Technical Edge —

NYSE Breadth: 16% Upside Volume (!)

Advance/Decline: 19% Advance

VIX: ~$22.80

Mixed bag session on Thursday and obviously not a “win” for the bulls. The market opened daily-down and failed to gain any meaningful traction until late in the day. Downside breadth got above 80% early and stayed there the rest of the day.

The late-date pop couldn’t get the S&P back above last week’s low and we’re now in a weekly-down state for the SPX and SPY. However, the /ES didn’t break last week’s low on Thursday (thus the “mixed bag” comment), although it did during Globex.

I’m quite, quite glad we played offense when the market was cooperative, but we’ve been a bit more defensive on the individual stock front (taking profits, raising stops, etc). We’re down to just two open positions now, with b/e or better stop-losses in.

It’s imperative to listen to the market’s tells. When it’s healthy, there are plenty of opportunities. When things start to sour, those opportunities dry up quickly.

Trying to force trades in all environments is where so many traders give back a bulk of their gains. As traders, we have to keep what we earn, otherwise, what’s the point? I often think of trading like I think of surfing.

We wouldn’t surf every day in all conditions, right? When it’s flat, there are no waves. When there’s a hurricane, it will get us killed. The market environment is like that as well. We need to surf — trade — on the good days and take shelter in the van on the bad days.

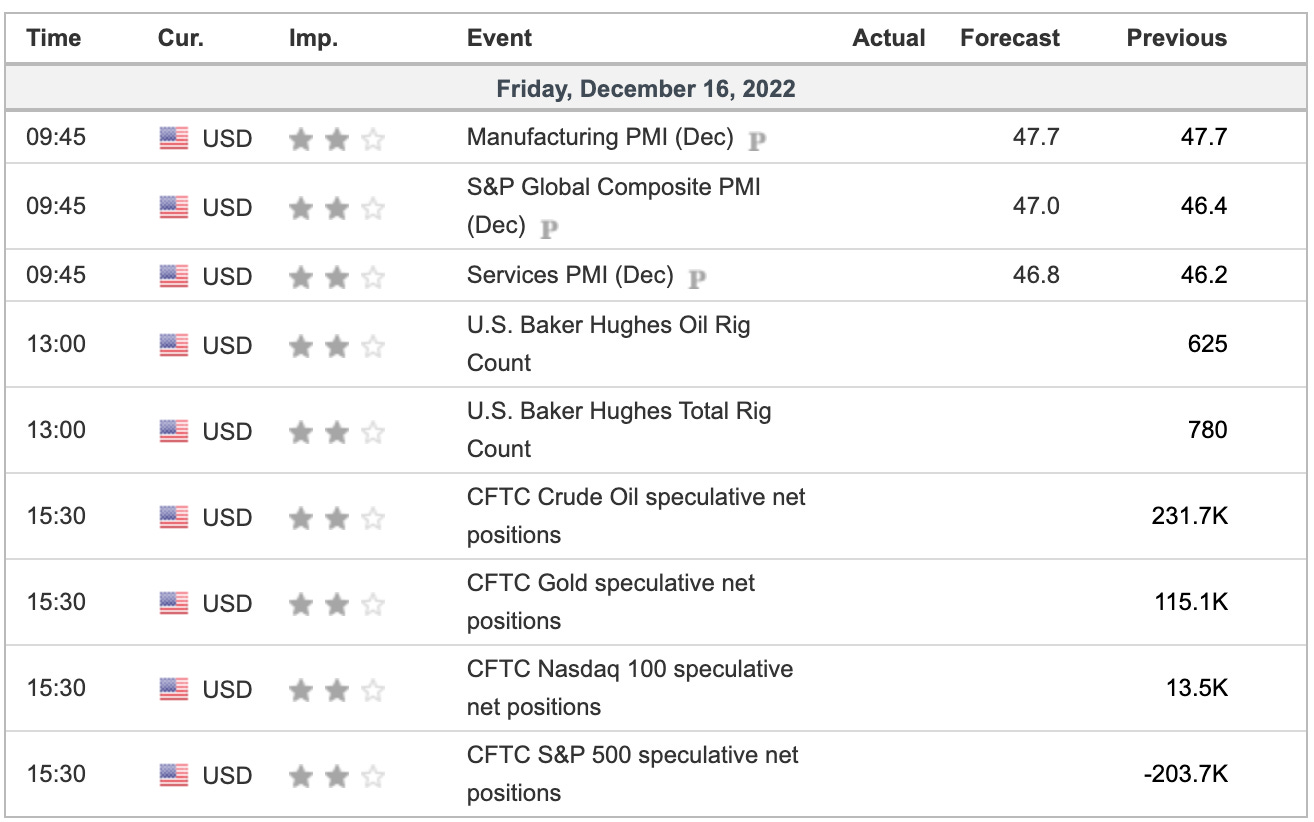

Today we have quad-witch or triple-witch…“Witchever” you prefer, it doesn’t matter; Friday still has the potential to be very choppy.

Let’s see how Friday shapes up as it could set the tone for the rest of the year. Keep in mind, there are just 10 trading days left in 2022.

S&P 500 — ES

Notice yesterday that the ES bounced off the 3900 to 3920 zone and held last week’s low. Well that’s not the case this morning, with the ES going weekly down. It’s currently bouncing from the 50-day, a great overnight trade for some, I’m sure.

The question is, will we retest the 50-day and Globex low of 3871 — if indeed that ends up being the low by the time the 9:30 open comes around — in regular-hours trading?

If so and breadth is okay, we can look for a potential bouncer. Otherwise, a break of this area without a reversal could open the door down to the 3840 level, then eventually 3760 to 3770.

On the upside, it’s key for the ES to reclaim 3914 to 3920. The overnight high is up at 3934.

SPY

$390 has been a clear pivot and it’s also the 50% retracement of the larger range. How fitting is that, as we swivel around and around this level.

In any regard, the SPY went weekly down yesterday near $392, which turned to intraday resistance. Then we closed below $390.

Today, two levels matter: The rising 50-day moving average and the $381.14 gap-fill. If we see the latter, it means the SPY will have fallen 2.2% on the day. The 50% retrace is at $379.30, by the way.

On the upside, regaining $390 to $392 would be a huge win for the bulls.

AAPL

Yesterday we gave a word of warning about AAPL, as it was opening near the $140 to $141 area. Apple has been heavy, and with a market cap in excess of $2.1 trillion, it’s not something to ignore for its impact on the Nasdaq.

A bit more selling pressure puts the Q4 low in play at $134.37. A break below that level could put the 2022 low in play near $129.

On the upside, see if Apple can reclaim $140. This is not a trade. This is watching the market’s biggest stock as a clue.

Open Positions —

Numbered are the trades that are open.

Bold are the trades with recent updates.

Italics show means the trade is closed.

TLT — Trimmed down to our final ¼ or ⅓ at $108.50. A complete exit is okay too. Those still holding can fish for the $110 to $111.50 area.

Stops raised to profitable at $106.

IBM — last ⅓ stopped at B/E. Nice Trade!

CEG — Exit more at $93+. Looking for $95 to $96 for small trim (down to ½). Down to ⅓ if we see $97.50+

Stops at $89 (essentially B/E)

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

LNG — keep an eye $150

CAH

SBUX

DE — gap-fill & 10-week at ~$413

AMGN

HON

LMT, RTX, NOC

MET — weekly

GIS

CI

MCD

ENPH, FSLR, CEG — solar has strength

VRTX, UNH, MRK

XLE — XOM, CVX, COP, BP, EOG, PXD (Weekly Charts)