Cautious Bulls Are Watching This Level in SPY, QQQ

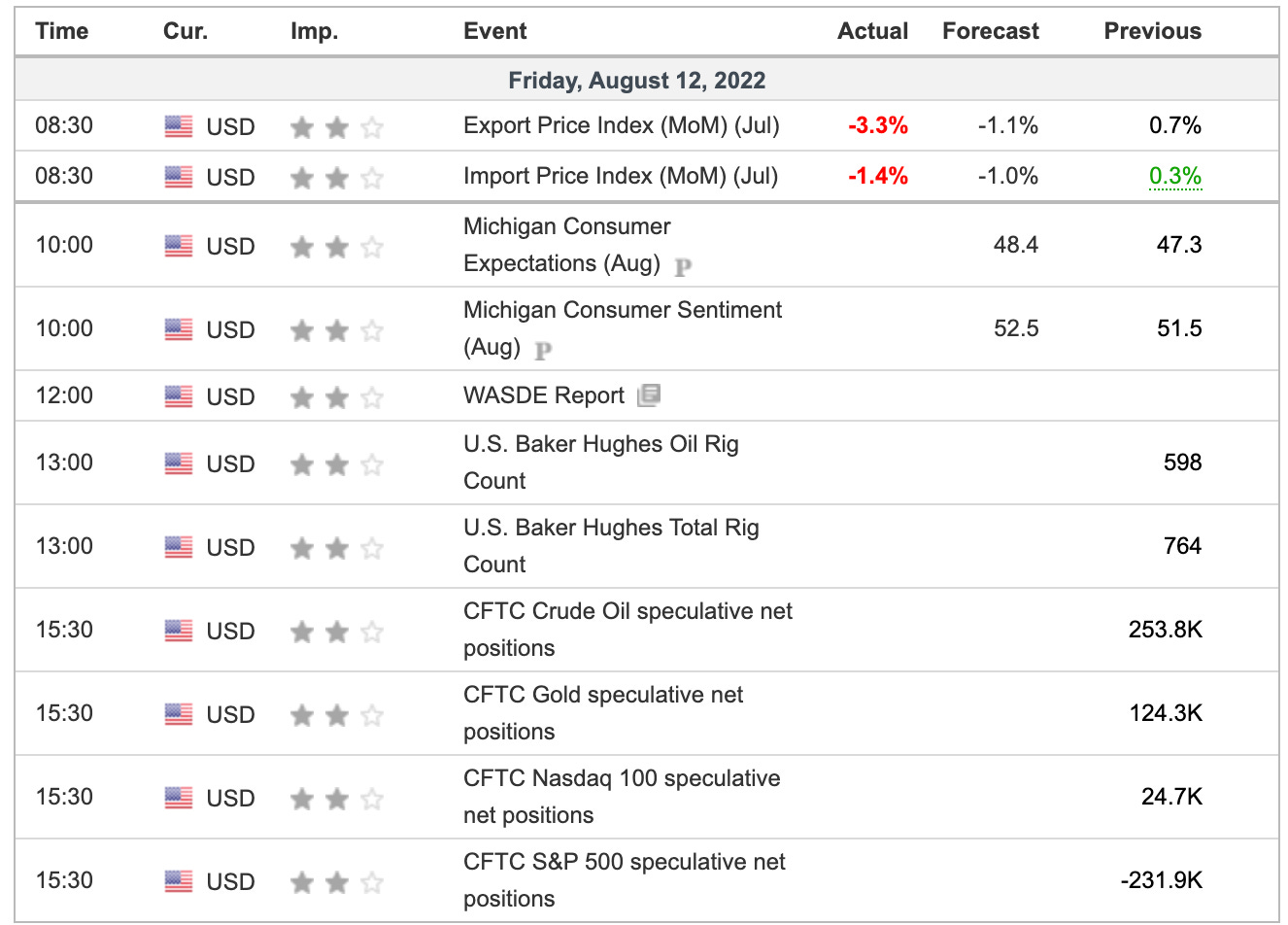

Here are the levels we're watching as enter the last day of the week.

Technical Edge —

NYSE Breadth: 62% Upside Volume

NASDAQ Breadth: 56% Upside Volume

VIX: ~$20.10

Game Plan: SPX BMRN, HWM

The Individual stock list went out yesterday and in it, we noted the bonds.

Bonds and stocks do not have a 1:1 correlation, but the weakness we’re seeing in bonds does seem noteworthy at the moment. Let’s get to work. It’s Friday.

Bloomberg wrote a good piece on the bonds yesterday too.

S&P 500 — ES

That’s an ugly candle from yesterday. Daily-down below ~4202 could open a test of the 4170 area, which was former resistance.

If that plays out, bulls will want to see if this level becomes support. Below that opens the door to the 10-day.

Above 4238.50 could open the door to 4250+

S&P 500 — SPY

Daily down for SPY is $419.21.

I’m not necessarily bearish here, but yesterday we noted that we were “cautious bulls.” Part of that caution comes from the potential of something like this…a daily down accelerating some of the selling pressure.

Nasdaq — QQQ

The QQQ was the first to go red yesterday after being rejected from the 10-month moving average.

Watch $323.36 — yesterday’s low. A daily-down rotation could put the post-CPI low in play near $322, then the gap-fill in play near $319 and a test of the 10-day ema.

