Yesterday Rally Pays Off Big. Here Are Today's Key Levels

Some individual stocks still stand out.

Technical Edge —

NYSE Breadth: 83.4 Upside Volume (!)

NASDAQ Breadth: 81.4% Upside Volume (!)

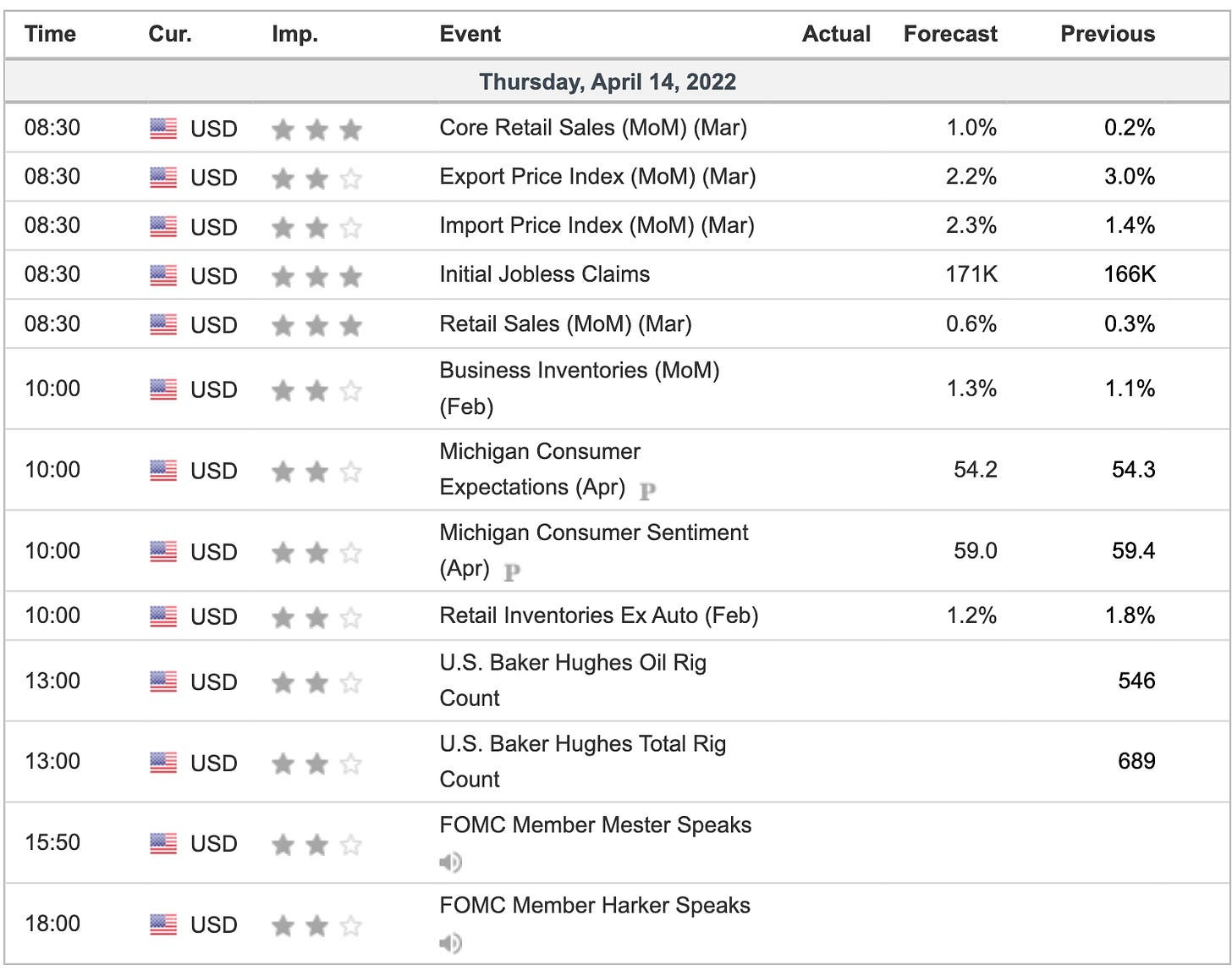

Well how about that for a way to hammer home some gains during a short week? On Thursday we made the case for a brewing short-term bounce and boy did we get one.

