Another Day, Another Dip: Navigating Friday's Pullback

We've had a great week. Let's not ruin it ahead of a 3-day weekend.

Technical Breakdown

This is what I call a “shadow bear market.” Most people look at the indices to get a sense of what’s going on, but that is not even close to telling the whole story.

Countless names are enduring, 40% to 60% corrections — or more. Many of them needed and/or deserved it. Plenty of them don’t.

Energy and financials are doing well, but is that enough to prop up the whole market?

Apple and Alphabet account for $4.65 trillion in combined market cap value and are down 5.5% and 7.5% from the highs.

However, the rest of FAANG, plus Microsoft, Tesla and Nvidia are down anywhere from 11% to 25% from their respective one-year highs.

So what the hell is keeping the S&P afloat?

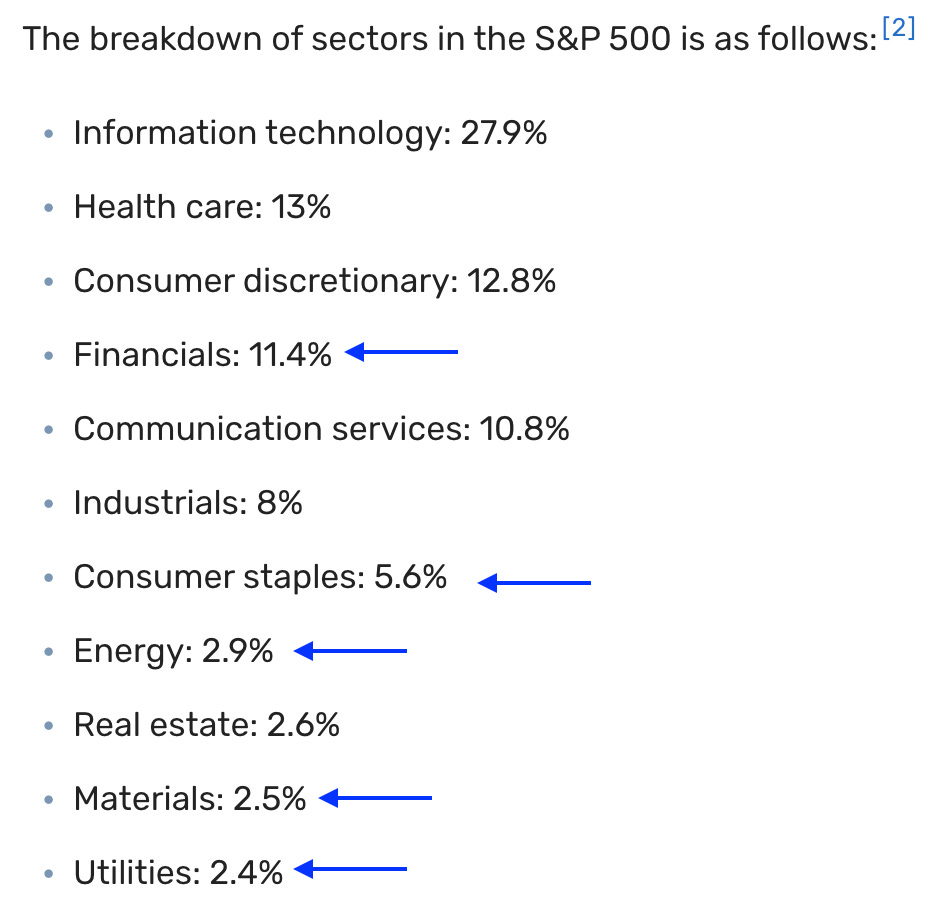

The financial and energy sectors are down less than 50 basis points from the highs. Consumer Staples (XLP) are down 0.9%, Basic Materials (XHB) are down 1.2% and Utilities (XLU) are down 2.4%.

That’s where the strength is, but there are so many oddities.

Some of those scream “Defensive! Caution! Bear market!” That’s stuff like Utes and Consumer Staples.

However, banks and energy stocks are not exactly the go-to stocks to buy ahead of an impending recession.

Even more interesting is that Energy, Consumer Staples, Utilities and Basic Materials have four of the five lowest weightings in the S&P 500 (about 13.4%). Inclusive of Financials, the total jumps to almost 25%.

However, Information Tech — which is ~8% off its high — has the highest weighting at almost 28%. Consumer Discretionary and Health Care account for a combined ~26% weighting and are down 6.6% and 5%, respectively.

The weightings have obviously fluctuated a bit, but these three sectors account for more than 50% of the S&P, yet the pain from the under-the-surface carnage remains masked. Will (or when will) it eventually show?

Game Plan

NYSE Breadth: 44% upside volume

NASDAQ Breadth: 70.8% downside volume

Team, I can’t explain how happy I am with some of the feedback we’ve been getting here. We have been incredibly fortunate with how we’re navigating the SPY/S&P, as well as individual stocks like ARKK, GM and BIIB.

Sometimes in a tough market, it feels good just to lose small or to turn in break-even results. It’s the reality of trading: Not all weeks are winning weeks. But man, it feels great when we get through a tough stretch in the green.

Further, it puts us in the driver's seat and lets us really wait for a slow fat pitch down the middle of the strike zone. We don’t have to swing at anything we don't like, because we’ve already got profit in our pockets.

The lesson here: Don’t force anything — particularly on a Friday before a holiday — if it doesn’t feel or look right.

