We’re nearing the monthly August options expiration and the stock market has been skidding lower into the event.

Will Opex be enough to turn things around?

I’m not sure about that. However, I am sure that the S&P and Nasdaq are both creating some headaches for the bulls. Yesterday, both indices (as well as their ETF counterparts, the SPY and QQQ) traded down into notable intermediate-term support, then closed below these measures and at/near session lows. By breaking below these support measures, it creates more potential upside hurdles if and when we bounce.

My biggest question is: Was Wednesday’s price action an “empty out” maneuver, a move that triggers a load of stop-loss orders — i.e. the “empty out” — only to reverse higher in the short term? Or was it a more deliberate action showing that more lows are ahead?

Unfortunately, no one knows that answer, although we should get some clues today.

The S&P has been getting rolled, down 9 out of 12 days this month, while another session in that mix may as well have been a down day too (we closed higher by 0.03% but faded 1.3% from the high on Aug. 10th). That said, the index is down “just” 4.4% from its 2023 high in July.

Bonds are at YTD and 52-week lows (depending on whether you’re looking at TLT or the /ZB futures) and are not helping the narrative either, as 10-year yields hover near 52-week highs. We have talked extensively about the need for yields to “chillax” in order to take some pressure off equities.

Technical Edge

NYSE Breadth: 25% Upside Volume

Advance/Decline: 25% Advance

VIX: ~$16.75

SPY

A deliberate break of the 10-week, 50-day, 61.8% retrace and ~$444 area. Is that an “empty the bus” move ahead of Opex or a downside break?

The 10-ema has been resistance on the 4-hour chart. If we get a bounce going today or tomorrow, this measure could very well be resistance again, along with the $444 to $445 area, as highlighted below:

Upside Levels: $444-45, $448, $451 to $451.50

Downside Levels: $439.50, $437.50

SPX

Upside Levels: 4435, 4450, 4460-64

Downside Levels: 4400, 4385-88, 4328

S&P 500 — ES Futures

At the Globex low of 4409.50, the ES was down 225 points or 4.85% from the July high. The issue is, support keeps giving way, which creates upside hurdles if and when the buyers finally muster up some strength.

I expect 4475 to 4482 to be resistance, followed by 4493 to 4503.

