Trading Microsoft's Gap-Up Open | Fed on Tap

Here are the levels to watch in MSFT, the S&P and others.

Technical Edge

NYSE Breadth: 47.6% Upside Volume

NASDAQ Breadth: 35.5% Upside Volume

On Monday, the markets fell precipitously and then recovered all of its losses and then some by the close. On Tuesday, it looked like it was going to try the same thing, but they sold the close and the S&P and Nasdaq couldn’t recover.

Now we come into Wednesday’s Fed day with a gap-up rally, with both the ES and NQ futures near yesterday’s highs.

For what it’s worth, it’s not likely that the Fed will raise rates but the expectation is that they will do so in March. However, investors will be paying careful attention to the language in today’s statement, looking for a potentially less-hawkish Fed after the Nasdaq’s peak-to-trough decline of 18.5%.

In Q4 2018, the Fed capitulation with its plans for a rate-hiking spree after equity markets fell about 20%. We’re in a different setting than a few years ago though and one has to wonder (at least currently) whether the Fed really cares about the market’s temper tantrum.

That said, how much of a decline do we need to see before the correction accounts for four rate hikes in what would still leave us in a low-rate environment, historically speaking?

Game Plan

When I started writing this newsletter, I made a promise to myself that I would not deviate from my personal trading plan and that I would not add setups for the sake of filling up a page with words and charts.

With the VIX near $30 and the market all over the place, I’m not looking to make any bold moves ahead of the Fed announcement just a few hours from now.

We are pretty fortunate to have navigated these first few days without getting hurt. Monday was tough — well, from the perspective of a pre-market newsletter anyway — with the gap-and-puke but Tuesday was a great situation with XOM.

It was one of the only setups we were watching ahead of the open and it paid off tremendously well as the stock hit new highs on the year.

Almost always but especially now, simpler has been better. If you don’t already, consider following me on Twitter. I usually stick to the Game Plan, but when I write it at 7 a.m., things can change throughout the day and if they do, that’s where I’ll post about it.

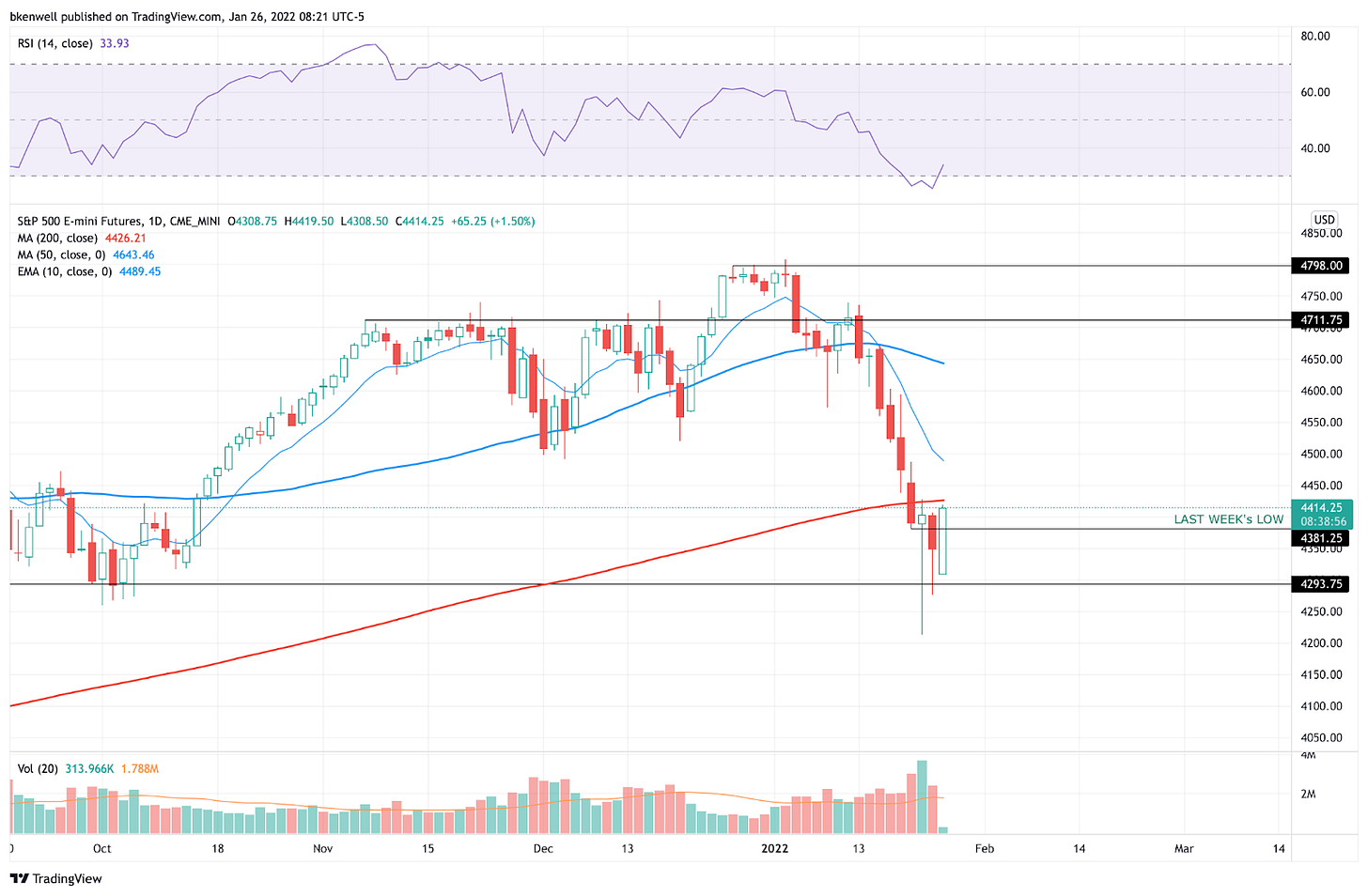

S&P 500 Futures and SPY

Above is a daily look at the ES and you can see how big these ranges are. Right now, 50 handles is the new 10 handles and the futures will gladly steamroll anyone who can’t mind their risk.

It’s back above last week’s low, but continues to struggle with the 4405 to 4425 area, as attempts to reclaim the 200-day moving average.

I can’t help but feel like how we close today will be important.

Below last week’s low keeps 4300 in play, as well as Tuesday’s low. A break of the latter makes this week’s low vulnerable. Above 4430 and we could see a push up to the 4480 to 4500 area.

As for SPY, it’s a similar look. Bulls need to clear $440 and the 200-day to open the door up to $450.

Below $437.95 keeps the $427 to $430 area and Tuesday’s low in business. Below the Q4 low of $426.36 and this week’s low is vulnerable.

This is your roadmap. Keep it handy when the Fed starts flapping its lips and it may remain in play the rest of this week.

Nasdaq and Individual Stocks — MSFT, JNJ, Energy, Go-To List

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.