Technical Edge —

NYSE Breadth: 85% Upside Volume (!)

NASDAQ Breadth: 74% Upside Volume

VIX: ~$22

Game Plan: S&P, Nasdaq

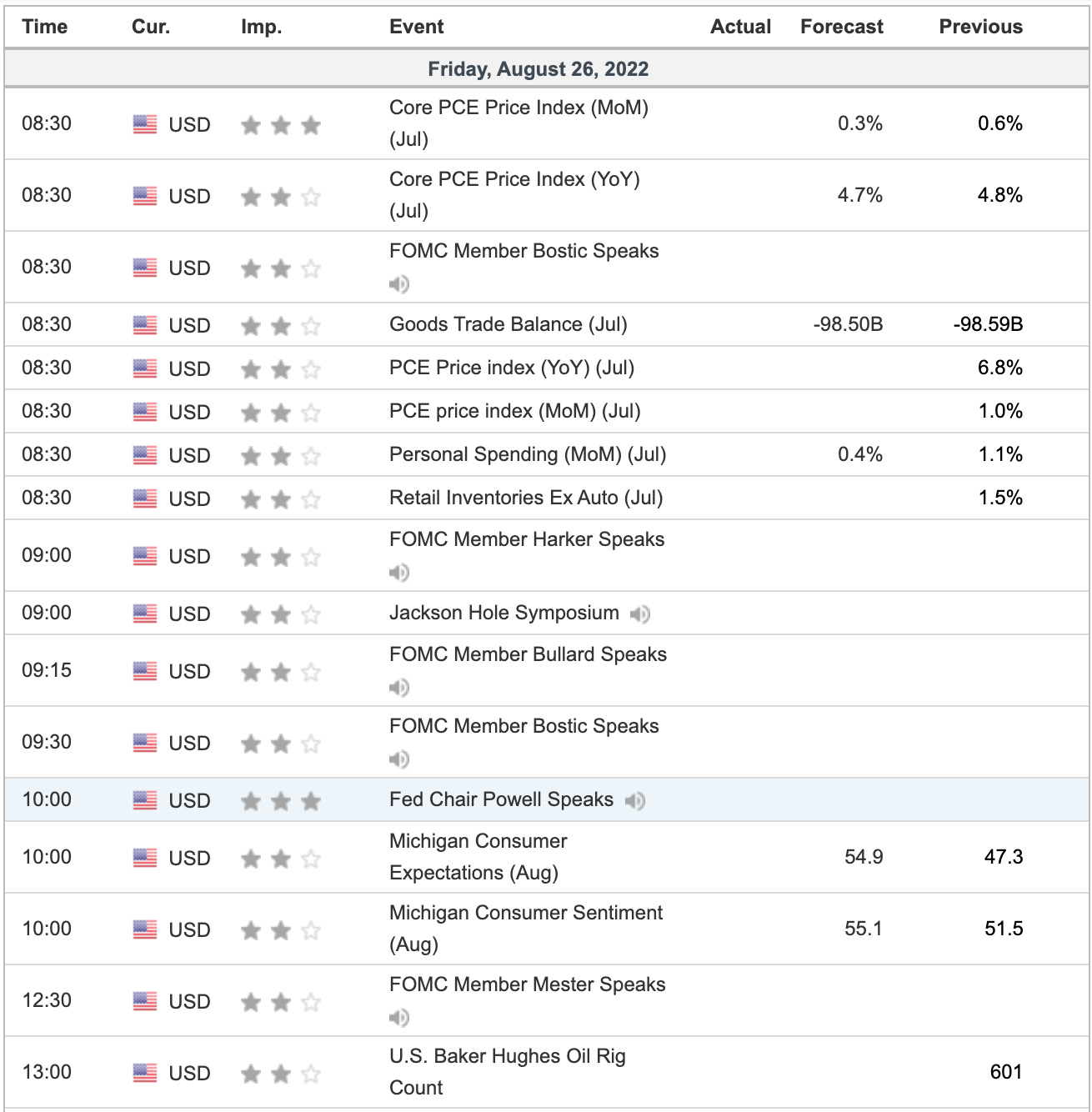

Does the Powell speech matter for today? Some traders have everything staked on this event, while others consider it a bunch of hot air.

I’m in between. The Fed is not the “end-all, be-all” force in the market. However, they do play a pivotal role when it comes to money supply and liquidity, two driving forces in equity markets.

However, just like an earnings event, the reaction to the news is likely more important than the news itself.

The caveat is, today’s action could be messy and it may take a little time to sort out the real “reaction.”

S&P 500 — ES

Yesterday we rallied right back into the 10-day and 21-day moving averages and 4200 — just shy of the 50% retrace near 4220.

We can bounce around a bit, but my two main areas of interest are 4100 to 4110 on the downside and 4300 to 4310 on the upside.

If we rally to 4310 and the 200-day moving average, it’s critical that bulls break the ES out of this zone. Otherwise, this level is resistance until proven otherwise.

On the flip side, bears are looking to break the 4100 zone. If they can do that without the market reversing back to the upside, then I do think we could see 4000.

In a nutshell, bulls need 4300+ and bears need sub-4100.

