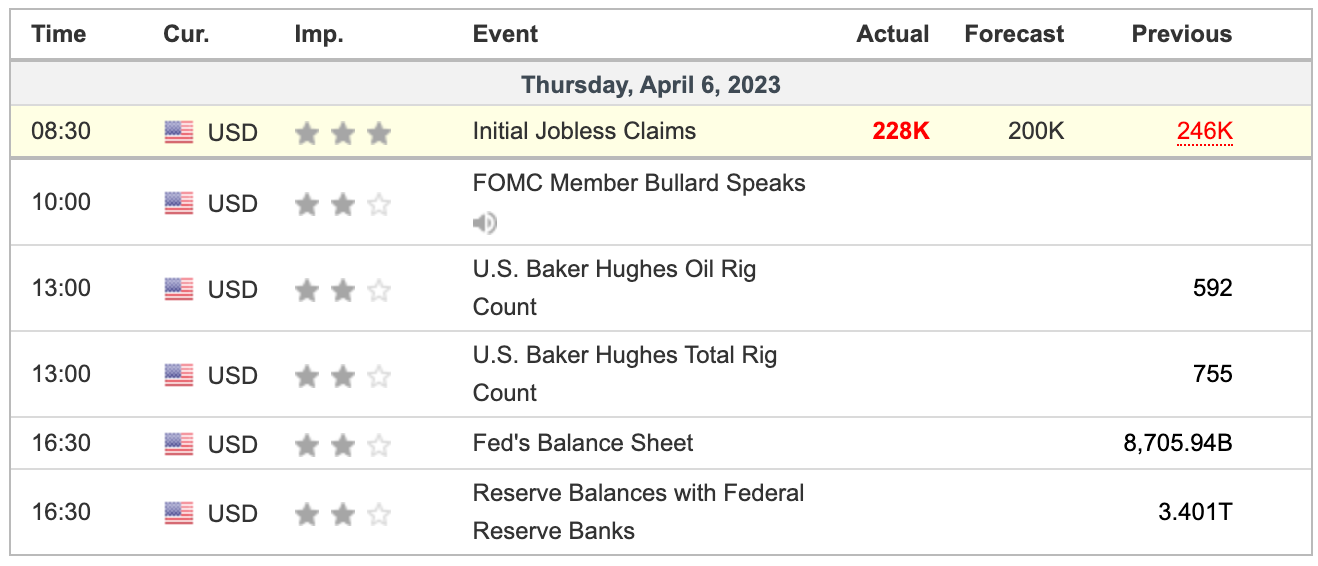

At the top of this week, we talked about patience and asking for a pullback in the market and that’s exactly what we’ve been getting. The Nasdaq has reset back to the 10-day ema, while the S&P holds in a bit better.

Thursday marks the last session of the week, before we enjoy a three-day weekend.

On that note, thank you for riding with us! It’s been a pleasure being able to write every morning for you and formulate a game plan that we can all be proud of. We don’t “bat a thousand” everyday, but we do our best.

Trade ‘em well, then remember to enjoy the long weekend.

