Trading Around the Inflation Number | AAPL, AVGO

Inflation reports are almost more closely followed than employment data right now.

Yesterday was a chop fest, plain and simple. That should come as little surprise after we said this before the open:

“We do have some potentially choppy events to navigate, starting with today’s “Roll Day.” Next Friday is quad-witch expiration, as well. The latter can lead to choppy price action early in the week too.”

Some people thrive in choppy conditions (but then struggle in trending conditions). Other traders — like swing traders — thrive in trending conditions and really struggle during the choppy periods.

Know what environment you trade best in and work on singling out those types of conditions. It took me a long time to realize that!

Technical Breakdown

NYSE Breadth: 77.7% downside volume

NASDAQ Breadth: 70.2% downside volume

Breadth was on the heavy side during yesterday’s decline, but after such a robust start to the week, the way we finish it is going to say a lot. I’d love to see the S&P 500 finish in a weekly-up setup. The Nasdaq could too, but an inside week wouldn’t be bad either, as it has yet to fire above last week’s high.

Let’s not force anything. Again, we’re in a period that can be a little tough to navigate with swing trades. Today’s CPI number could be a market mover and I think some of the late-day decline on Thursday can be attributed to this report, due up at 8:30 am ET.

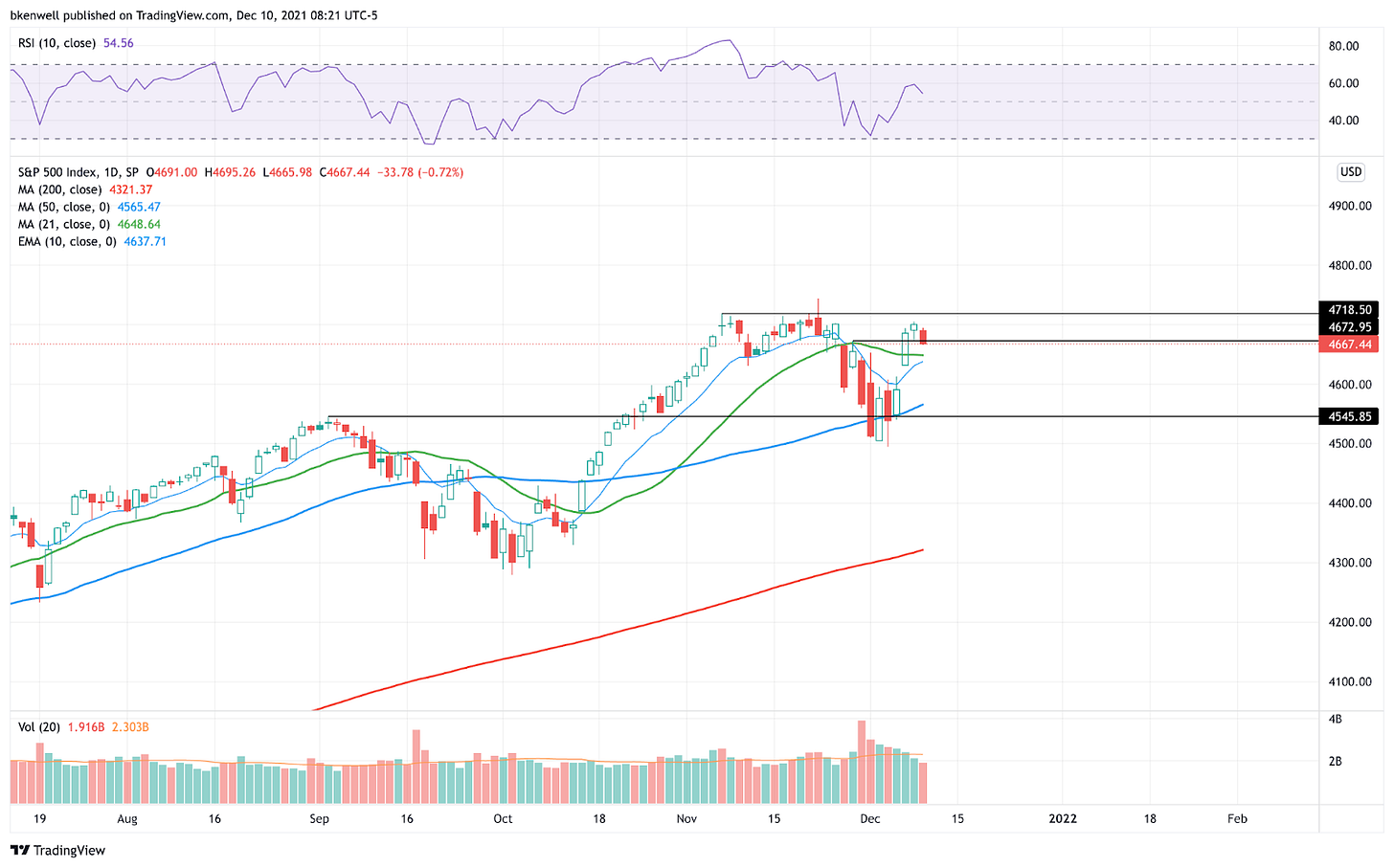

S&P 500

I would love to hold above last week’s high at ~4667.50 in the S&P 500 index. Above this week’s high and 4720+ is possible.

Below last week’s high and bulls need to defend the 10-day and 21-day moving averages.

Nasdaq

Let’s zoom out a bit with a weekly chart here. We’ve had multiple 7.5%+ dips this year down to the 21-week moving average. So far, all of those dips have led to new highs.

Unless the Nasdaq Composite takes out 15,833 on the upside or 14,931 on the downside, we will get an inside week going into the weekend. That sets us up for a potential inside-and-up or inside-and-down rotation.

Whichever it is, take it in stride and trade what the market is giving us. A rotation lower that’s not a false breakdown likely puts the 50-week moving average in play. A rotation higher that’s not a false breakout likely puts 16,150+ in play.

