Trading Tesla's "Elon Musk Dip"

Shares are down on Musk's proposal to sell 10% of his holdings.

We’re riding a pretty hot streak coming into Monday, Nov. 8. In that sense, not a lot has changed from last week. The jobs report and the Fed did not cause the earth-shattering correction that the bears were looking for.

Instead, the Fed is staying in the lower-for-longer camp and that’s helped give the market it’s next leg higher. Bulls are looking for names like Apple and Amazon — which are trading well after a post-earnings dip — to carry the torch on the march to new highs.

That said, a dip in the markets would be relatively healthy at this point. The ES and S&P 500 are now up in 16 of the past 18 sessions. One those dips was a decline of just 0.12% — in other words, flat.

We don’t need a “hard reset,” but a bit of a breather would be healthy for a year-end push. Also worth mentioning, we have some talking Fed heads today, including Powell on the mic. That can add to the volatility.

The ES (But Translates to SPY and the S&P 500)

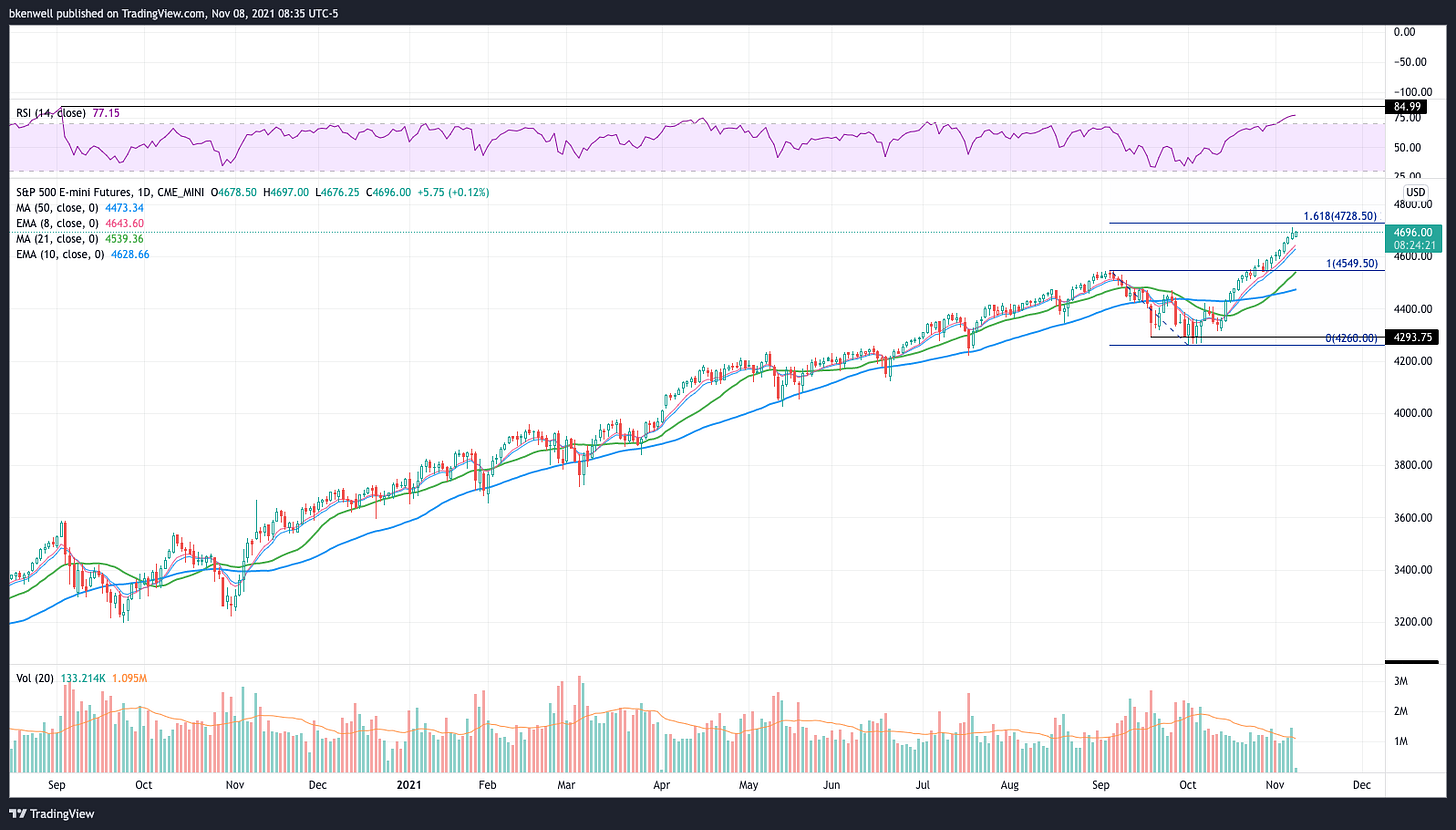

The ES is getting close to our first target of the 161.8% extension near 4728. With a high of ~4711, that may have to be close enough for now. We’ll see if bulls come to play early in the week and that will likely be the deciding factor in whether we hit this target before an eventual pullback.

On a dip, I want to see how the ES handles the 8- and 10-day moving averages. Below puts 4550 on the table. I don’t want to sound like a broken record — re: the 8/10-day combo and follow-through downside level — but oftentimes keeping it simple is best and our approach has worked thus far.

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.