Technical Edge —

NYSE Breadth: 72.3% Upside Volume

NASDAQ Breadth: 74.6% Upside Volume

Obviously downside volume tends to outpace upside volume, but the dive in volume is a bit of a concern to me even though the bulls have done a great job over the last two weeks.

I’m totally fine with the low being in and being wrong about feeling somewhat cautious. But the lack of upside volume — really, just one 80%+ upside day on the NYSE in this stretch? — has me wondering…

Game Plan

The bulls can have their time in the sun and believe me, as a natural bull, I would love nothing more than to yell, “The coast is clear!”

A few things linger in the back of my mind though — upside volume included. Beyond that, the ongoing geopolitical issues remain, inflation is raging (as are gas prices), and the Fed is in a tightening cycle.

That said, longs seem determined so let’s look at the levels.

S&P 500 — ES

Feel free to extrapolate the below levels to the SPY

Same upside take as yesterday:

“On the upside, we have back-to-back highs at ~4515. A break above this level that doesn’t reverse puts 4440 in play, then potentially 4480 — two main levels from this week’s video.”

Now making some nice progress, I want to see last week’s high of ~4466 and the 200-day act as support. Below puts the multi-day low of ~4445 in play, along with the sharply rising 10-day ema.

Nasdaq — NQ

Feel free to extrapolate the below levels to the QQQ

No change to yesterday’s view.

“Clearing the two-day high of 14,690 could open the door to a larger rally, potentially up to 15,000.”

Above 15K opens the door to the 200-day sma, then the 61.8% retracement near 15,300. Below 14,690 and the 14,450 to 14,500 area is in play.

Russell — RTY

Refer to yesterday’s chart. Longs need 2100+ to regain momentum.