It was a combination of seasonality, the Thursday/Friday low (a day ahead of time because of the holiday), the technicals and the likelihood of lower volume.

It paid off in a big way, as the ES paid out 50+ points and the QQQ ran to our upside targets. Plus, we were able to manage a few individual stocks into key price targets.

It’s hard not to feel good after ripping off a good couple of days in a tough tape. Now remember, the last thing we want to do is make mental errors ahead of a long weekend.

Game Plan — A Short-Term Bounce Brewing?

I like that the market is not trading higher in the pre-market. Let’s see if the bulls can grab the ball and run with it for one more day, if only just for the morning session. Above 4444.50 in the ES and we’re looking for 4460 to 4465.

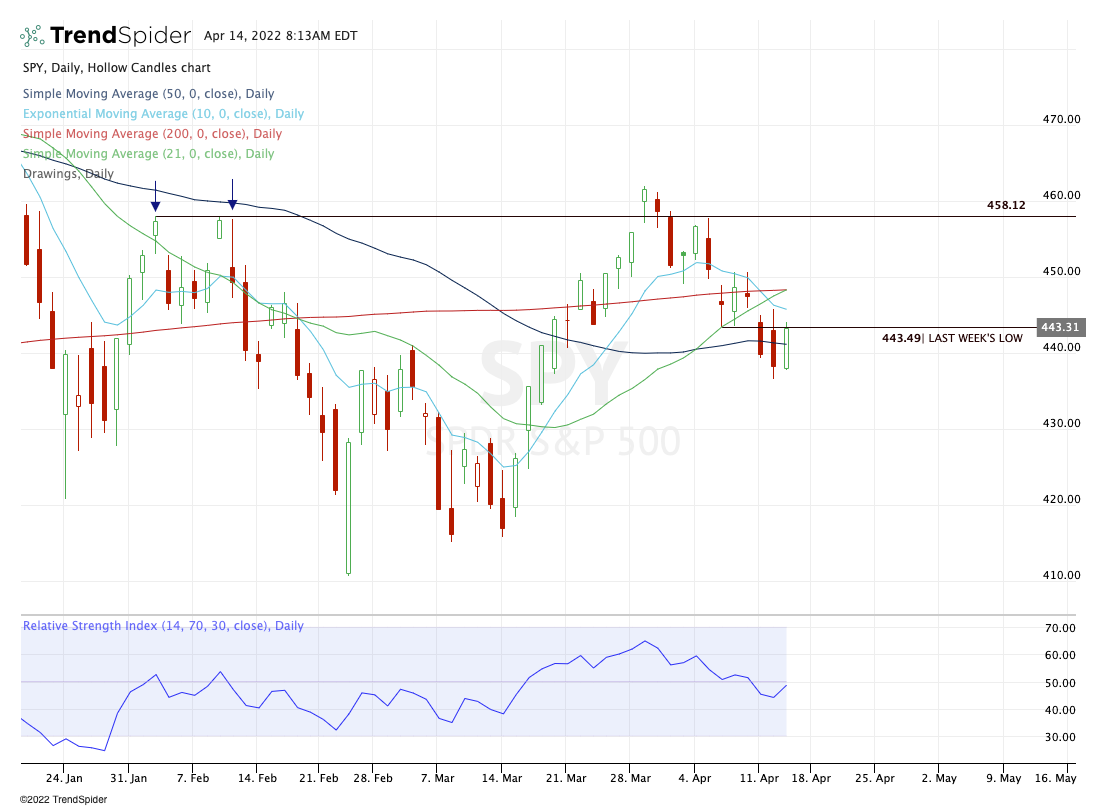

Let’s look at the SPY and QQQ.

