Support Held. Now the Jobs Report Is Critical

Reacting well to the report, let's see if the ES can clear 4000.

Yesterday we asked, “Is a bounce brewing?” and boy was it.

The ES traded down to 3903.50, found its footing and bounced. It took a while to get going, but it ended up running all the way up to our 3965 to 3975 resistance zone.

If it weren’t the jobs report, this setup would look primed for even more upside. We may get more upside, but the jobs report is keeping us on the sideline after yesterday’s big move. I may be wrong about this, but the jobs report could be key in the short term.

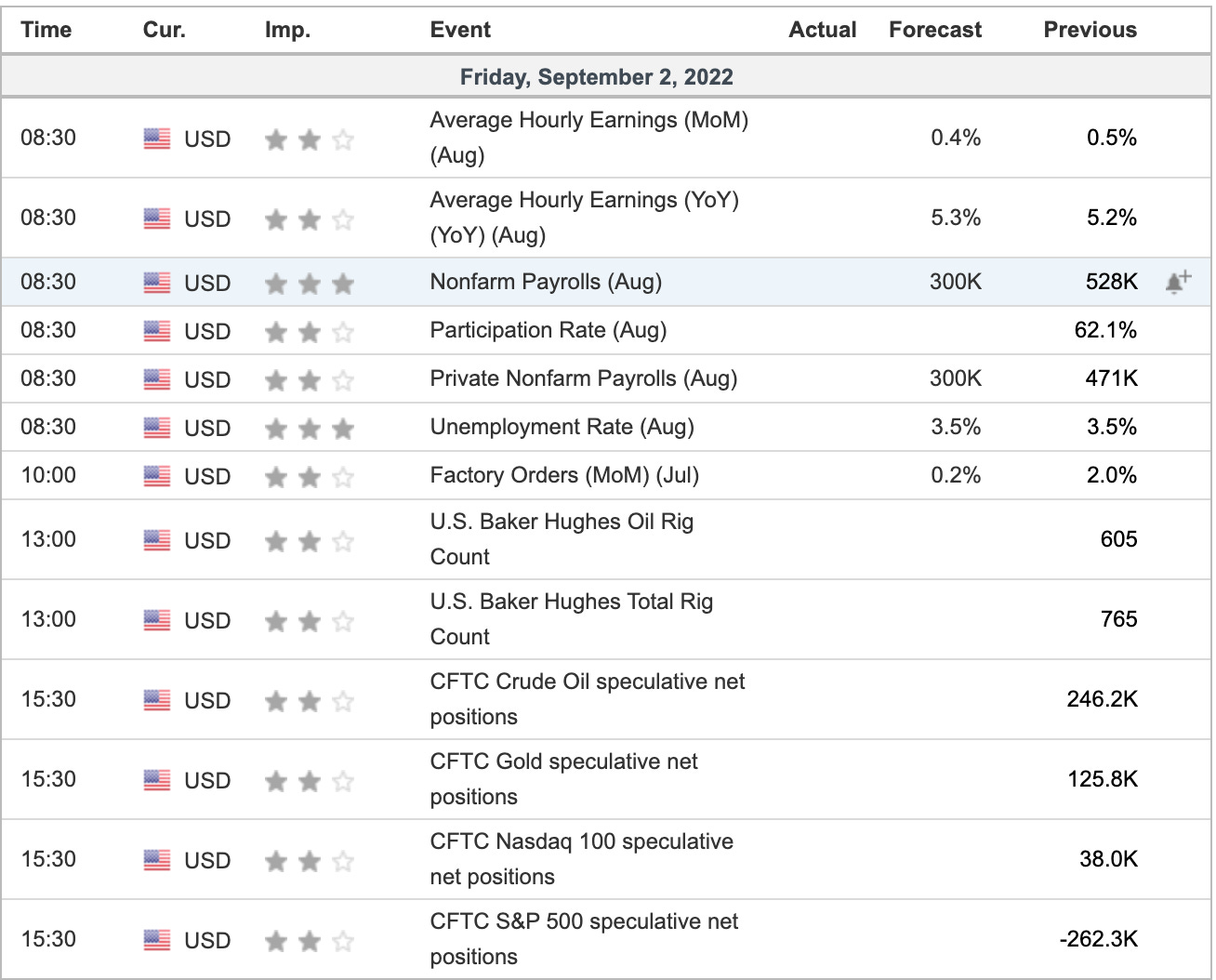

Economists expect 300,000 jobs to be added in August. Worse-than-expected results suggest a weakening labor market and would imply a continued cool-down in inflation. Stronger-than-expected results suggest a strong labor market and imply that inflation may keep running.

I believe that is how the market will interpret the report. While no one wants to see people lose jobs and the economy head into a recession. But market participants also want to see the Fed take its foot off the gas.

Technical Edge —

NYSE Breadth: 31% Upside Volume

NASDAQ Breadth: 36% Upside Volume

VIX: ~$25.30

Game Plan: S&P, Nasdaq

We are just going to cover the S&P and Nasdaq today. I might send an update afterwards, but I want to see the reaction to the jobs report before doing too much.

If it’s a favorable reaction, we may get a “risk-on” setup for a bounce. Remember, bears have the momentum right now, as bulls try to carve out a bounce. But they need to prove themselves by reclaiming resistance at this point.

Otherwise, it may eventually just be a rally to sell.

After what has been a tough week, patience has clearly paid off as we got that move back to 12,250 in the NQ. Between the ES and the NQ, we got a stellar rebound from a great R/R point on the charts.

S&P 500 — ES

Man, what a move we saw out of the 3905 to 3920 pocket. Just a stellar bounce that took the ES right to our resistance zone of 3965 to 3975.

That put ~50 points in our pocket and let us flatten out ahead of the jobs data.

On a favorable reaction, let’s see how this handles 3990 to 4000. Back above out could put ~4040 in play.