S&P 500 — SPY

For the SPY, those levels are $430 on the upside and $410 on the downside.

I know it’s a wide range, but that’s just the reality of it.

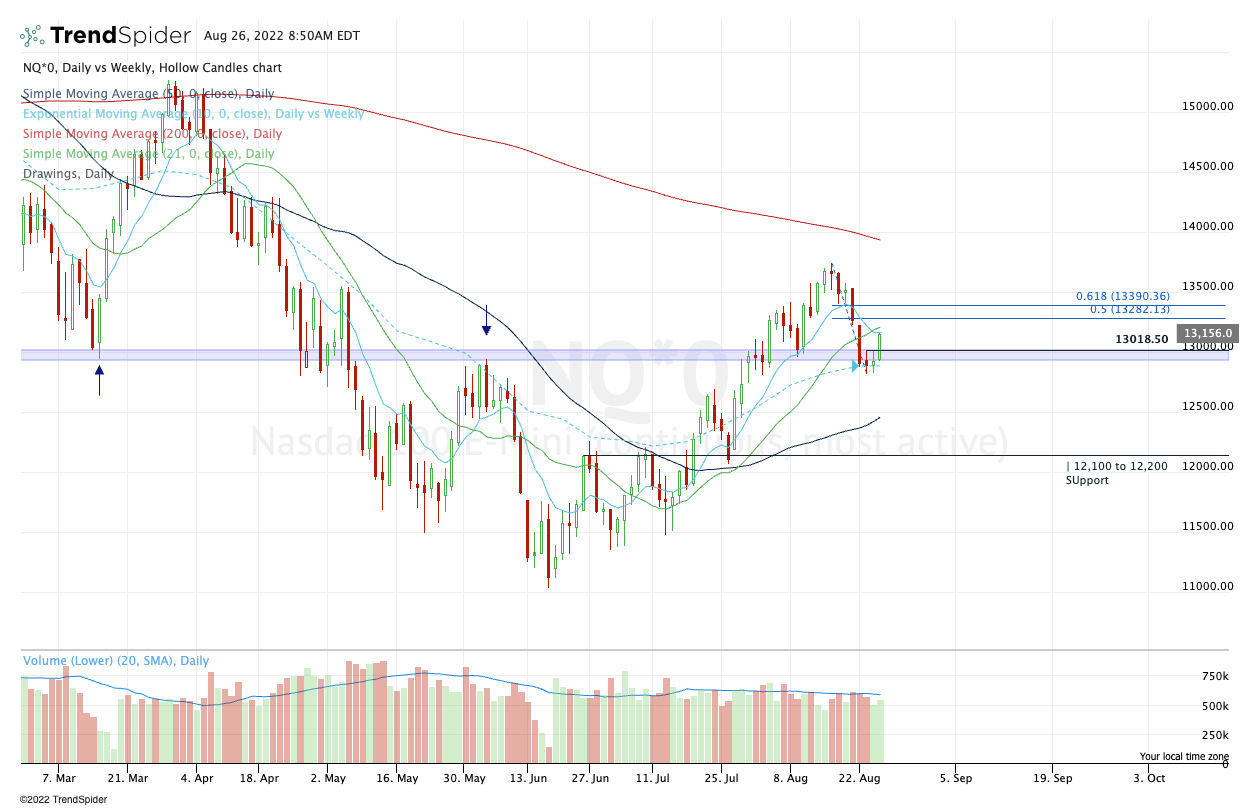

Nasdaq — NQ

Yesterday, we finally got a range break, calling for a move over the two-day high of 13,020. That put the 13,150 to 13,200 zone in play, with the NQ going out at 13,156 yesterday.

Anyone who lined their pockets with 100+ points yesterday is able to coast into today feeling pretty good.

Now we have to see if the NQ can push out a bit more upside into the 13,280 to 13,390 zone. Above it puts 13,500+ in play. The fact that it remains below the 10-day and 21-day does have me a little leary, though.

If we pull back, the 12,825 zone becomes critical. Below it will open the door to 12,500.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

UUP — Down to ¼ position as we hold for potentially higher prices. Raise stops to $28.40 to $28.50. (Fed is possible catalyst for volatility today).

CHNG — second target of $25 hit. Now down to just ⅓ position. Take all profit here or move to a B/E stop and look for $25.50.

Still looking for $25.50 on the upside, but can be back up to a ½ position or more $24.73. $24.25 is a reasonable stop-loss for those that added.

AR — Out ⅔ of position after hitting our second target at $44. B/E stop. Might as well look for $46.50+ for the rest.

O — long from $70.50, as mentioned in yesterday’s midday update. $72.50 is our first upside target. $68.75 is a reasonable initial stop-loss.

HRB — long from $46.75. Initial stop-loss at $44.75. Can make a minor trim at $47.50 just to get some risk off the table, but really looking for $48.25+

Relative strength leaders (List is cleaned up and shorter!) →

Top 5:

HRB

PEP

XLU

CI

MCK

The Rest:

CNC

F

BMRN

APLS

ENPH

TAN

FSLR

LNG

PWR

CHNG

CELH

COST

UNH