Gold's Got Its Shine Back | UPST, RBLX, S&P 500

Gold is roaring higher, while the indices need a rest.

We have been talking about the tiredness of the broader market for the past few days now. Up 16 days in an 18-day stretch and it’s not unreasonable to say the S&P 500 needs to take a break.

A 12% beating in Tesla doesn’t help matters when we’re talking a $1 trillion company, either.

We also got some weakness in AMD and Nvidia, two big semiconductor companies. I don’t like shorting into something as strong as these two stocks, but these were high-probability reversal trades and we were lucky to cash in on them.

In fact, I even offered a 7-day trial for new subscribers so they could see how the charts were setting up.

In any regard, too much combined selling pressure could give us some mild weakness in the days ahead. More on that in a minute.

Gold’s Got Its Shine Back

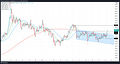

Guys and gals, we have obliterated the trade in gold when we got bullish on the yellow metal near $1,795 an ounce. Why?

It held the midpoint of the channel and rebounded hard over the 50-day and 200-day moving averages. Then we had a quick monthly-up rotation up over $1,815, a gain of $20 an ounce.

This morning we’re seeing a powerful 1.3% push over the $1,837.50 mark, which was the Q3 high. In other words we had a monthly-up rotation followed by a quarterly-up rotation and now have $60 an ounce of unrealized gains in our pocket.

From here, there’s nothing wrong with taking a little bit of that profit off the table and certainly nothing wrong with moving to a breakeven stop-loss. Remember, trading is all about mitigating our risk, then maximizing our reward.

On the upside, I still want to see if gold can push to the $1,900 to $1,920 an ounce area. So far, we remain bullish and will let patience play out in this one.

S&P 500

Keep reading with a 7-day free trial

Subscribe to Future Blue Chips to keep reading this post and get 7 days of free access to the full post archives.