S&P 500 and QQQ

Like the ES, the SPY is hanging around last week’s low. Let’s see if it can reclaim 443.50. If it can do that, $445.75 is in play (this week’s high and the declining 10-day). Above that could open the door the 21-day and 200-day near $448.

Keep it simple.

On the downside, $441 is the 50-day moving average and the 50% retracement of yesterday’s range. Bulls don’t want to lose that ahead of a long weekend.

QQQ

Technically an inside day yesterday, which gives us potential for an inside-and-up rotation today. However, this $350 to $351.50 area looks stout.

It’s last week’s low and this week’s high, as well as the 50-day, 10-day and 10-week moving averages. If the QQQ can clear this area, then the 21-day could be in play, followed by the $357 to $360 area.

I don’t see it happening today, but I guess you never know.

We want some follow-through to the upside, but caught the bulk of the move yesterday. So we’ll just see how today goes.

$340 is the obvious downside area that the QQQ needs to hold.

WMT

I’ll update this on the Watchlist, but want to illustrate it again here. Walmart was just a beauty of a trade as it timed up with short-term trend support (the 10-day) and the big breakout area near $152.50.

From here, I’d love to trim into $158 to $158.50. Last week’s high is at $158.41. A small trim around this area is warranted. I am long calls and common stock, so I’d love to pare it down a bit.

Ultimately though, the goal is to get to our first trim spot, move to a break-even stop-loss (to remove the stress) and hopefully ride a push to the $165 to $170 area.

VRTX

No trade here just yet, but want to point out how strong of a stock this has been (we’ve been waiting for a pullback seemingly forever). Aggressive bulls can zoom into a smaller timeframe (hourly, H4, etc.) if they want.

Otherwise wait for the 10-day to see how it responds.

ABBV

ABBV has been a relative strength monster, but has gotten hit.

I would love to see an undercut of yesterday’s low and a tag of the 10-week moving average.

JPM

I’m not personally a buyer of JPM, but several people have messaged me about the chart.

Bullish divergence here (blue arrow), with notable support at $125 via the 50% retracement and the 200-week moving average. A break of that could usher in $113 to $115, then $105.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely. Please look at these closely, as there are several updates (the most recent of which are noted in bold).

PANW — Hit weekly-up level, enough for a trim spot if so inclined. Otherwise, still looking for $645 to $655 on the upside against a B/E stop (near $598)

MKC — $103 to $104 Trim Spot hit → Stop now at break-even or ~$99. Look for another small trim at $105+ | If we see $107 I want to be down to just ⅓ position

Taking kind of long to develop. If we don’t get a 2x daily-up over $102.55 tomorrow, I’m inclined to exit even though we have a B/E stop.

TGT — Monthly-up trigger from Friday hit, as well as our first price target of $236 — Now let’s see if it can settle in. As long as it holds $229.25, let’s see if we can clear $236. Above puts $250 in play.

HD — Nice pop so far, but a bumpy start to the week on tap. Conservative bulls can use a B/E stop now. I am still looking for $320 to $325 on the upside.

WMT — Trim spot No. 1 hit, if more conservative with the trade → Either way, a B/E Stop is appropriate now as we look at a potential $158 to $158.50 trim.

WM — First trim spot $164 was hit. Stopped at B/E

ABBV — Continues to struggle — Want to see how it reacts to the 10-week.

ABC — $164 trim spot hit → B/E stop ($160). $166 is the next ideal trim spot. $170 to $172 would be for final tranche.

Look at how strong these stocks have been!! In a market rife with volatility, head-fakes and downtrends, these names are trending higher. That’s why I always say “feel free to build your own trades off these relative strength leaders!” They are dominant.

COST

DLTR

MCK

BRK.B

XLB — ADM, MOS, NTR, CTVA, NEM

ABBV

TU

VRTX

BMY

Energy — FLNG, XLE, APA, CNQ, CVX, ENB, PXD — etc.

PANW

AR

AMGN

ABC

UNH

VRTX