The markets are continuing their upward accent. When there’s low volume like we’re seeing now, “thin to win” can take over. We have been talking about it all week and it’s what allows the market to go on the path with the least resistance — which is higher.

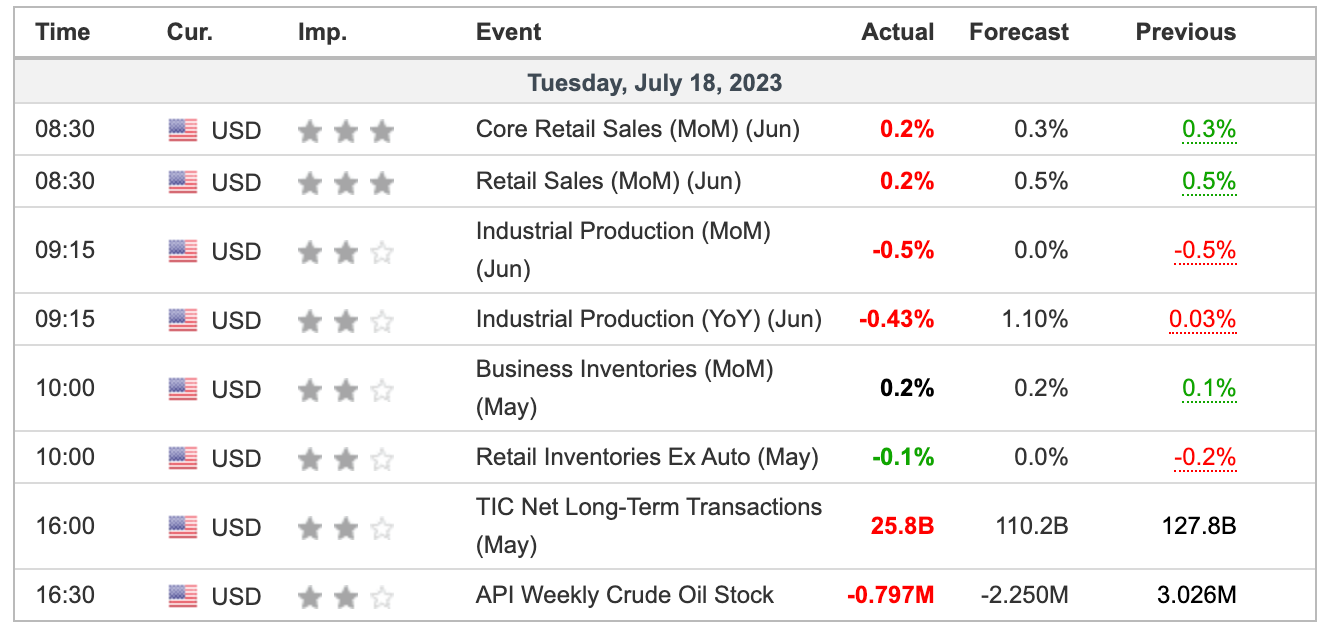

The Fed is trying to balance rate cuts without crushing the economy. While the CPI number came up light last week, so did yesterday’s retail sales and industrial production number.

That’s how the knife can cut both ways and yet, the markets rallied. The trend is on the bulls’ side for now — there’s no sense in fighting it until it fails.

Let’s see how it handles earnings from TSLA and NFLX tonight.

Technical Edge

NYSE Breadth: 68% Upside Volume

Advance/Decline: 69% Advance

VIX: ~$13.25

Those who took the DAL and Dow setups from yesterday, updates below in the “Open Positions” tab.

SPY

Going with a different look today, with the 30-min chart. Let’s see how the S&P handles dips to its key short-term, intraday moving averages. It could be a trend day into tonight’s earnings reports.

On a larger correction, don’t sleep on a dip do the 4-hour 10-ema and the $451.75 to $452 area, which was two-day resistance.

Upside Levels: $455-56

Downside Levels: $452.50, $451.75 to $452

S&P 500 — ES Futures

I don’t know that we’ll see a dip down to ~4530, but it's the first “big” spot for dip-buyers to step in. That said, it would require a fall of more than 1.2% from yesterday’s close, which some may see as unlikely in the current tape.

Upside Levels: 4600, 4620

Downside levels: 4555-65, 4525-30, 4493-4503

SPX

Upside Levels: 4565-68, 4585, 4600

Downside Levels: 4545, 4525-30, 4500-05

NQ

Bigger picture look, then hourly chart below.

