In Wednesday’s article, I linked to a YouTube video about growth stocks with a dead link. Oops. Here is the correct link for those still interested.

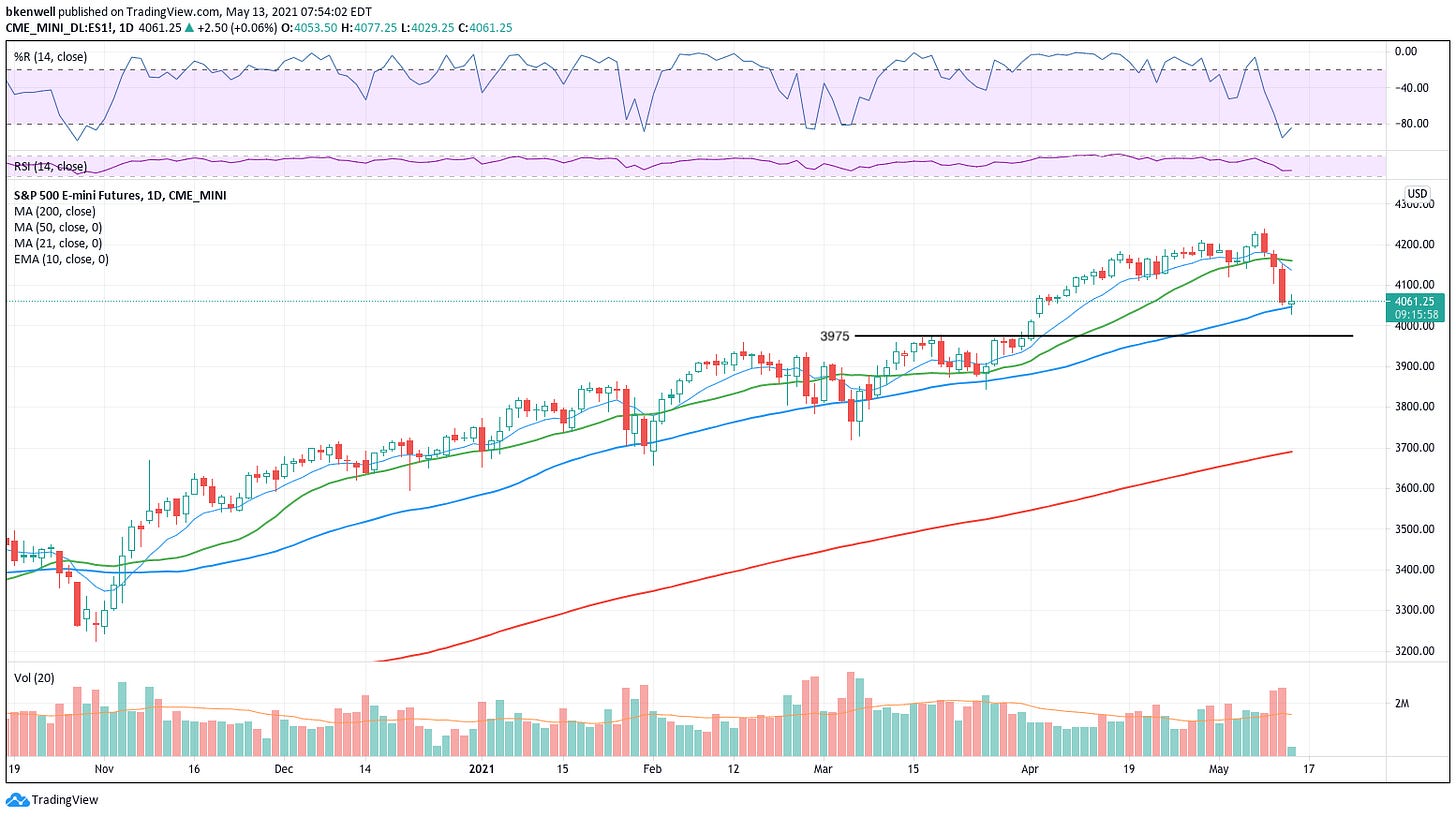

Trading the S&P 500 or its futures contract has not been an easy task this week. The latter shed 2.1% in Wednesday’s session, dropping more than 87 points.