For this decline, we had a peak-to-trough fall of 7.9%. That’s pretty normal based on this year.

Individual Stocks — A Learning Lesson

We got the inside day we were looking for Nvidia, but no trigger on the rotation higher. That’s just fine, as Qualcomm gave us a pretty potent 2.25% rally from the daily-up trigger we were watching.

However, the stock closed lower on the day, down 0.2%. Have a look at what I tweeted yesterday in regards to QCOM.

Last week’s high was at $186.81. The stock topped about $1 a share above that mark. From there, I raised my stop up to break-even on the trade (as I do with almost all of my trades once I start trimming).

It’s a more conservative method, but I’d rather take ⅓ or ¼ of my position off for a profit and exit the rest at even, than take a loss on a bulk of the trade. That’s just the way it goes sometimes.

Who’s to say QCOM wouldn’t have blown through $189 and made new all-time highs?

Homebuilders

The relative strength remains in this group. HD, LOW, BLDR (especially), TOL, LEN, TREX — etc.

A lot of these stocks were higher yesterday. Many remain at or near the highs and are in strong uptrends. Don’t lose focus of the leaders. Semiconductors continue to perform well too.

Apple

Apple has been a monstrous performer as of late. However, yesterday it pushed above the prior high and failed to hold.

That’s not an outright “sell and get short sign,” but when combined with a little bearish divergence on the chart, it’s just something we want to take notice of.

If Apple (and its near $3T market cap) struggles, then the QQQ may have some trouble too.

A move below yesterday’s low at $173.94 could take a little steam out of this, but that may be healthiest for a buy-the-dip setup going into the second half of the month.

Again — not necessarily bearish on Apple here, just looking for a reset.

Broadcom

Yesterday I did a little mapping of AVGO ahead of earnings. Essentially, where to buy the dip and where the rally could go.

Shares are changing hands at $625 in the pre-market now, just under the 261.8% extension. Let’s see if it can gain traction over this level or if it fades from here.

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!