Technical Issue: Monday's GamePlan 11/28

Technical Edge —

NYSE Breadth: 57% Upside Volume

Advance/Decline: 64% Advance

VIX: ~$20.50

The dollar is making new lows on this current decline, while bonds are up in the pre-market. Aside from booking some more profits in our short dollar position, this setup tends to bode well for equities, even though the S&P is coming into the session under pressure.

I am interested in seeing how the market handles a lower open. Let’s take our time and let price lead the way. We don’t want to start the week on a negative note.

S&P 500 — ES

The ES is fading down to the 4000 area ahead of the open. I’d like to think this area acts as support, with the 50% retracement of last week’s range at 3993. For now, that’s where ES has bounced from.

If it takes out the Globex low, look for support in the 3975 to 3980 area. That’s where we have the 10-day moving average and the 61.8%.

If we get that kind of dump to start the week, I imagine they at least give us a bounce to work with.

On the upside, 4024 is clearly relevant, as it marks Friday’s low and the overnight high. A move above this area puts 4050 in play.

The Bigger Picture:

Bulls need active support to continue to hold. Currently that’s in the 3975 to 3980 area. Below that and 3940 to 3950 may be called upon.

On the upside, we have a 2x weekly high of ~4050. If we can rotate over this level — and the declining 200-day moving average — it puts 4135 to 4150 on the table.

SPY — Daily

The SPY has a similar look. Bulls need the 10-day moving average to hold as support on the downside.

On the upside, they need to clear $402.30-ish. Ultimately, we want to see a push above the 200-day moving average and a gap-fill at ~$408.50.

A break of the 10-day that’s not repaired puts $390 and the 21-day back in play.

SPY — Weekly

A prior doji week was met with a push higher last week, although not one that could really rotate over the high.

On the downside, the SPY needs to hold the 21-week and 10-week moving averages, while a push up to the 50-week would be ideal.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Numbered are the trades that are open.

Bold are the trades with recent updates.

Italics show means the trade is closed.

Open Positions —

TLT — Now ⅓ to ½ position here. Raise stops (B/E at minimum) and looking for $104.50 to $105 next.

CCRN — down to ⅓ or less. Exit at $36+ or consider holding for $37.50 to $38. Stop at $32.

QQQ — Just down to runners. #cheers

DIA — Just down to runners, if you want. #Cheers

Gold — A traction-less trade thus far, although we were able to cut ½ the position above B/E and get our exit about 1760.

Can be down to ⅓ or less or out completely.

UUP — Trimmed again on continued fade. Down to ⅓ to ½. Trim down to runner or exit the rest if we open below last week’s low.

For DXY, I would love to exit the rest at the 200-day moving average. (at 200-day now in the pre-market).

Relative strength leaders →

LNG

CAH

TJX

SBUX

DE

CCRN

AMGN

GIS

REGN

CI

MCD

ENPH, FSLR — solar has strength

VRTX

UNH

MRK

XLE — XOM, CVX, COP, BP, EOG, PXD (Weekly Charts)

SBUX

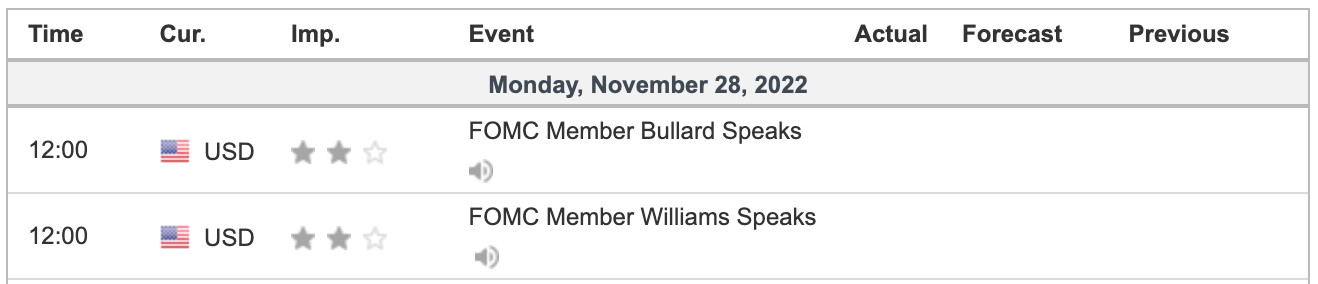

Economic Calendar

**Powell Speak on Wednesday afternoon**