Stock Bulls Need to Reclaim Key Levels To Regain Momentum

Trimming into strength

*Quick note: Couple of nice trims coming up today in our QQQ and CRM and call positions.

I am going to keep today’s piece quite light. Friday’s big-gap down and subsequent all-day rally helped set up a multi-day bounce. Yesterday we prepared for two scenarios: A potential multi-day rally into prior support (and now potential resistance) or a gap-and-fade response that put last week’s low in play.

The former has played out, with Monday’s strong finish and Tuesday’s upcoming gap-up. Today’s gap-up provides an opportunity for Friday’s buyers to take profit and remain nimble.

Until the SPY can regain $445 and the SPX can regain 4460, active bulls have to remain aware of the short-term trend.

Technical Edge

NYSE Breadth: 49% Upside Volume

Advance/Decline: 53% Advance

VIX: ~$16.75

SPY

It will be paramount to determine whether the bulls can regain some of the key moving averages and levels they lost in this selloff. If they do, the bull move remains intact. If they don’t, we could be vulnerable to more downside.

On the upside, $442 to $442.50 is key. That’s the 61.8% retrace of last week’s range (and the last down leg), as well as the 10-day moving average.

Upside Levels: $442 to $442.50, $445

Downside Levels: $440, $436 to $436.50

SPX

Upside Levels: 4435, 4455-60

Downside Levels: 4400, 4370-75

S&P 500 — ES Futures

After some early-session wobbling, the ES found its footing and now our 4435 to 4450 area is being reached this morning. In this area now, we can adjust our range to the 4445 to 4455 area — which encompasses the 10-day moving average and the 61.8% retracement.