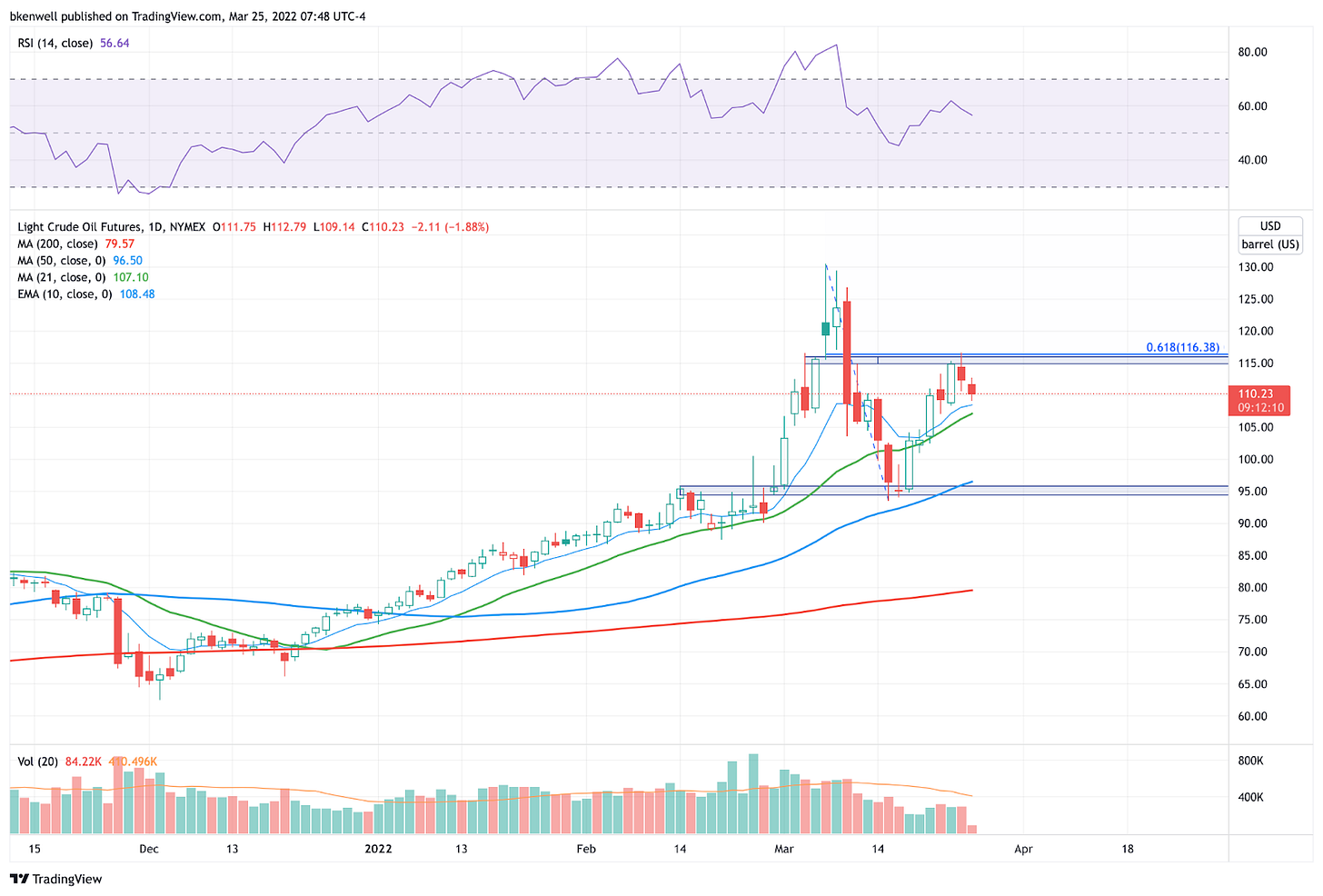

Oil

Man, how nice has this oil trade been to us?! Yesterday we flagged the $115 to $116 zone as “a major trim zone for longs.” Oil has now reversed lower by $7.50 a barrel — a nice move in the futures world.

You know the drill now. We need the $107 to $108 area (10-day and 21-day) to hold as support. If it does, $115 to $116 is back in play. If it fails, $103 is on the table.

NVDA

Nvidia has been an absolute monster for tech lately. We’ve hit 2 out of our 3 upside trim spots. The last level I have for this series is $293-ish. I’ve raised my stop to $250.

Nice profits here, now no letting a remaining winner turn into a loser.

TSLA

The relative strength in AAPL and TSLA jumped out to me yesterday and that remains the case today. Both have rallied in 8 straight sessions, not something many others have done.

TSLA has done so on strong volume, too. Now we have an inside day.

If markets are firm, watch for a daily-up rotation in TSLA at $1025.50. That could put this week’s high in play near $1040.

On the downside and if markets are weak, a daily-down rotation below $988.80 that’s not quickly reclaimed could put $975 to $977 in play quickly, then possibly $950-ish.

Go-To Watch List

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely. Please look at these closely, as there are several updates (the most recent of which are noted in bold).

PANW — Definitely trimming ⅓ to ½ here at ATHs. Would love to see a further push to the upside. $645 to $650 is the next trim zone.

BRK.B — Hit $342 trim spot. Trimmed another ⅓ at $350 — down to runners but no problem with cashing out completely here and look for a BTD opportunity at the 10-day ema.

VRTX — Trimmed ⅓ at/near $250. $254-$255 next trim spot (small).

F — 2x weekly up rotation is triggered (from video). Looking for $17.50 to $17.80 as first trim area. Followed by the declining 50-day. Would love a gap-fill at $19.87.

BMY — Trimmed ⅓ to ½ here. Look for $73.50 to $75 next.

COST — Trimmed ½ at $565.

TECK

TU — forming a nice inside week

MCK

MKC — Was watching $99+ but now an inside week forming

CCK

Energy —XLE, APA, CNQ, CVX, ENB, PXD — robust strength

ABBV

ADM, MOS

CHKP, PANW

AR

DLTR — Flirting with weekly-up over $157.80 — $165 is the upside target.