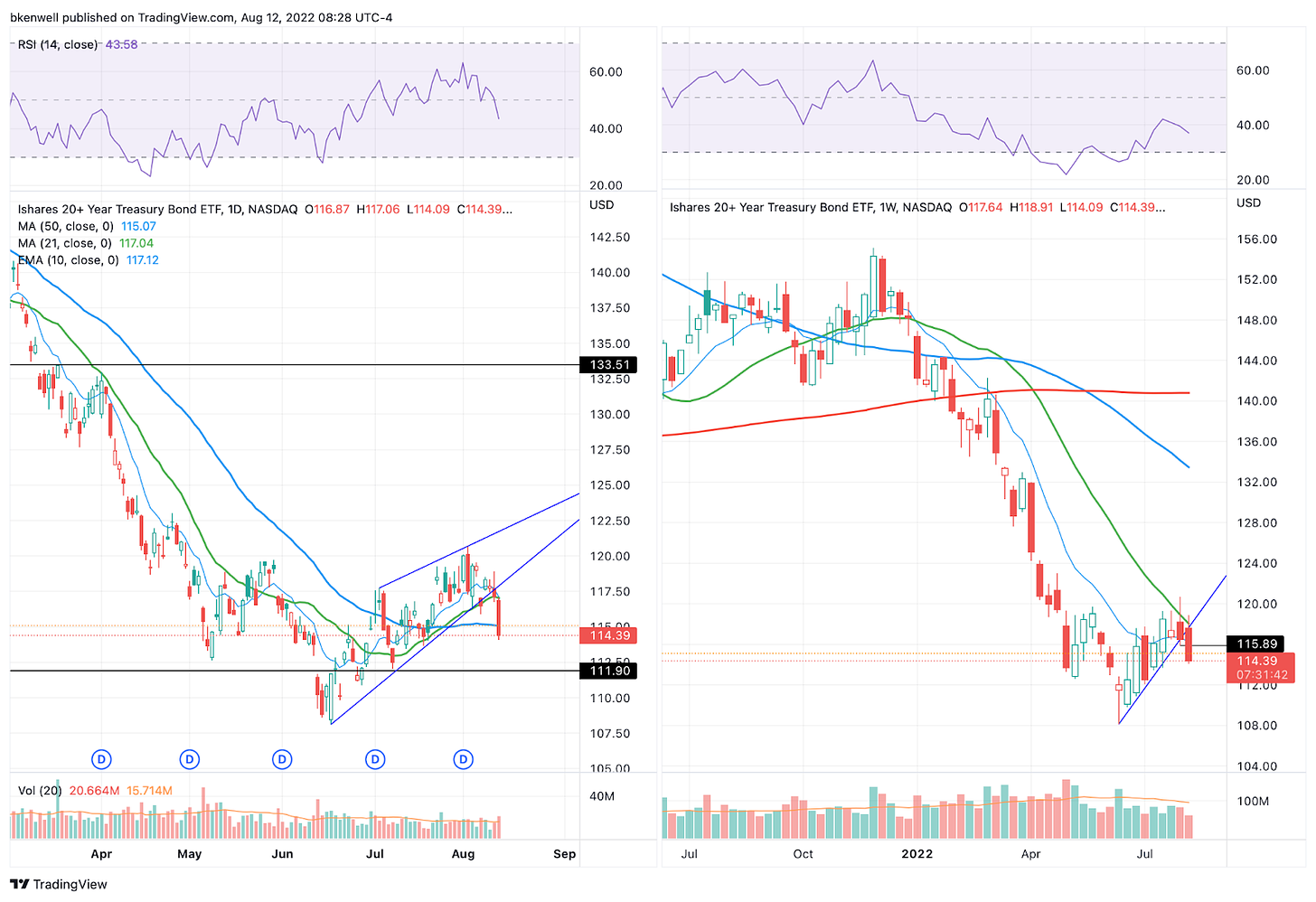

TLT

We have been yammering on about the bonds, but look at how they rolled over yesterday. See this post from last week for a larger breakdown.

Regardless, the TLT went weekly-down yesterday below $115.89. That’s the level to reclaim today if bulls want to unwind the damage. Otherwise, more selling could ensue.

BMRN

A huge breakout near the $92 to $92.50 area. A dip ot this area and the 10-day for BMRN would be a potential buying opportunity.

HWM

Keep an eye on the $37 to $37.50 area and the 10-day ema. A very strong move for HWM lately and on a dip, I want to see if this area can hold as support.

Initial stop loss near $36.25-ish — just below last week’s low.

Go-To Watchlist — Individual Stocks

*Feel free to build your own trades off these relative strength leaders*

Numbered are the ones I’m watching most closely.

Bold are the trades with recent updates.

Italics show means the trade is closed.

Trade Sheets: Now have 2-3 live trades, all with breakeven or better stop-losses. Great stress-free position to be in as we try to squeeze a bit more of upside out of this move.

PEP — We got out Target No. 2 at $177. Either all out now or down to ⅓ of a position if playing for a breakout. Stop at $172 (above B/E).

UUP — $28.60 to $28.80 is ideal trim zone, but bulls can trim ¼ at $28.50-ish if they’d like, as the UUP runs into the 10-day ema.

$27.95 stop-loss.

CHNG — Trimmed a little over ⅓ of position into our first target of ~$24.50. Inching stop-loss up to $23.50. Conservative bulls go with a break-even stop.

Next target: $25 to $25.30

O — For anyone in it, $74 target hit, B/E stop. $75+ is next area for trim.

Relative strength leaders (List is cleaned up and shorter!) →

CNC

HRB

ENPH — kickstarted the rally in Solar

TAN

FSLR

LNG

PWR

CHNG

COST

PEP — trade is live

BA

UNH

XLE

MCK — trade is closed