The Retail Sector Has Terrible "Higher Lows"

It will need a strong showing from retail earnings

Technical Edge

NYSE Breadth: 17% Upside Volume (!)

Nasdaq Breadth: 40% Upside Volume

Advance/Decline: 19.5% Advance

VIX: ~$17.50

A couple of notes:

That DXY note from yesterday was something to keep an eye on and now it’s powering higher again (updated chart below). Despite yesterday’s rough ending, the S&P cash (SPX) all but gave us another inside day (although it technically broke the prior day’s low by 0.40 points).

Retail — HD, TGT & TJX — has been unimpressive thus far and overall, the sector continues to disappoint (chart on that below too).

The SPY, DIA and IWM all ended near session lows on Tuesday, while the QQQ/Nasdaq finished the day in positive territory.

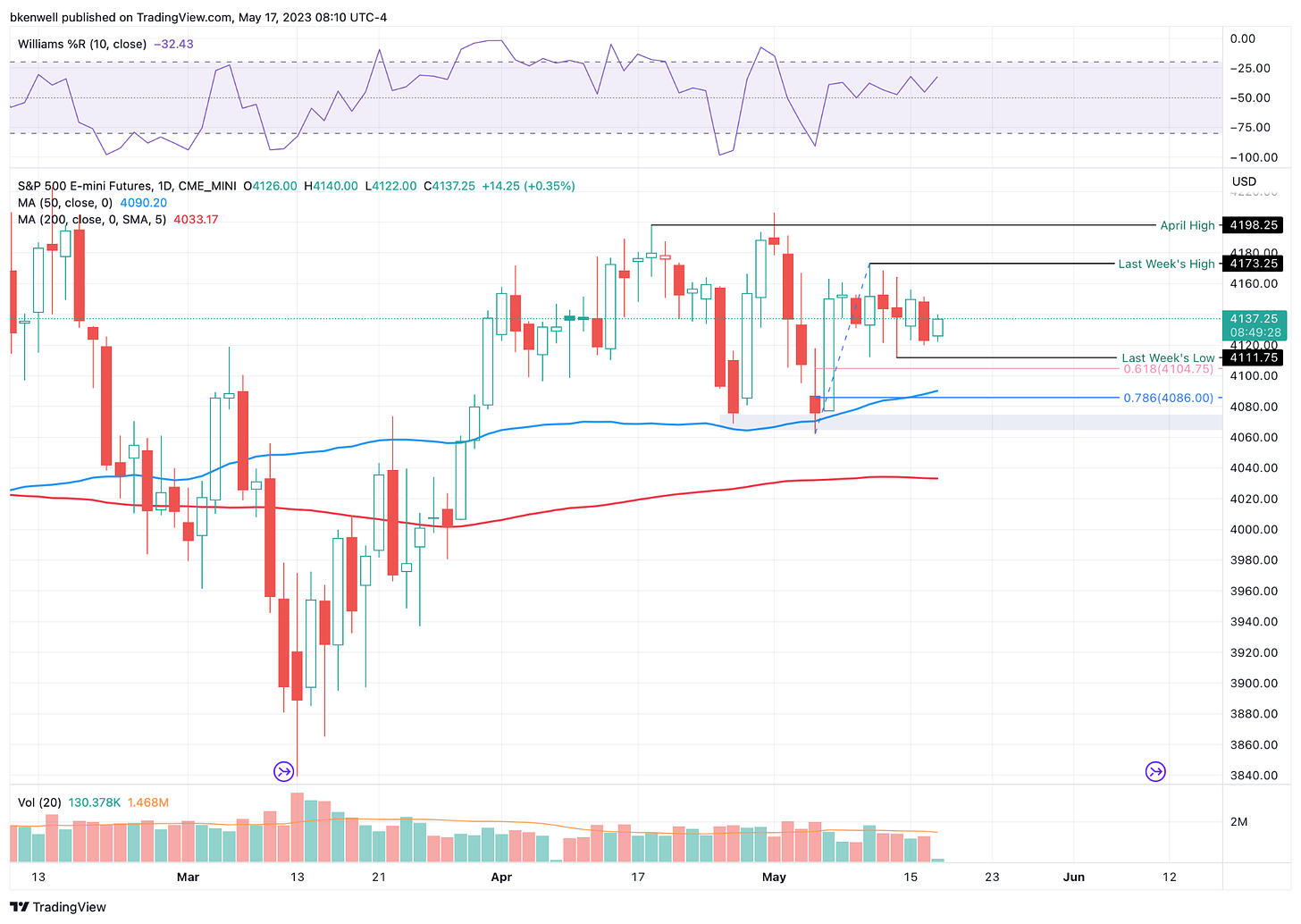

S&P 500 — ES

The upside has been capped by ~4175 (and more recently, by 4160-65). The downside limited to ~4115. We need a break of one of these areas to push the outer edges of the range.

Upside Levels: 4165, 4170-75, 4198-4206

Downside levels: 4110-15, 4100, 4080-85, 4063

SPY

I wish there was more to say. At this rate we will be trading “unchanged” for the day next Wednesday! Kidding aside, we basically play the ranges until the range breaks.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.