US Credit Downgrade Dings Stocks. Bonds Hit 2023 Lows

The VIX is getting a bit of life, popping back above $15 as headlines hit regarding the US credit downgrade from Fitch. Since June, the VIX has closed above $15 just once.

From one report: “Fitch Ratings has downgraded the United States' long-term rating to AA+ from AAA, echoing a move made by S&P Global Ratings, which cut its rating for the U.S. in 2011 after a different government standoff.”

Of course, this caused an overnight flush. At the Globex low, the ES was down about 50 points from its 4:00 p.m. ET print. So far, they are buying the dip, but the ES is still down about 22 handles or 0.50% as of 7:30 a.m. ET.

It’s been a quiet start to August until that news dropped. Now we’ll see if that will be enough to “shake the tree” and get us a larger pullback or if it will be business as usual for the S&P, which has rallied for five straight months.

Elsewhere, bonds remain quite weak. The 10-year yield ended the day above 4% yesterday, while the 2023 high is up near 4.09%. It’s closed above 4% just five times this year. This has /ZB and the TLT at their lowest levels of the year, as some begin to wonder if and when a 4%+ 10-year yield is going to be a problem for equities.

Tomorrow, we get earnings from AAPL and AMZN.

Technical Edge

NYSE Breadth: 33% Upside Volume

Advance/Decline: 32% Advance

VIX: ~$15

SPY

Sticking with the 1-hour chart on SPY, we’re trading $454.50 and are about in the middle of the overnight range. That makes the open tricky, as we don’t know which way they will run it first.

If the SPY rallies, watch yesterday’s low at $455.50. Does it “accept” price back above this level or does it “reject” price back below. My guess would be a rejection, at least initially, as we have been on a tear and this is as good of an excuse as any to take some air out of the market.

If they sell the open in SPY, watch the $453 area for any life, while knowing that the $451.50 area is a much more resilient support level.

Upside Levels: $454.50, $456.50, $457.75

Downside Levels: $453, $451.50

SPX

Upside Levels: 4567, 4575, 4590

Downside Levels: 4550-53, 4537-42, 4525-28

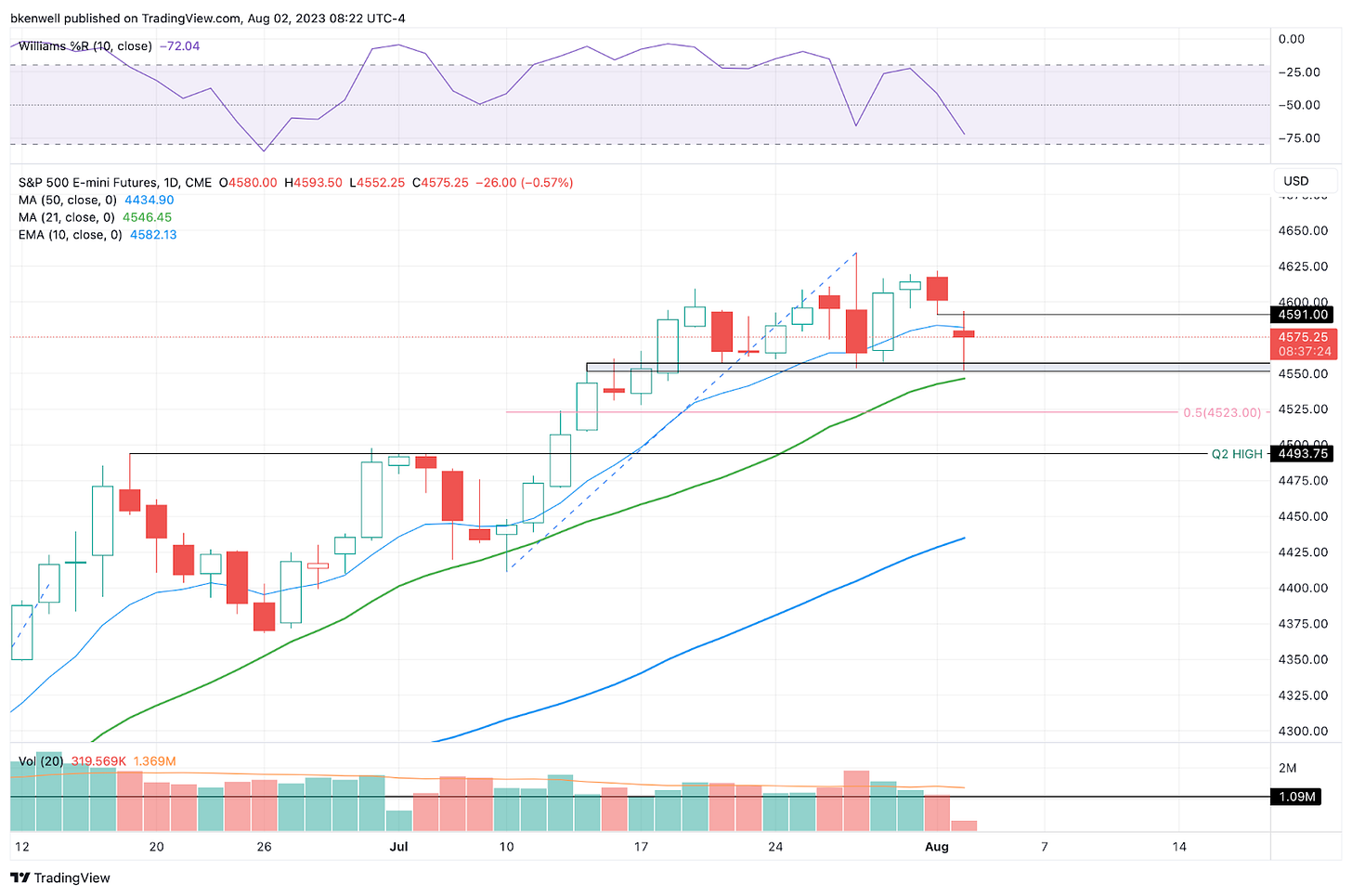

S&P 500 — ES Futures

Upside Levels: 4582-85, 4492-95, 4607-10

Downside levels: 4550-58, 4545, 4523

NQ

I am sticking with the 1-hour chart we have used all week long. Why? Because it continues to work!

After holding the 15,800 area on Monday, that zone broke in Tuesday’s Globex and gave us a test of the 15,700-25 zone, where it bounced 120 handles from.

Overnight, the NQ broke this zone and traded down to our 15,600 zone (aka the 78.6% retracement). That area held, but now 15,700-25 is overnight resistance. Let’s see if this area is reclaimed or if it’s resistance.

Upside Levels: 15,700-25, 15,790-800, 15,900-15

Downside levels: 15,600, 15,520-550

QQQ

Upside levels: $380.75, $382.75

Downside levels: $379, $377.50, $375-76

Open Positions

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.