Pivot: 4417

Upside Levels: 4450-53, 4475-83, 4493-4503, 4540-42

Downside levels: 4447, 4400-10, 4370

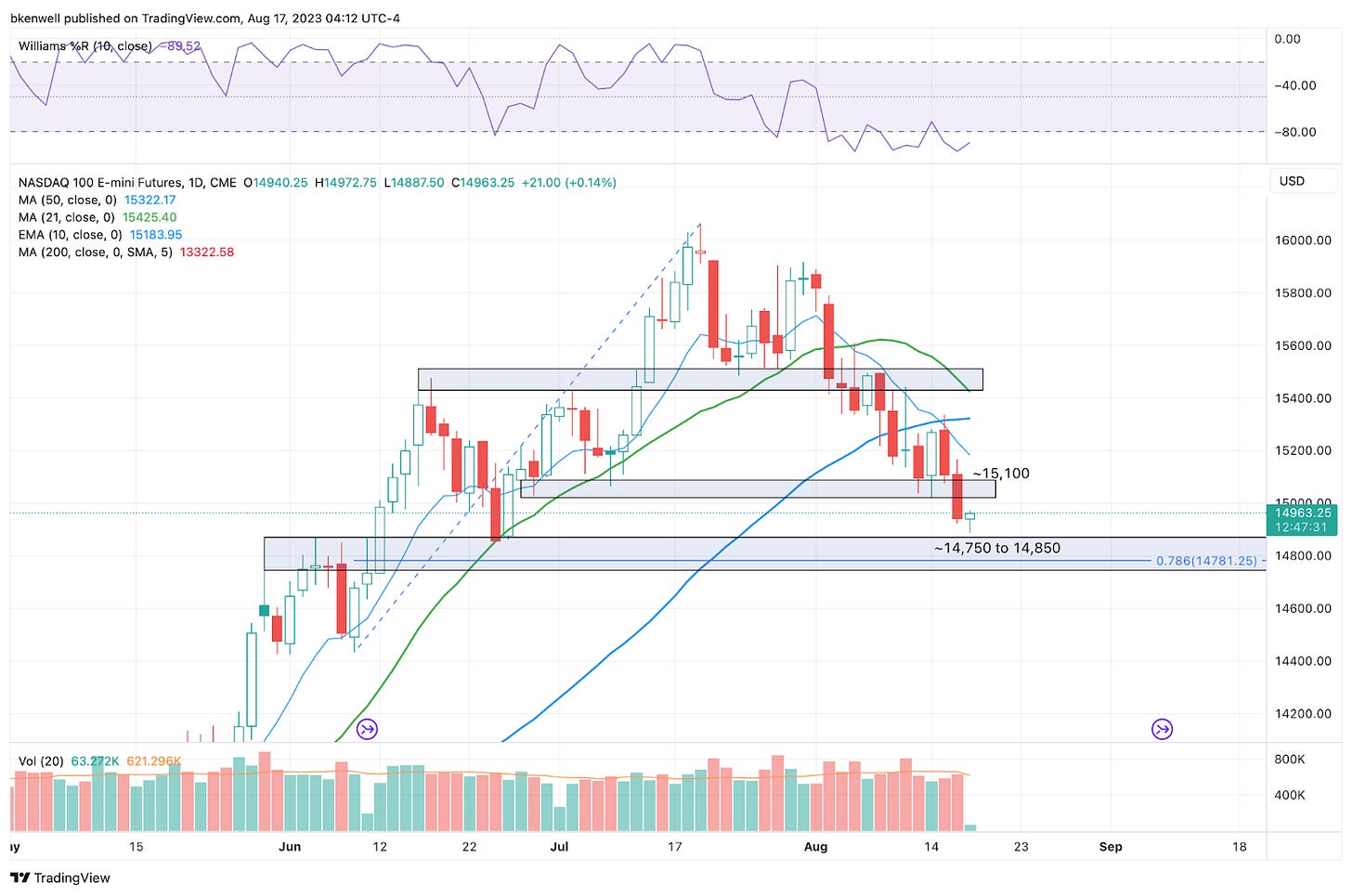

NQ

If you asked me two weeks ago about the 14,750 to 14,850, I wouldn't have given very good odds that we’d see the top of this area tested by mid-August. But with a low of 14,887.50 during Globex, we’ve gotten quite close.

Keep an eye on this admittedly wide zone for the rest of this week. Back above 15K and the 15,100 level is the next focus mark.

Upside Levels: 15,000, 15,100, 15,300, 15,450-525

Downside levels: 14,887, 14,750-850 (and with the 78.6% at 14,781)

QQQ

A deliberate break of the $363.50 to $365 area. Bulls need to regain this zone if they want to make a sustained bounce in the short term. Otherwise, the risk is that this zone becomes resistance.

On the downside, watch yesterday’s low of $362.44 to see if we can form some sort of active pivot around this area — AKA the line in the sand.

Further weakness keeps the $357 to $358.50 area in play.

Upside Levels: $370 to $372, $374.50

Downside levels: $363.75 to $364.50, $360

TLT

Bonds remain weak. We were lucky and got that ~$95 buy and quick bounce, but now breaking the recent low and we’re back to the Dec. lows. FWIW, /ZB has already broken the 2022 lows.

A further breakdown could put the $91.85 low in play from October, which would raise the question: Are stocks next?

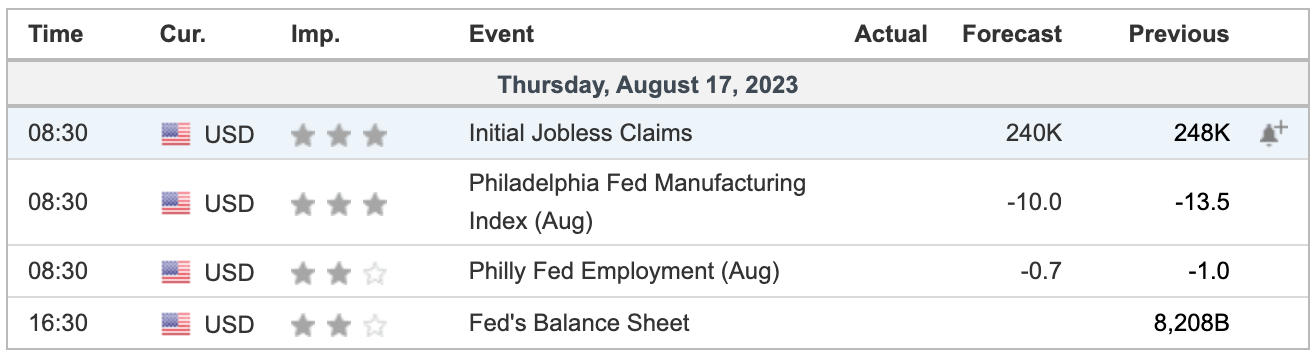

Economic Calendar

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.