Trading Around the CPI Report + Gold, Oil and More

Tech continues to fail on the rallies. Commodities remain volatile.

Today’s Game Plan Video Can Be Found Here. Thank you!

Technical Edge

NYSE Breadth: 74.8% Upside Volume

NASDAQ Breadth: 80.2% Upside Volume (!)

The rallies feel good. It’s part of the trick, the trick that says, “hey guys, I think the coast is clear!”

At one point, the coast will be clear, but for now we need to stay on our toes and be untrusting of the rallies. This is what I like to call a “prove-it” market — prove it to us that the bulls are back in control.

Despite the nice gains yesterday, we still didn’t register an 80%+ upside volume breadth day. That’s disappointing given that we rallied out of the gate and generated a strong return throughout the session. In fact, not once did we hit the 80% mark on volume breadth. That to me says this is more of a dead-cat bounce than a true demand-has-returned type of reversal.

If today can prove otherwise, we’ll change our tune.

Game Plan — Amazon Stock Split

Yesterday was a feel-good rally. The market gapped up, wavered but held, then powered higher. The ES closed right at our key level of 4275, (it closed 4275.25).

To me, that still presents caution, although this morning’s 40-handle dip (~1%) is pre-CPI profit taking, IMO.

Yesterday after the close, Amazon announced a 20-for-1 stock split and a $10 billion buyback plan. Although the stock has struggled, it still sports a $1.4 trillion market cap, so the buyback is nothing to get worked up over, but I want to touch on stock splits.

When Tesla and Apple announced their splits in the summer of 2020, the stocks exploded. People are wondering if Amazon’s stock split will inspire the same reaction.

It could, especially if the market responds favorably from these levels. But just like the overall market, I am cautious on that reaction for two reasons.

I believe stock splits are reacted to favorably when the environment is favorable. In the summer of 2020, bulls were in control and risk was running wild. In 2022, that’s not the case thus far.

Alphabet announced a 20:1 stock split on 2/11 and a buyback plan when it reported earnings. While the move sent GOOGL to all-time highs, it faded almost immediately.

So I’m using those two reactions as a blueprint for AMZN. Let’s see if it can buck the trend.

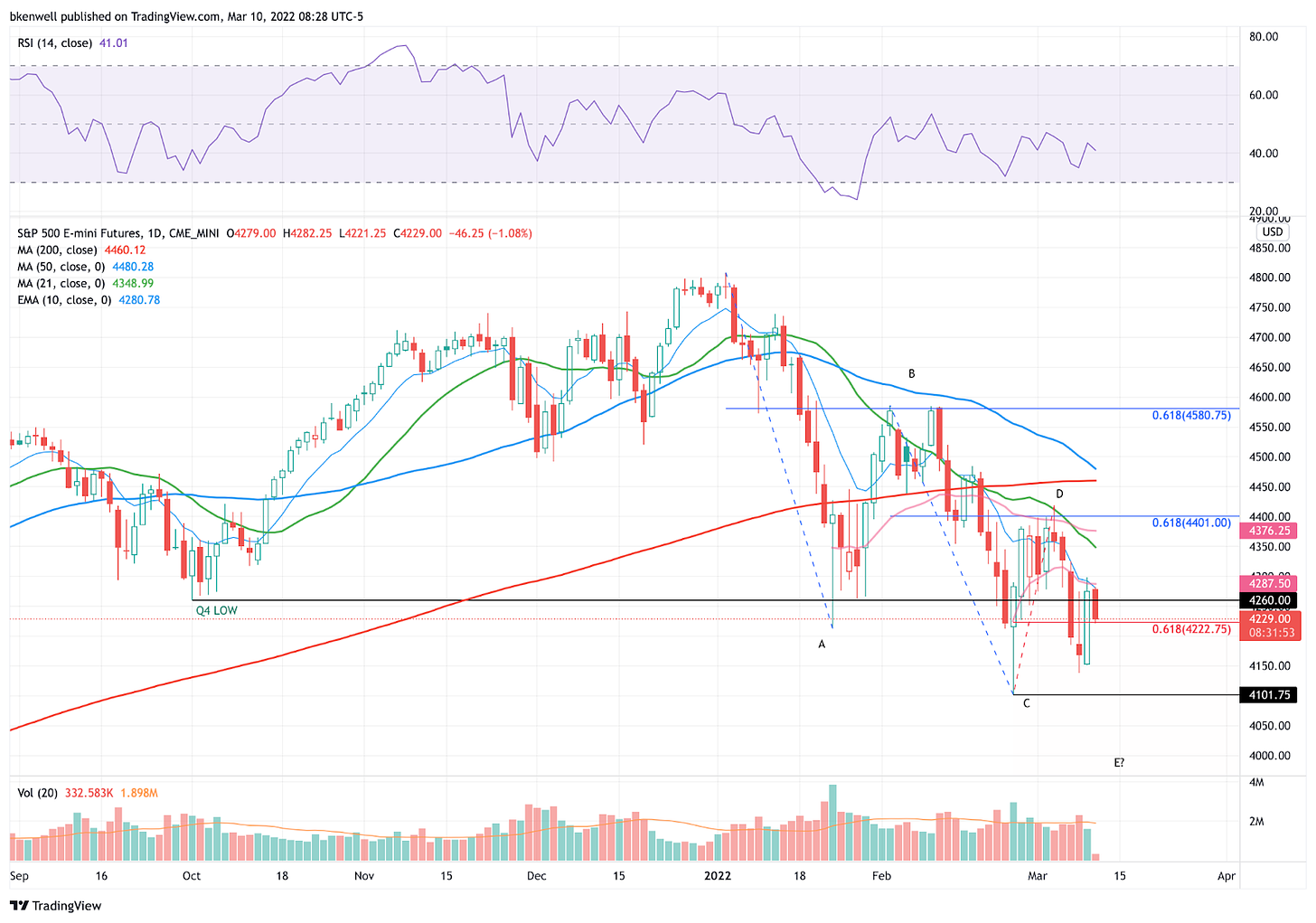

S&P 500 — ES

Feel free to extrapolate this layout to the SPY.

*Covered in video*

Keep it simple.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.