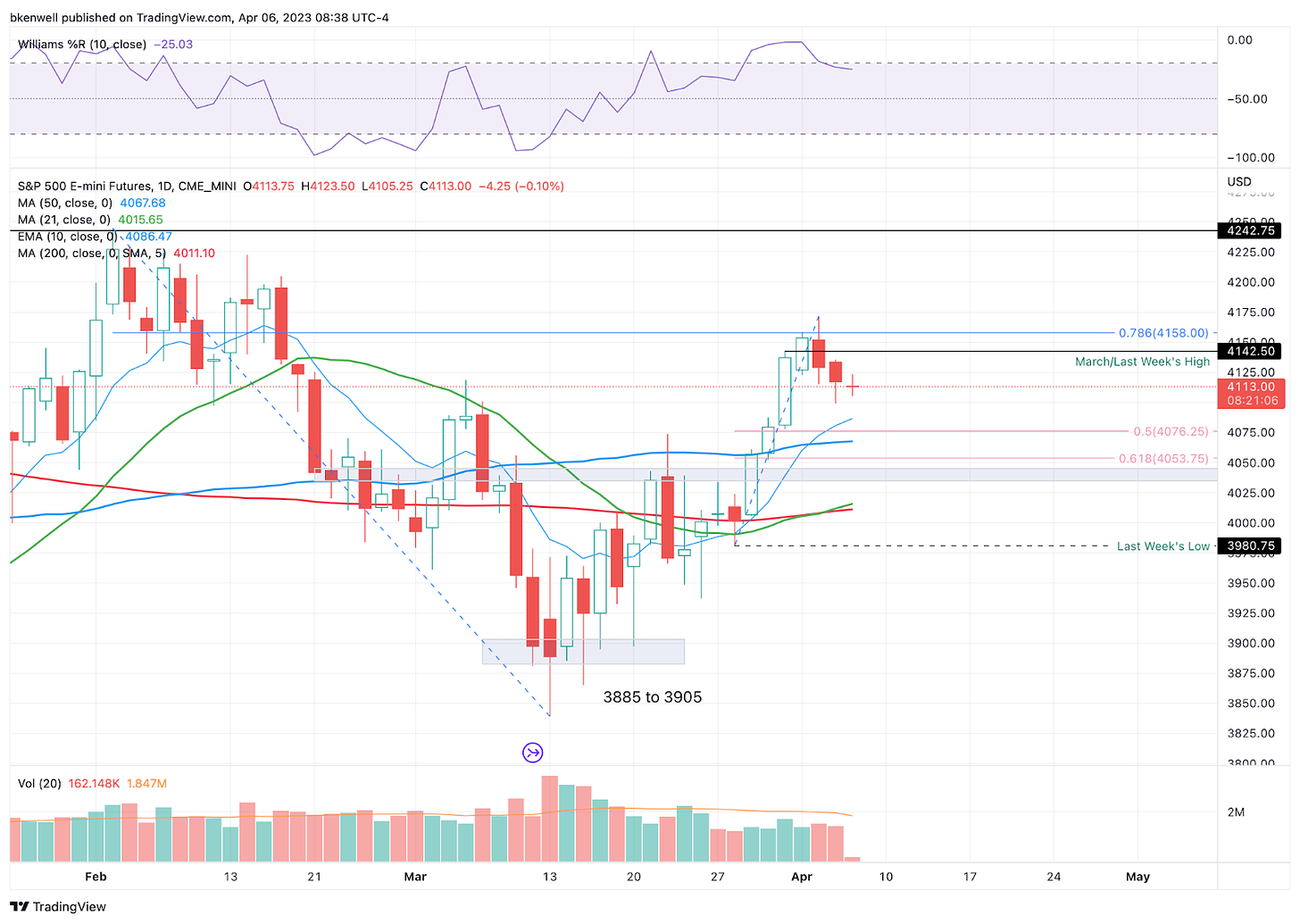

S&P 500 — ES

Upside Levels: 4135-44, 4158-60, 4172-75

Downside levels: 4100, 10-day ema, 4076, 4060-65

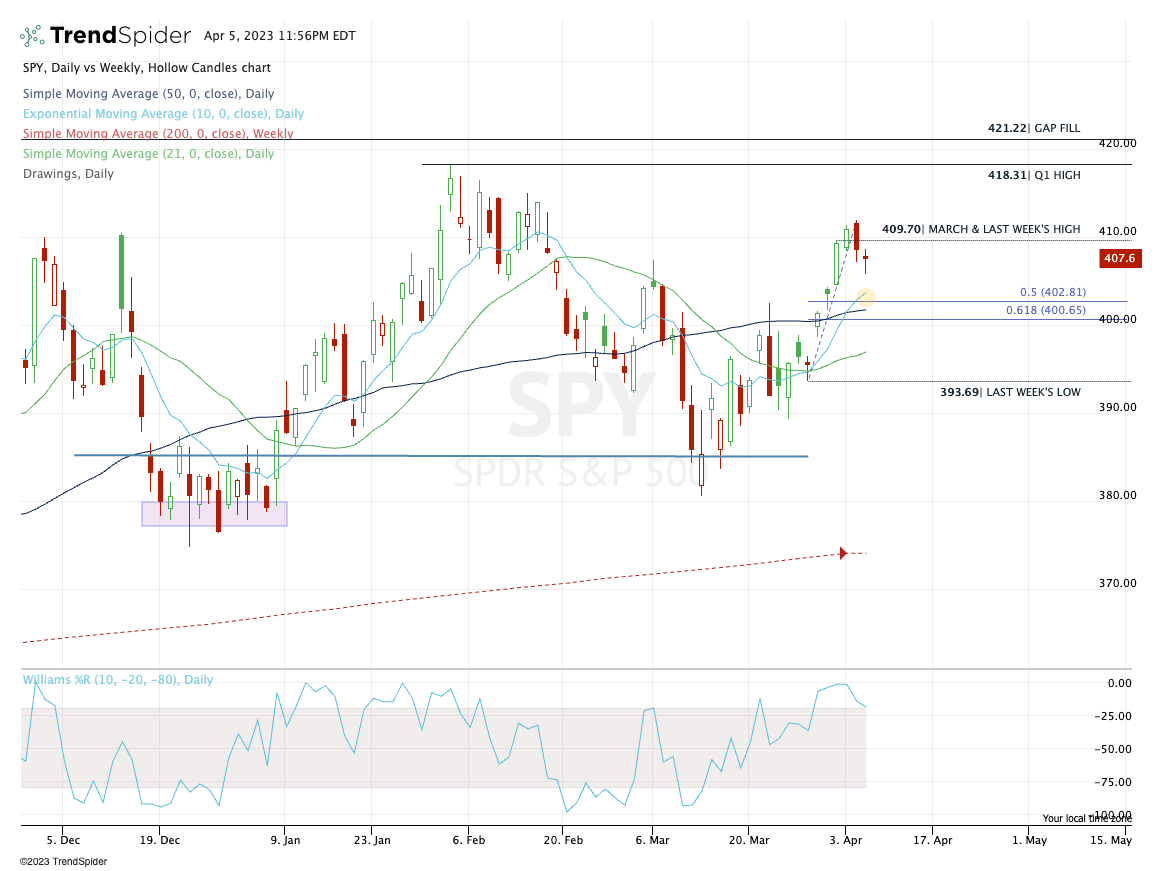

SPY

I reiterate: I would absolutely love a test of the 10-day, 50-day combo and the 50% retracement. Now though, the 10-day has climbed (trading around $404).

H4 10-ema held firm well. Now we see.

Key Pivot: $408.70 on upside, $406 on downside

Upside Levels (SPY): $409.75 to $410.25 (last week + month’s high, 78.6% retrace), $412, $414.50 to $415

Downside Levels (SPY): $405.50 to $406, 10-day ema, $402 to $403

SPX

H4 10-ema held firm well. Now we see.

Upside Levels (SPY): 4100, 4127-4130, 4150

Downside Levels (SPY): 4072, 10-ema on daily, 4025-4030

NQ & QQQ

Both measures tagged the 10-day moving average and the prior breakout spot.

Let’s see if we can get some upside follow-through back into the 13,150+ and $317.50+ area, respectively.

AMD

I don’t want to put too much emphasis into tech here, but the AMD setup is too hard to ignore until the trend fails.

In this case, I’m watching the $87.50 to $89 zone. There we find the 10-week moving average, 161.8% downside extension and a prior breakout zone. Not to mention, we would have a nice ABC correction down to this area.

GE

