Technical Edge —

NYSE Breadth: 84% Downside Volume (!)

NASDAQ Breadth: 82% Downside Volume (!)v

VIX: ~$23

Game Plan: S&P, Nasdaq, TLT

Last week, we mentioned if there would be a “change in tune” — and we would know if we had our ⅓ and ½ running long positions in the winners get stopped out.

The S&P is not finding its footing at active support, so we’ll need to see if this is just a shakeout or something more.

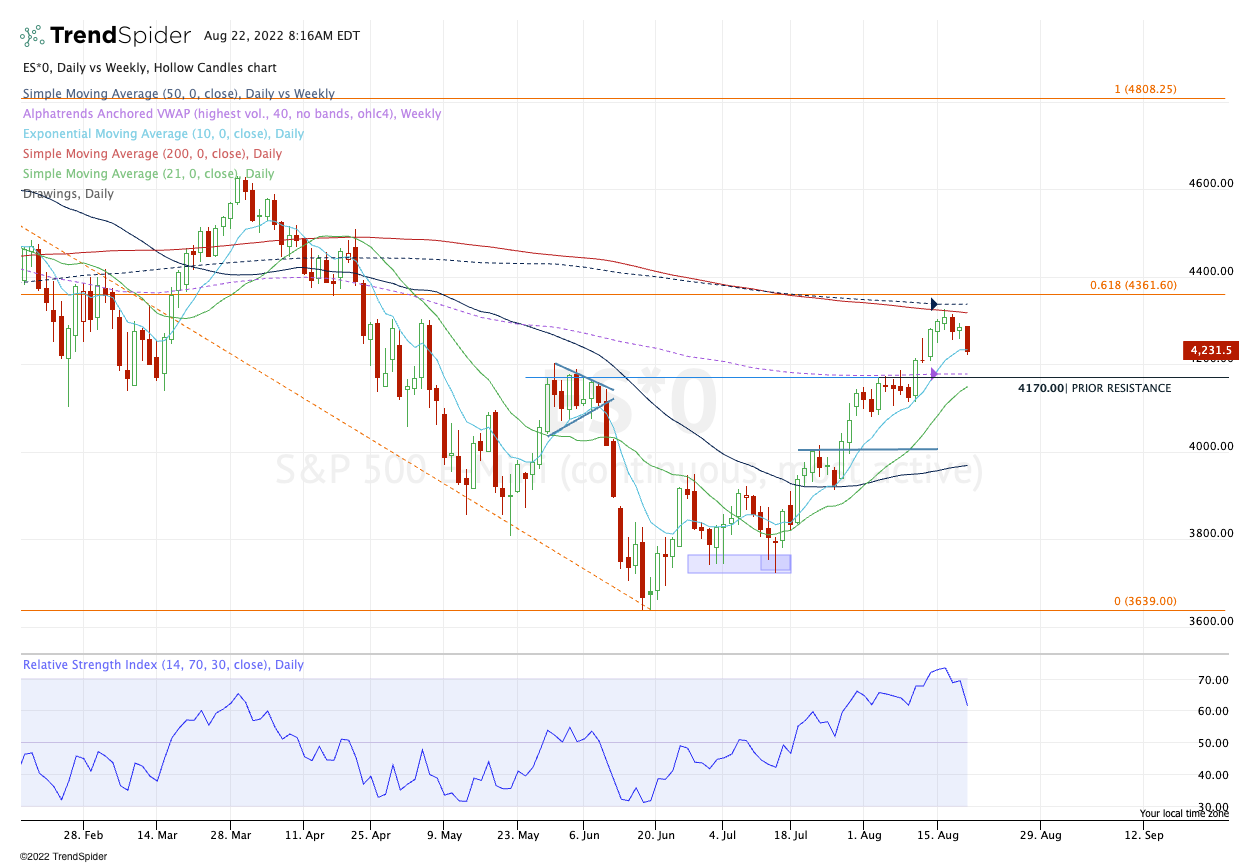

S&P 500 — ES

The ES is pulling back into the 4170s as we speak. This is a big area to me. The S&P is not holding active support via the 10-day moving average, a measure it has held for the past month.

The 4170s area was resistance until the Aug. 10 breakout. Let’s see if this area — along with the weekly VWAP and rising 21-day moving average — is enough for an opening morning bounce.

If so, my upside targets are 4200, then ~4220 (which is the underside of the 10-day and Friday’s low). Reclaiming this area is bullish. Not doing so leaves the S&P suspect in my book.

S&P 500 — SPY

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.