S&P 500

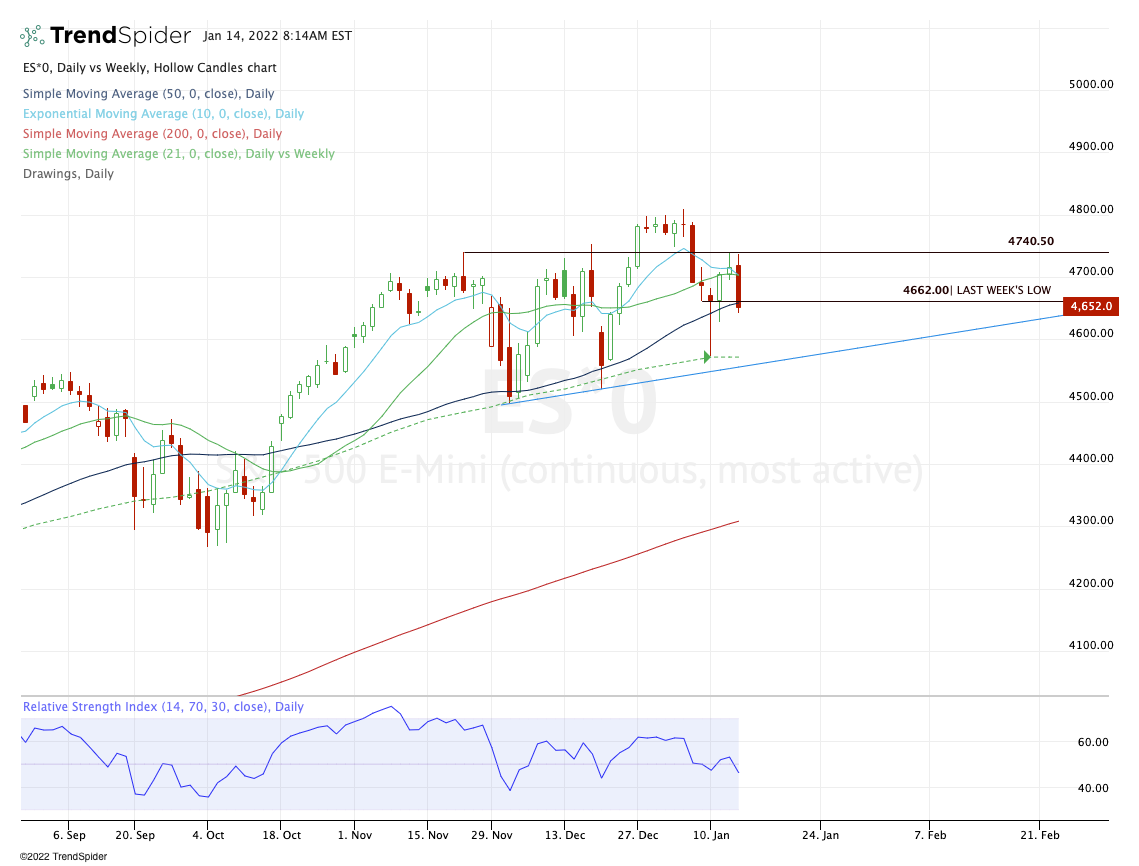

On Tuesday Jan. 11, I said the S&P futures could see 4740 on the upside, assuming it could reclaim its moving averages. It gave us a high of 4736.25 and that was apparently close enough for the index.

It closed near last week’s low on Thursday and is rolling over on Friday morning.

If the S&P 500 can close above last week’s low (at 4662) and the 50-day moving average, then bulls will have made a decent stand.

Below these marks and Thursday’s low though, and the S&P could have another date with the 21-week moving average and this week’s low.

Individual Stocks

I’ve rambled enough, with today’s breakdown on the S&P sectors and all. With the morning weakness, I’m essentially doing two things:

Looking for a gap-down to see how it’s handled. That could be:

A reclaim of the prior day’s low in the QQQ and SPY (NQ/ES) on a more shallow gap down.

On a larger gap down, we could be looking at a situation where we crack Monday’s low, giving us the chance to reverse with a reasonable R/R.

Lastly, we could have a Monday situation where we gap-and-fall for an hour or two and then do some sort of 30- or 60-minute reversal. If that’s the case, it lets us get long with a decent R/R and look for an afternoon bounce. It looked like this earlier in the week:

Since gap downs are not ideal to short into, I’m looking for buy-the-dip setups in stocks and sectors that are trending higher. That includes energy and financials, but also names from our Go-To list.

(Notice how each possible outcome, whether it’s the SPY or the stocks below, is all about maximizing our R/R).

Go-To List:

Energy (PXD, FANG, DVN, SLB, COP, CNQ and XOM)

Financials (KRE, ASB, TD, STL, MET, BAC)

F (Careful though. It did give us a tag of the 261.8% extension we wanted and is now retreating. Downgraded this a.m. too).

ABBV

QCOM — great weekly chart.

CAT

BRK.B

PG (weekly setup from the other day) 1/13

UNP (also the setup from the other day) 1/12

Thank you for reading and I hope you enjoyed the week!! Recharge this weekend and let’s get ready for earnings season!

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.

Remember: Not all setups will trigger. Not all setups will be profitable. Not all setups should be taken. These are simply the setups that I have put together for years on my own and what I watch as part of my own “game plan” coming into each day. Good luck!