When it comes to trading, we’re constantly on the search for winners and losers. What I mean by that is, we’re constantly looking for stocks that are outperforming the indices and for stocks that are underperforming the indices. This is called relative strength and relative weakness, respectively.

No one group stays hot forever and thus, we are always looking for which industry has the momentum. For instance, the financials remain quite strong, while growth remains quite weak.

Even though the latter is searching for a bottom, it’s clear it doesn’t have any bullish momentum. Contrast that with the bank stocks and there’s a huge difference.

Trading the Banks

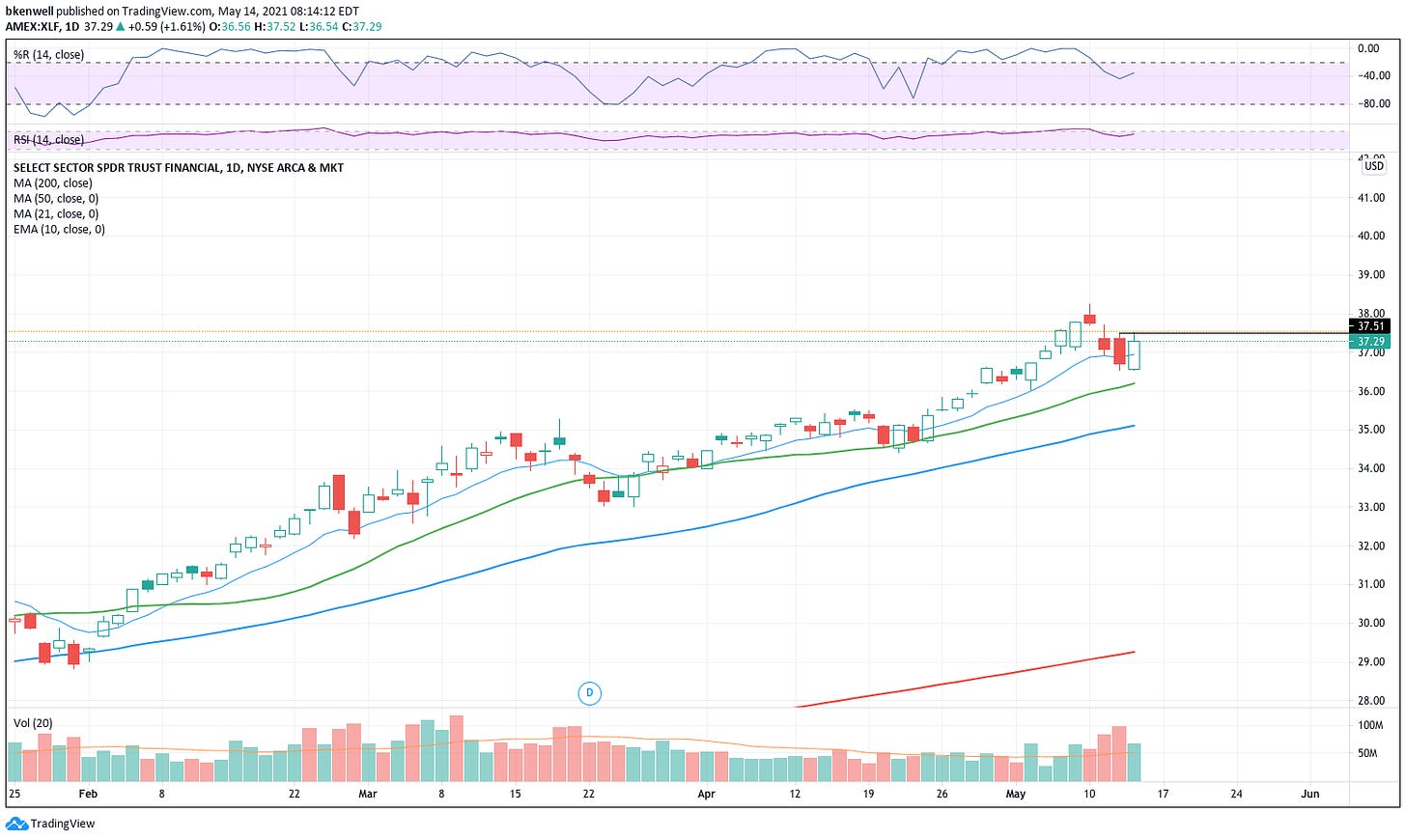

Take a look at the XLF above. It continues to trend nicely higher, while finding support between the 10-day and 21-day moving averages.

Wednesday and Thursday have highs of $37.51 and $37.52, respectively. I’m looking for a two-times daily-up rotation on the XLF over $37.55-ish.

If we get it, it will quickly put $38 to $38.25 in play, followed by a potential push to the $39.50 to $40 area. By the way, $39.96 is where the 161.8% extension from the March 2020 correction comes into play.

So that would be a great spot to lock in some profit if this trade triggers.

The risk is that we get a push into the two-times daily-up trigger, followed by a reversal or false rotation. Interestingly, the last two days also share a session low within a penny. A break of this low ($36.54) could put the 21-day moving average in play.

It’s just something to be aware of. Let’s trade when the opportunities come to us. We’ve already had a banger of a week as the ES (S&P) futures gave us 40-60 points on our trade from Thursday morning. The YM (Dow) futures gave us more than 400 points.

So let’s not screw anything up going into the weekend and perhaps we can enjoy a nice drink or two after the close.

For those that prefer individual stocks, the three largest holdings in the XLF are Berkshire Hathaway, JPMorgan and Bank of America. The first two went daily-up yesterday, while BAC did not.

Cheers.

Disclaimer: Charts and analysis are for discussion and education purposes only. I am not a financial advisor, do not give financial advice and am not recommending the buying or selling of any security.