Technical Edge —

NYSE Breadth: 90% Upside Volume — (!!)

Advance/Decline: 84% Advance

VIX: ~$22

I don’t know how the markets will end today, but they are starting off on the wrong foot. That’s no surprise for those who have follow the markets closely this year.

Yesterday we outlined one potential path back up to the 10-day moving average in the SPY, which is active resistance. Those who got short into yesterday’s close should consider taking some profit off the table early in the session in an effort to book some gains.

Yesterday was a 90% upside volume day, but advancers could not top 90%. Had we got a 90/90 upside day, it would have been easier to turn more bullish. But unfortunately, that didn’t happen.

I want to turn away from today’s setups a little bit and talk longer term as we enter 2023.

So many traders and investors focus on their PnL, which is reasonable. However, they don’t focus enough on their mental capital.

This is a tough business and it’s no surprise that so many fail at it. It’s because they spend too much time looking for a magic indicator or a special strategy; one they can work over and over with minimal mental strain and come out on top.

It doesn’t work that way, though.

As the environment constantly changes, the way our strategies perform constantly change. Once you nail down a strategy, you must find a way to effectively apply it to the market. It’s one reason why you’ll see us have 6+ positions on at once during a 4-6 week stretch, then 0-2 trades on for a month. That’s me taking a strategy that works for me, and trying to apply it during the most optimal timeframes and environments.

Use today and the long weekend to reflect on 2022 — the good and the bad. Put more effort into focusing on what worked for you as a trader and an equal focus on trying to actively avoid what went wrong.

There are traders out there who have been at this a long time and they are still learning new things everyday. We will all continue to do so and having an open mind greatly increases the odds of our success.

With that, have an amazing (and safe!) New Year and thank you so much for being a reader and subscriber this year!

S&P 500 — ES

Odds are high for a bit of “fuckery” in the ES today. Holiday-like volume combined with end-of-quarter and end-of-year shenanigans and it’s no wonder many traders check the open and then get an early start on the long weekend.

The ES is coming in under pressure as it remains pinned below active resistance via the declining 10-day moving average.

On the downside, 3835 to 3844 is the 50% to 61.8% retrace zone of yesterday’s range. If short from yesterday’s close, consider a trim into that area.

If this area can’t buoy the ES, then the 3805 to 3810 zone could be in play. Below that puts last week’s low in play at 3788.

On the upside, 3862 to 3867 is my first area of resistance. Above that and 3880 is back in play.

SPY

The SPY ran right into the declining 10-day moving average yesterday, its first test of active resistance in 10 days. To me, that’s a short. If wrong, we’ll know quickly and can cut our losses and move on.

If right, we’ll be able to trim ⅓ and move to a B/E stop.

On the downside, watch $381. A break of this level and failure to regain it puts Thursday’s low in play, at $379.08. Below that and the SPY could press into the $375 to $376.50 area.

DIA

Struggling with a few moving averages here, the DIA has been the leader of the “big 4.”

Keep an eye on $330, roughly yesterday’s low. A daily-down rotation from here opens the door back down to the $326 area and the 200-day moving average.

On the upside, there’s too much selling pressure in the $333 to $334 area. Clearing it and the 21-day could put $340+ in play, but that doesn’t appear to be a high-probability setup at this time.

CAH

One of the bull leaders this year, even as CAH struggles with $81. CAH is now pulling back into the 50-day and 10-week moving averages, as well as the 50% retracement and recent support.

There is an open gap down at $76.70, so we could see a bit more pressure.

This one has been a slow mover and I’d love a tight inside day here to get us a cleaner setup. More aggressive bulls could take a half-size position on this dip though, and look to trim in the $79s. That may be my course of action, especially if we can get $77.25 to $77.50 today.

CAH shouldn’t see sub-$75 if the bulls stay in control.