Upside Levels: 4445-55, 4465-70, 4482, 4493-4503

Downside levels: 4420, 4395-4400, 4385

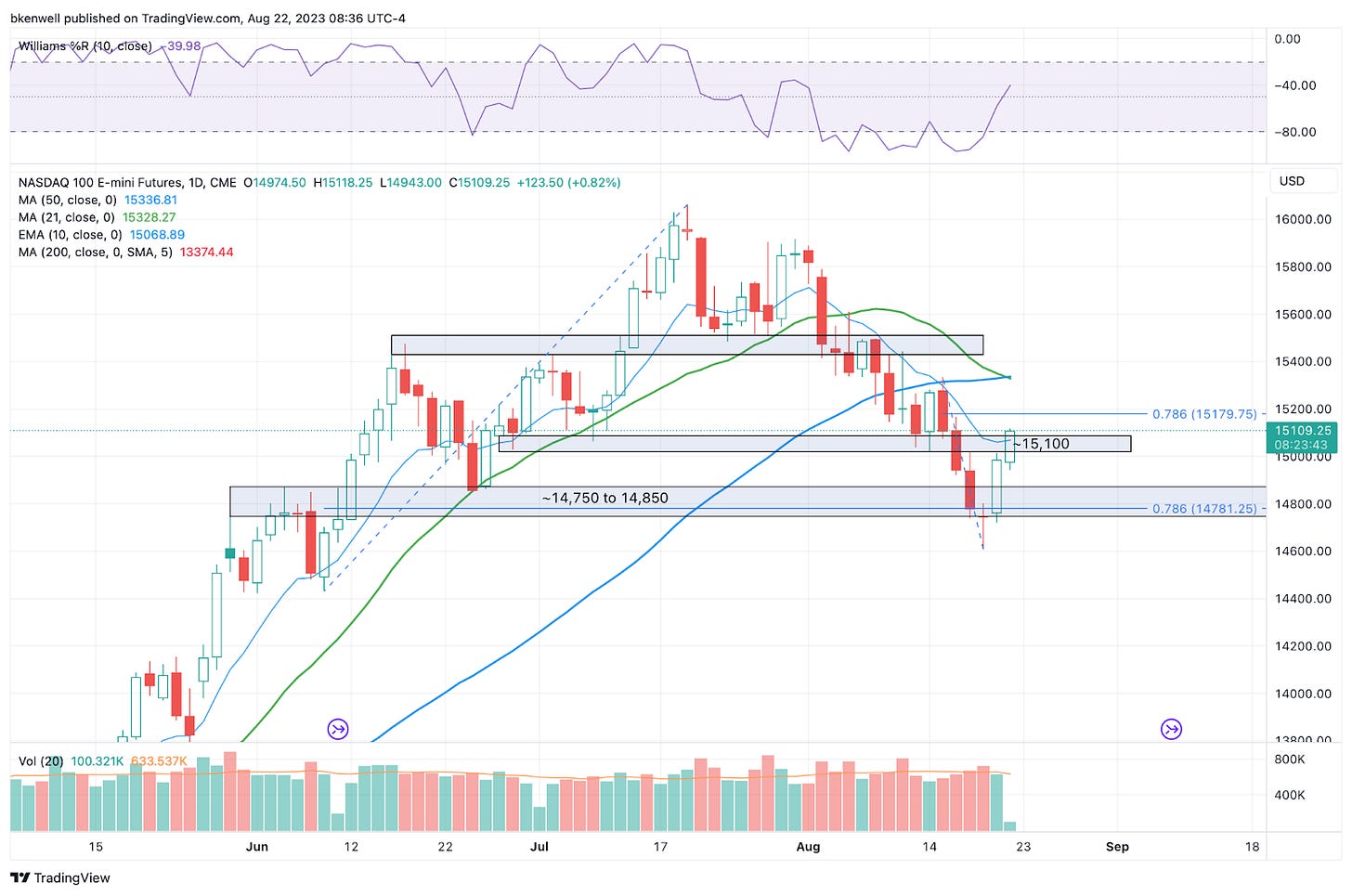

NQ

NQ into our 15,100 level during Globex. I would trim/take profit if long and look to see if 15,175 is doable.

Upside Levels: 15,175, 15,270, 15,340

Downside levels: 15,000, 14,940, 14,860

QQQ

On yesterday’s close, the QQQ neared the underside of the 10-day and 10-week moving averages, as well as a prior support/resistance (S/R) zone.

Making it a bit trickier is today’s gap-up above these measures into the $367 area (the 78.6%). With that, I’m inclined to reduce or exit our long QQQ call position, even if it can maintain momentum into the $370 to $372 area.

If we fade off the open, holding the $364 to $365 area is key.

