Technical Edge —

NYSE Breadth: 94.3% Downside Volume (!!)

Second 90%+ downside day in three sessions

NASDAQ Breadth: 84% Downside Volume

VIX: ~$34

Yesterday we opened with more than 90% downside volume and a TICK reading below 1700, yet couldn’t get a bounce going.

Two 90% downside days in three sessions is noteworthy and there’s been plenty of downside days in the last few weeks. Sentiment is trashed as investors throw in the towel and/or get short. Bonds made new lows but reversed and closed higher on Monday.

A bounce is coming. The question is when and for how long. Interestingly, the S&P has not sold off for 5 straight weeks since 2002. It’s done that now, as it looks for 6 straight weeks this week.

Game Plan — S&P, Nasdaq, Bitcoin, Individual Stocks

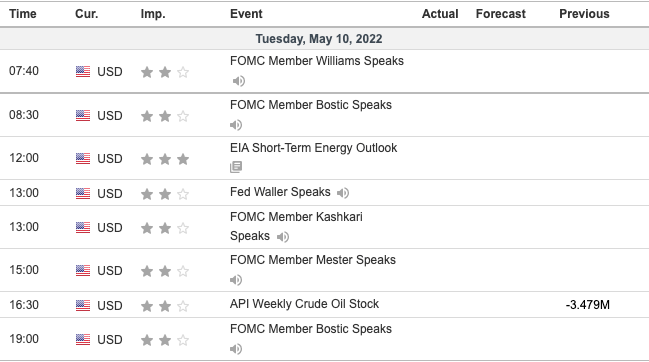

FYI — there are a ton of Fed speakers today, (see calendar below).

S&P 500

On the downside, the 3962 to 3970 area is key — the Globex low and Monday’s low. If we break these measures and can’t reclaim them, the 3900 area could be on the table.

On the upside, let’s see how the ES handles last week’s low at 4056, assuming it can even get there.

Above 4056 and 4100 is back on the table, followed by 4160 and the declining 10-day moving average.

SPY

The “half-back” of yesterday’s range — the 50% retracement — is near $401.50, which is around where the SPY is trading in the pre-market this morning, up about 0.8%.

After a big down day, a gap-up into yesterday’s 50% to 61.8% retrace zone is not the most attractive setup I’ve ever seen. On the plus side, bonds are adding to yesterday’s reversal rally.

Over $402.60 — the 61.8% retracement — and we’ll be watching last week’s low near $405. That’s followed by $410 to $411, then $413.

QQQ

Above is an hourly look at the QQQ, which is gapping higher by about 1.6% this morning. That move is putting it near $302, which is where the declining 10-ema and 61.8% retracement of yesterday’s range come into play.

I’m not necessarily saying this is a short right out of the gate — assuming we open around this area — but it’s definitely something I’m keeping my eye on from the short side and how I’ll be trying to play it unless it blasts right through this zone.

If the QQQ pushes through this area — and it could! We are due for a bounce — then yesterday’s high at $306 is in play. That’s followed by $310 and $313.

On the downside, a fade puts $300 in play, followed by $298 and then the lows near $295.75.

Bitcoin

Down on the day but up almost 7% from the lows, Bitcoin is bouncing from a major support area.

You don’t have to trade bitcoin or crypto, but like other assets, it’s worth knowing. If this “risk-on” asset gets a move on, then we could see a follow-through rally in other tech names.

On a bounce, see how it handles $33,000. A larger rally could put $37K to $37,500 on the table. A break below $29,000 does not bode well for Bitcoin.

AR

Relative strength leader under pressure. Let’s see if we undercut $30.85 and tag the 50-day. If we do that and reverse back up through $30.85 to $31, it could get a nice trade going on the long side.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely. Bold are the trades with recent updates.

DLTR — B/E stop just to protect profits after a nice move on Friday. → trim on any push into $164.

Relative strength leaders (List is cleaned up and shorter!) →

AR

WMT

PEP

KO

MCK

BMY

JNJ

DLTR

DOW