On the downside, 3920 to 3925 could be support if the reading is mostly in-line and we have a knee-jerk down. Below that puts ~3900 and yesterday’s lows in play.

SPY

If the SPY can clear $396.50, I’m looking for $400, then $401.50 to $405.

On the downside, a bearish reaction could put $390 to $392 back in play. That’s a support area that needs to hold, otherwise, lower prices could be ushered in.

Nasdaq — NQ

Yesterday we were looking for a bounce out of the 12,080 to 12,100 zone and “on a bounce, I’d love to see 12,250+”

If we continue up over yesterday’s high of ~12,300, we could see the 12,550 to 12,600 area today or on Tuesday. That was a resistance zone previously the list week and it’s also where we find the 50-day and 10-day moving averages.

A move lower could put 12,050 to 12,100 back in play.

Nasdaq — QQQ

Yesterday we said, “on the upside, $300 needs to be reclaimed. Bulls can’t even think about getting back in control until that happens.”

That’s still true. Bulls need to clear $300, opening the door to the $305 to $307 area, where it finds the 10-day and 50-day moving average. Until reclaim, this looks like potential resistance.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

For those that want to preserve their gains, feel free to exit any position below, as many are a ½ positions or less.

CNC — what the hell was that yesterday? Action was wild. We’re down to just three longs now and being patient after 6+ weeks of register-ringing.

UUP — Down to ¼ position as we hold for potentially higher prices. Raise stops to $28.40 to $28.50. Look for $30 on the last piece.

CHNG — second target of $25 hit. Now down to just ⅓ position. Take all profit here or move to a B/E stop and look for $25.50.

Still looking for $25.50 on the upside, but can be back up to a ½ position or more $24.73. $24.25 is a reasonable stop-loss for those that added.

OXY — I like the look here. If we bounce, I’m looking for $75 to $76 as our first trim spot. On the downside, I actually like this one a dip down to $66-ish. So consider leaving room to add.

Relative strength leaders (List is cleaned up and shorter!) →

XLU

XLE

OXY

CNC

F

BMRN

APLS

ENPH

TAN

FSLR

LNG

PWR

CHNG

CELH

COST

UNH