Upside Levels: $367, $370 to $372

Downside levels: $364-65, $362.25

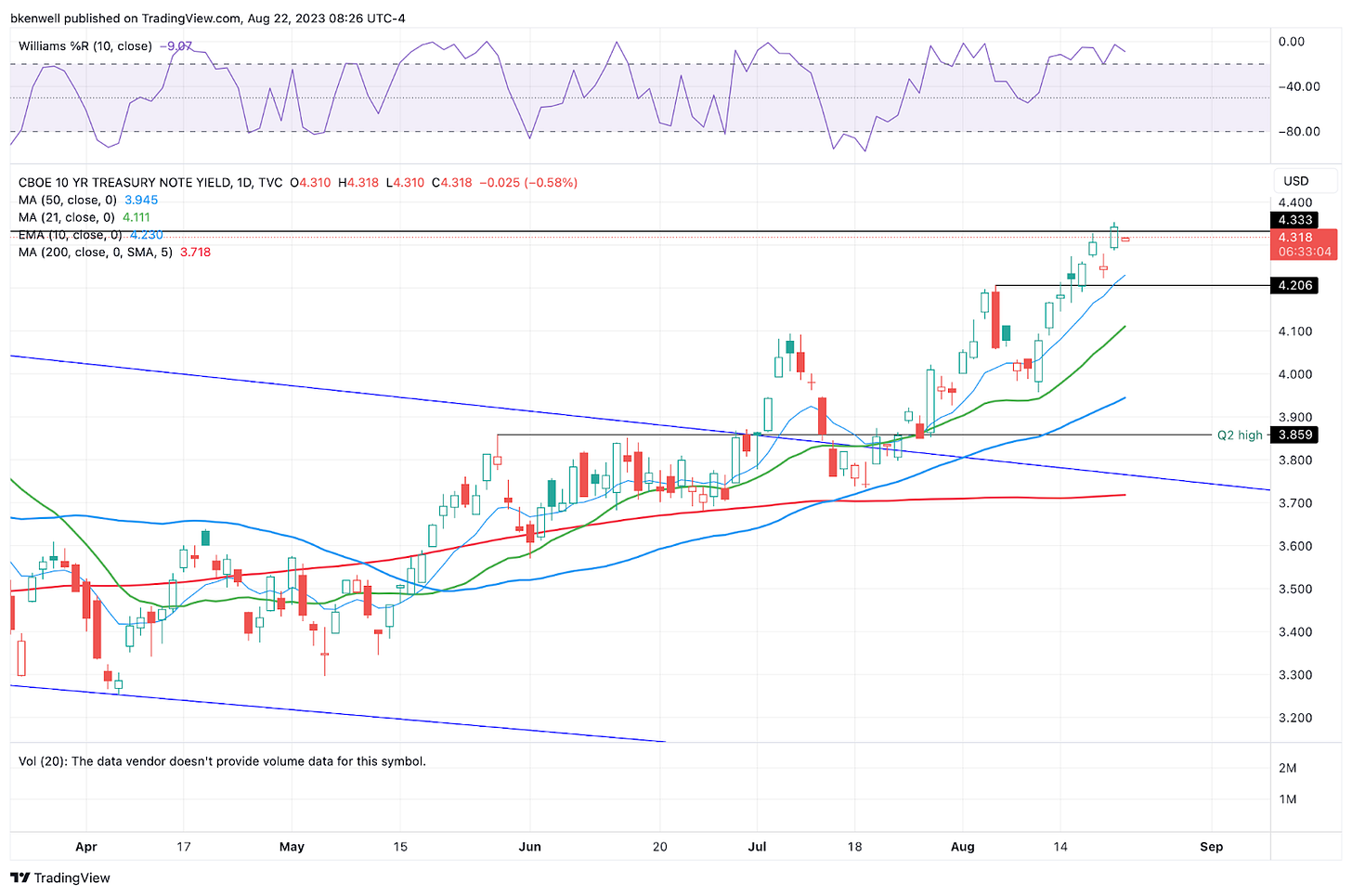

TNX

Don’t forget about 10-year yields (although it’s hard to at this rate). We need TNX to stay below 4.333 and ideally, start working below 4.20 and get down to 4.00 or lower.

Equities will have a hard time with a sustained rally if 10-year yields remain in an uptrend.

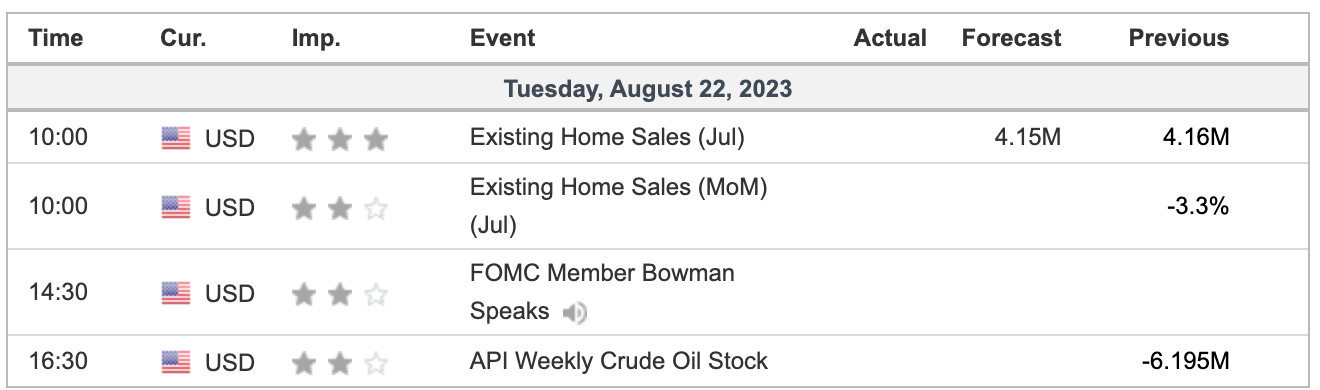

Economic Calendar

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

Open Positions

Bold are the trades with recent updates.

Italics show means the trade is closed.

Any positions that get down to ¼ or less (AKA runners) are removed from the list below and left up to you to manage. My only suggestion would be B/E or better stops.)

** = previous trade setup we are stalking.

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Down to Runners in GE, CAH, LLY, ABBV, AAPL, MCD & BRK.B. Now Add META, AVGO, UBER, CRM, AMZN, CVS, AMD, TLT and YM.

JPM — Many are long from $143-145. This is a longer term swing. Trimmed $153s, then $157.50+ on 7/24.

Down to ½ position vs. Break-even stop. Can make small, ~10% position trim if we see $160+

If worried about a larger correction, can sell/trim north of $150 and look to re-establish lower (if we get it).

XOM — Long from the monthly-up area at $108.50 — First ¼ or ⅓ trim is ~$112.50. Stops at $104.

CRM — long from ~$200 — Excellent gap-up open for a trim, then we got $208 to $210. Down to ½ position or less after a quick $10 move off the low.

The Sept. calls are +50% from our entry and will be higher today. If we get 2x, we need to trim again, down to a ⅓ position

QQQ — long this week or next week’s $360 calls — Trim ~½ on this morning’s gap-up. Trim down ¼ or less on Tuesday’s opening drive.

These are 2x gainers and will be more on the open.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

LLY

Energy stocks — VLO, SLB, EOG

AI stocks — NVDA, ADBE

Mega cap tech — GOOGL, AMZN

Select retail — ELF, LULU, COST

BRK.B (new all-time highs)

CAT

RCL

Relative weakness leaders →

DIS

NKE

PYPL

EL, FL, DG