Above yesterday’s HOD and 16,100 is in play. The “bigger picture” extension is up near 16,500 and the NQ will need strong earnings reactions to get there.

Now for the hourly:

Notice the Globex consolidation around 15,960, plus/minus about 10-20 points.

If we dip to this area, let’s see if bulls can defend it — at least for a day-trade bounce where we can take some profit and look for a break-even stop.

Below that and the 15,875-85 area is of interest.

Upside Levels: 16,030, 16,100

Downside Levels: ~15,960 (outlined above), 15,875-85, 15,740-50

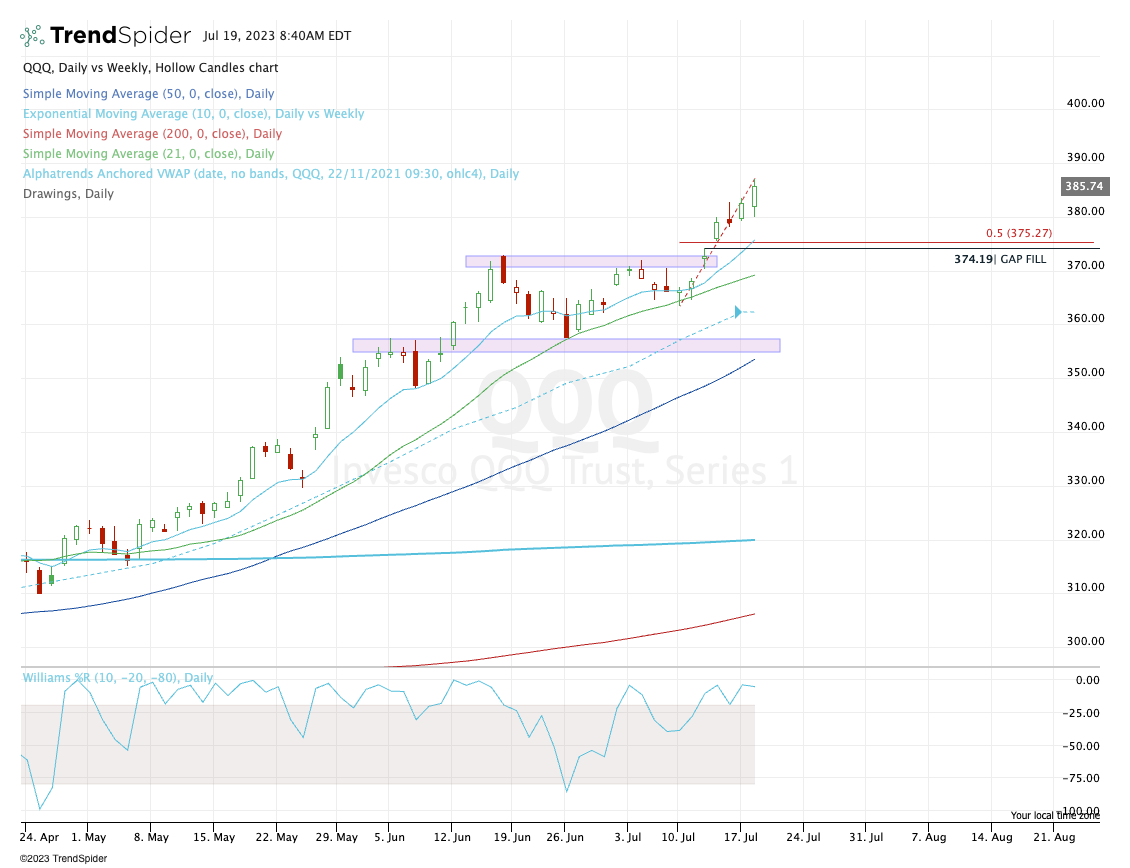

QQQ — Post-Earnings *IF Bearish

TSLA and NFLX report tonight. If both are bearish, the QQQ will feel it. I can assign a % to those odds, but I will say, the downside levels are clear in that scenario.

Zone 1 is at $374 to $375, which is the 10-day ema, the 50% retrace of the current rally and the gap-fill.

Zone 2 is the $370 to $372 zone, which was prior resistance and the 21-day moving average, which has been support since early May.

Upside Levels: $380, $382.50 to $383

Downside Levels: $375.50, $371-73

Open Positions — Absolutely Robust Performance

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.