On watch for daily-up rotation over $95.32 (look for some type of intraday close above this level, like a 15-minute close above this level). Ideal first target is $97+ for ½. $98+ would be the next target.

$93 to $93.50 would be our stop-loss if daily-up triggers.

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

FSLR, NVDA, QQQ, AAPL, down to runners. Congrats, all. Great sequence!

AAPL — for those that were swinging AAPL for the longer timeframe, we got our $165 area to trim into and as we continue to tip-toe higher, I’d say down to ½ size here or even less.

Going for $168.50 to $170 on the next tranche. Raise stops up to $160.

WYNN —Weekly-up over $110.73 — Should have trimmed ½ to ⅔ between $116 and $117. A nice initial reaction, but no dice on follow-through. Stopped at B/E and moving on.

CRM — Tagged and held ~$194 and the 10-day — $197 to $198 is ideal first trim. I’d like to get $199-$200 to get down to ½ or less, but that’s asking for a lot if tech is tried.

I am long calls instead of common, as it’s easier to manage the risk in this case. For those long common, you don’t want to see CRM break $192 to $192.50.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders → Tech remains absolutely the strongest group lately.

NVDA, AMD

TSCO

MSFT, AAPL, META

PANW, FTNT

FSLR

GE → love this name if we can get a test of the 10-week ema

DKS, ULTA

AQUA

LMT, RTX

GOOGL, AVGO

ULTA & LULU

MELI