Trading Around the Jobs Report | Gold, Bitcoin, Energy

The S&P remains the main focus amid heightened volatility

Technical Edge

NYSE Breadth: 37.8% Upside Volume

NASDAQ Breadth: 31.7% Upside Volume

Well, yesterday we said it would probably be tough to get another 80%+ upside day and that was the case on Thursday. Absent a return to demand, we must continue preparing for this environment to persist.

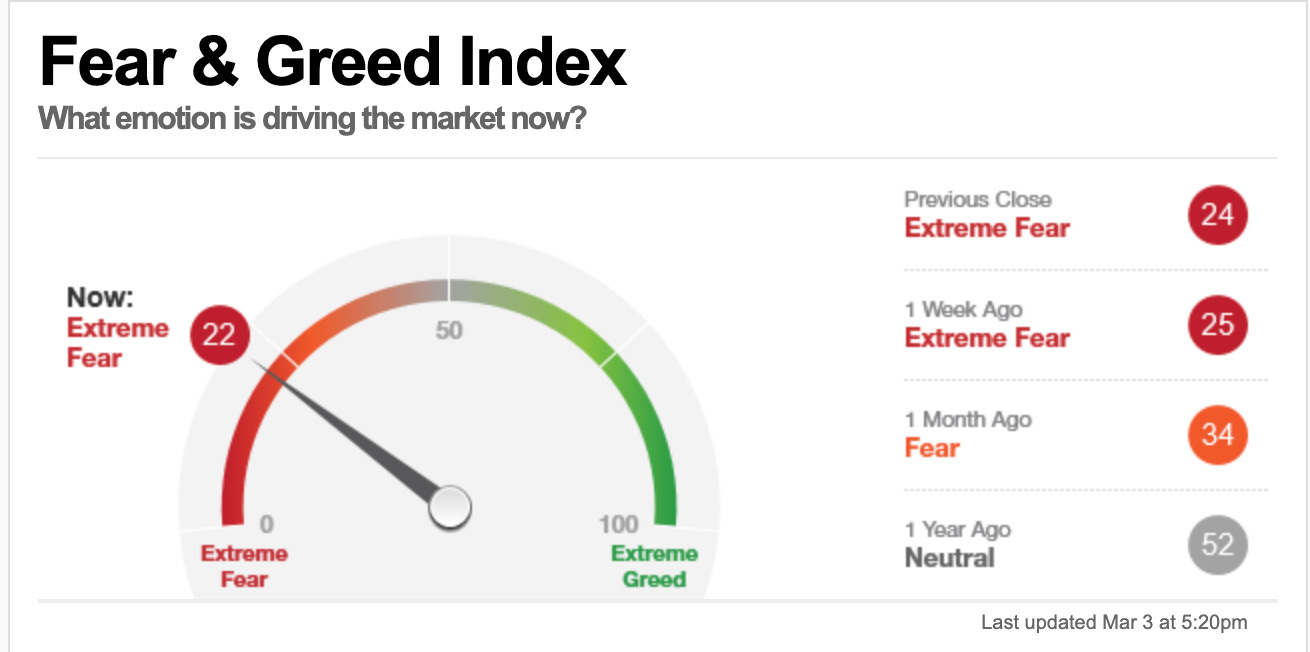

Sentiment continues to inch lower, but still remains above panic levels.

We don’t want to be full-time bearish and get short into the hole, just to get destroyed in a face-ripping rally. However, there are simply too many hurdles in the way for the S&P to enjoy a sustainable rally back to new highs.

Perhaps if there weren’t issues in Eastern Europe and the Fed undergoing a modest rate-hiking spree because the economy was strong rather than to fight inflation, we could look for a rebound higher.

Put it all together though and this remains a two-way market — and one that has been favoring the downside.

Game Plan

The game plan is simple: We’re going to keep going back to the well with the most water. In other words, we’re going to stick to what’s working: The S&P 500 and Gold.

Don’t forget, it’s the monthly Jobs Report this morning.

S&P 500 — ES

Feel free to extrapolate this layout to the SPY.

We have talked endlessly all week about the ES to the point where I’m afraid you all may be bored to death by it.

But here we are as the ES continues to stall at the 61.8% retracement just like in the prior leg.

It tried to breakout over this level yesterday, but failed and now we’re seeing if the dip can hold. I keep thinking 4,400 is a good place to reduce long exposure and/or hedge. From here, that remains the level to focus on.

***(For the levels below, simply move from one zone to the next & feel free to write them down. If we rally to 4,400, that’s the first upside level we’re watching. If the ES gets above and stays above it, the next “upside level” becomes our focus. In today’s case, that would be 4419)***

The upside levels are:

~4375 — Globex high

4400 — key zone (just see chart above)

~4419 — Thursday’s high

4450 and 200-day sma

Downside levels of interest:

4283.50 — Globex low

4260 — Q4 low

4251.50 — This week’s low

4212 — January low

Nasdaq — QQQ

Feel free to extrapolate this layout to the NQ.

On Thursday, the QQQ opened near and faded from the key $350 level, which was the Q4 low, the declining 21-day moving average (which has been active resistance) and the 61.8% retracement of the current range.

Now we must see if ~$339 continues to hold, which is this week’s low.

The upside levels are:

$348 — Recent resistance

$350 — Key zone

$354.50

Downside levels of interest:

$348.90 — This week’s low

$334.15

$330.40

Gold

We have back-to-back inside days and now a rotation up through Thursday’s high. That said, it’s stalling near the $1950 area again.

If it holds $1944.50 and pushes ahead, $1961 resistance is in play, followed by $1975. Above $1980 and the talk will quickly shift to $2,000. On the downside, we need to continue seeing the 10-day ema hold as support.

Individual Stocks & Go-To Watchlist

XLE Update — gave a decent fade opportunity yesterday and today, that setup still exists. Look for rallies above $73.63 that can’t be sustained.

Bitcoin

If Bitcoin can hold $40,000, it’s hard not to think it can’t push back up to the $45,000 to $46,000 area. A break of $40K could put $37K back on the table.

Go-To Watch List: Boring Is Working + Energy & Defense

*Feel free to build your own trades off these relative strength leaders*

Take a few minutes and study this list. These are the leaders right now, those with relative strength. I wish it was loaded with tech and some of the fast-movers. It’s not, but all we can do is trade the hand we’re dealt or fold and wait for better cards.

CHKP, UPST

Boring but Good: BRK.B, KO, KHC

ABBV, BMY

ADM

Defense — RTX, GD, LMT, NOC

Energy — FCX, CNQ, CVX, ENB

SYY — see if $86 holds

TU — Longs can go for $26 // There now. All out & back on the go-to list.

COOP — weekly up at $51.20.

MAT

Gold

CCK

TECK — Trim ⅓ at ~$39. Can go for $41 next, then $44.50