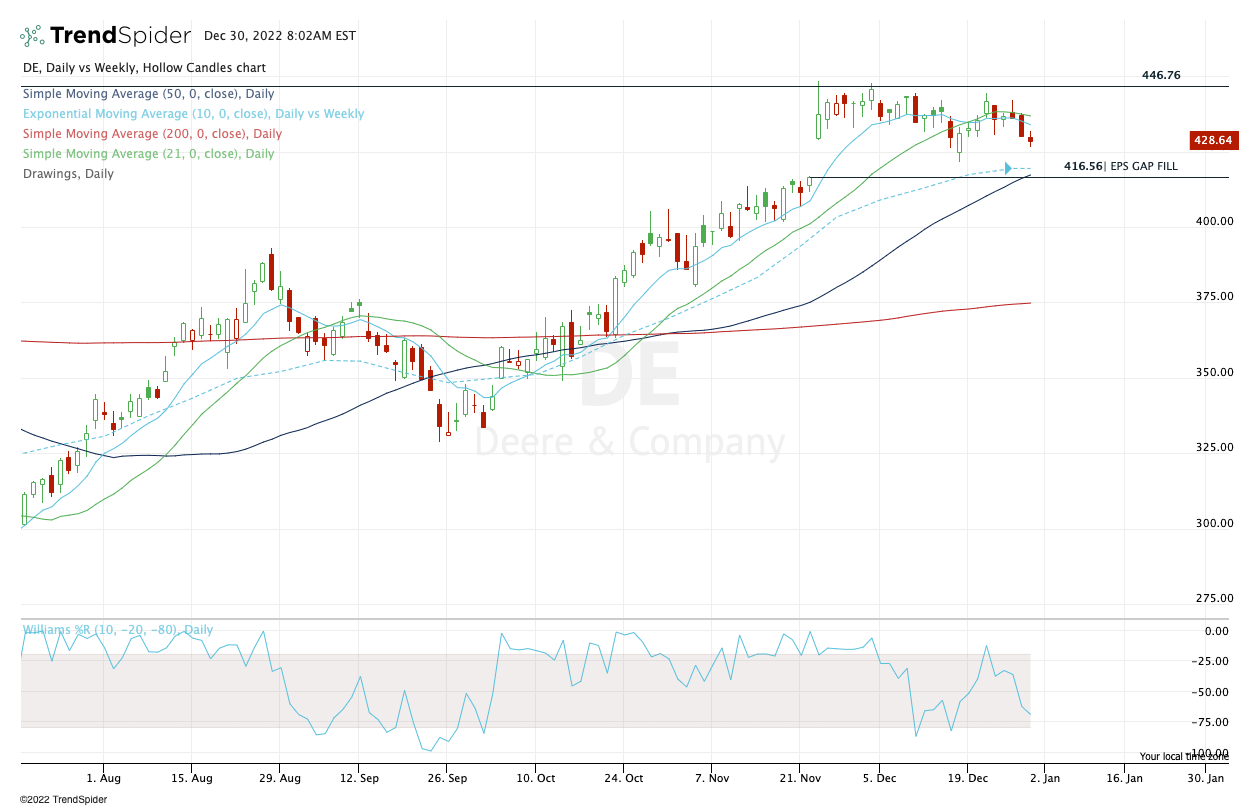

DE

Not sure when we’ll fill the $416.50 gap, but I’d love to see it happen while the 10-week and 50-day moving averages are in play.

Keep this DE setup in mind if we see it today or early next week.

Open Positions —

Numbered are the trades that are open.

Bold are the trades with recent updates.

Italics show means the trade is closed.

UUP — Ideally needed a close back over last week’s high of $27.95 and we closed AT $27.95. Long against $27.75 is fine with a ¼ to ⅓ trim at $28.15 to $28.25. Ideally looking for $28.40+

TLT — Slow start but we’ll see. I will feel better about TLT if it can clear and hold $101.10.

For now I’m using $98 as my stop. On the upside, can consider a small trim at ~$102, but really I’m fishing for $103.40 and the declining 10-day.

Go-To Watchlist

*Feel free to build your own trades off these relative strength leaders*

Relative strength leaders →

SBUX — nicely weekly-up setup after 10-week ema reset.

DE — gap-fill & 10-week would be attractive for potential longs

SMCI — weekly up over $85.85

HON — weekly

CAH

LNG

LMT, RTX, NOC

MET — weekly

GIS

CI

MCD — weekly

FSLR — $140 is the 21-week sma and retest of prior resistance

VRTX, UNH, MRK

XLE — XOM, CVX, COP, BP, EOG, PXD (Weekly Charts)