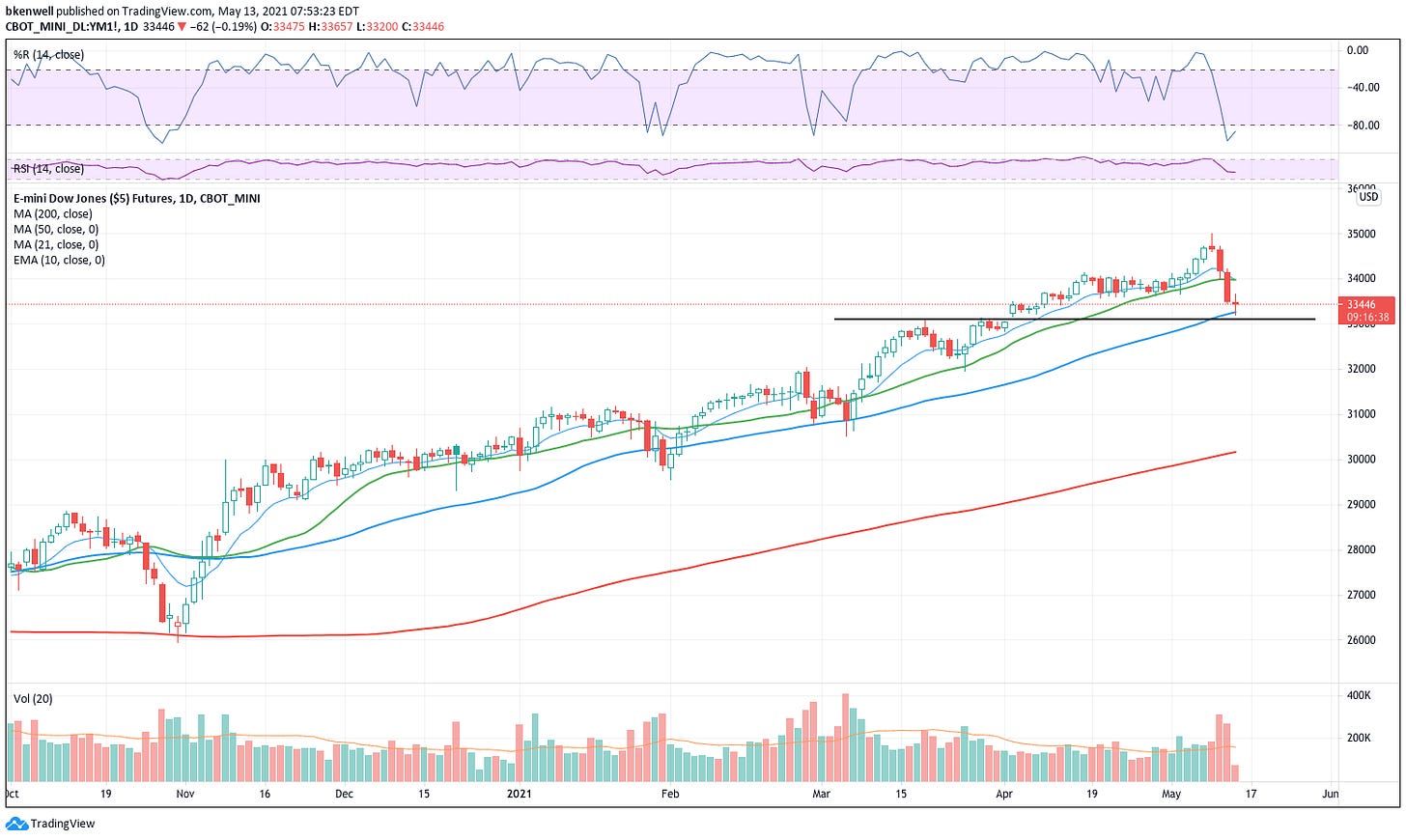

The Dow didn’t fare much better. The futures contract dumped 675 points, falling 1.97% on the day. That followed Tuesday’s session, where the index fell 485 points and after it made new all-time highs on Monday.

The undercurrents in the market have been tough, with some groups performing well and other groups performing dreadfully (looking at you, growth stocks).

Are we hitting a turning point though?

Trading the S&P 500

I was talking to Danny Riley last week on the phone, a 39-year trading floor vet. It was a Thursday. He told me, “When the market’s down Monday, Tuesday and Wednesday, you just gotta pick your spot and take a shot on Thursday or Friday.”

I’m going to see Danny next weekend and I’ll let you know what wisdom he chooses to impart on me.

However, he was spot on about that piece of advice, because we saw an absolute ripper on Thursday afternoon going into the close. Could we be setting up for the same thing this week?

The ES hit new all-time highs on Monday before reversing and closing lower by almost 42 points or about 1%. Not great price action. That was followed by two big down days as the contract now rests right on the 50-day moving average.

The dip to the 50-day amid an uptrend has me thinking perhaps we could be setting up for a rebound in the next day or two.

It’s possible we break Thursday’s Globex low and potentially test down into 3,975. However, I am eyeing the index from the long side this morning.

Trading the Dow

The Dow has a similar setup. We have a nice three-day flush to the downside, with the fourth day resulting in a test of the 50-day moving average.

Let’s see if the Dow can find its footing here.

We just about filled that gap from April 1st, but again, if we break the Globex low, it’s possible we see the 33,000 area tested in earnest. The Dow has been the relative strength leader as of late, so let’s see if that will continue.

The Bottom Line: We’re fresh off all-time highs from earlier this week for both the Dow and the S&P 500. The CPI reading spooked investors and that spooking may carry into the weekend. However, at this point it would be a bigger worry (to me, at least) if we didn’t have inflation. Have we all forgotten what the year-over-year comps look like?

I am looking to buy into the rebound today and/or tomorrow in a limited-risk fashion. Let’s see if the bulls can make a stand here.

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.