Three-Day Range Creates Clear Setup for Traders

Clear the highs or pull back to support. It's not that complicated.

Technical Edge —

NYSE Breadth: 47% Upside Volume

NASDAQ Breadth: 65% Upside Volume

VIX: ~$23.25

Game Plan: ES Futures, S&P 500, NQ Futures, QQQ

Our list of individual stock trades triggered a few entries yesterday, notably CHNG and UUP, which will be included in the Go-To Watchlist below.

Other than that, the ranges simply continue to tighten. Either we push through resistance after a short rest or we pullback further and test more significant support. It’s not that complicated, but we have to be patient — and this is where impatient traders get burned.

Until then, we’ll wait. Here are the levels to watch now.

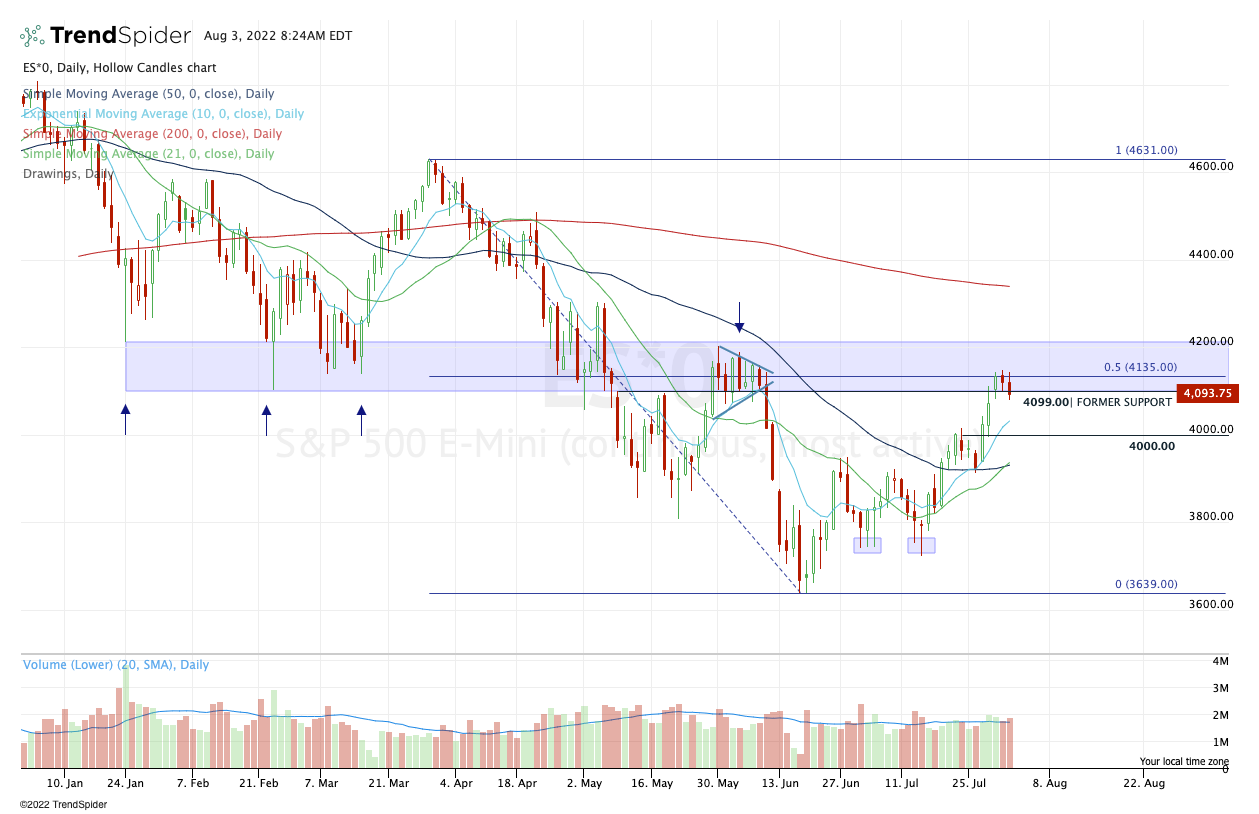

S&P 500 — ES

Over the last three days, the ES has topped out within a 4-point range. Those highs are 4144, 4147.25 and 4143. So it’s safe to say that, at the moment, resistance is in the 4140 to 4150 zone.

It’s also safe to argue that there are likely stops building above this level.

The 61.8% retrace from the Globex lows to yesterday’s high is 4119 — call it 4120. If we can clear and hold above that, I could see the ES pushing the 4140s again today. If we do clear this zone today or this week, it could set the stage for a push up to 4189 to 4200 (the June high being the former).

On the downside, 4080 has been support. A break of this area could thrust the 10-day into play, then the 4000 level.

S&P 500 — SPY

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.