Technical Edge

NYSE Breadth: 76% Upside Volume

Advance/Decline: 72% Advance

VIX: ~$15.50

At one point on Friday, we were clocking a 90% upside volume day, just a day after logging a 90% downside day on Thursday. Despite Friday’s midday rip, then late-afternoon puke, we still ended with a decent upside volume day.

That all said, it was not a good end to the week and the indices put in some ugly candles. I think we’ve got to preach some patience here, as that was not a healthy close and the futures are still mixed coming into today.

As for this week, patience comes into play as there are numerous Fed-heads talking today, followed by the CPI print on Wednesday and bank earnings kick off on Friday.

Keep that in mind as we had a tough session on Friday and sit near the low end of last week’s trading range.

SPY

Big pop, then huge fade leaves a wonky candle here on the SPY. On the downside, last week’s low and the 21-day moving average are big, near $437. A break of that could flush us down to ~$430.

On the upside, bulls need to clear Friday’s high of $442.64, putting key resistance back in play.

Upside Levels: ~$442.65, ~$444 resistance

Downside Levels: $437, $435, $430

S&P 500 — ES Futures

Flirted with a weekly-down move this morning below 4419.50. Keep an eye on that mark today, along with the Globex low at ~4411. A break of these measures puts 4400 or lower in play.

On the upside, bulls need to gain traction over 4400 and the 10-day ema, putting 4475+ in play.

Upside Levels: 4440, 4465, 4475-80, 4490-98

Downside levels: 4419, 4411, 4395-4400, 4370

SPX

Upside Levels: 4440, 4450-60

Downside Levels: 4385, 4375-77, 4350-55, 4325-30

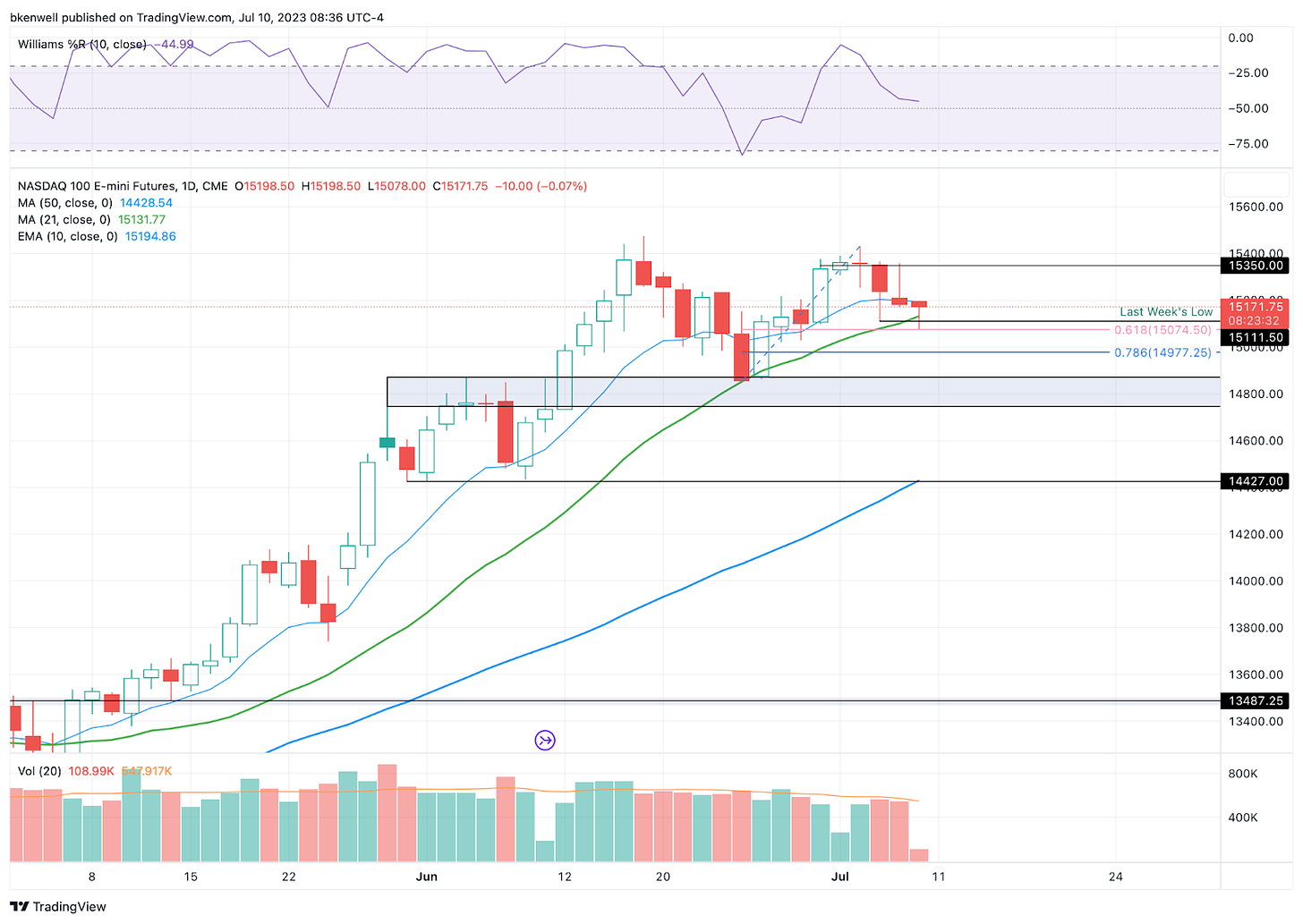

NQ

NQ Bulls need to see a sustained move over 15,200 to put 15,350 back in play.

On the downside, 15,111 (last week’s low) needs to hold. Below and 15,075 is back in lay. Then 14,975 to 15,000.

Pivot: 15,200

Upside Levels: 15,350, 15,425

Downside Levels: 15,100-110, 15,075, 14,975 - 15,000

QQQ

Same situation as the assets above. On the upside, Friday’s ~$370.50 high needs to be taken out in order for the Qs to push the $372 resistance area. On the downside, bulls will try to defend the $364.50 area. Below $363 and $360 is in play.

Upside Levels: $370-$371, $373

Downside Levels: $364.50, $363, $360.50

Open Positions

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.